The veteran trader who accurately called Bitcoin’s 2018 meltdown is issuing a fresh warning that a severe correction could be looming for BTC.

Seasoned market analyst Peter Brandt tells his 651,800 Twitter followers Bitcoin must recover its May 31st high of around $32,000 to avoid the risk of a massive capitulation event.

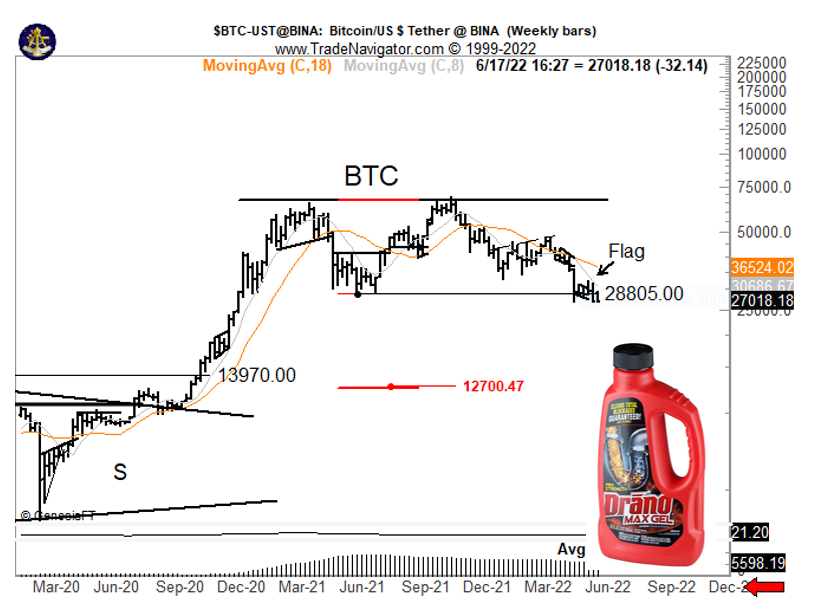

“Unless Bitcoin (BTC) can close above the May 31st high, this chart could become a textbook example of the famed ‘Drano’ chart pattern.”

Looking at Brandt’s chart, Bitcoin appears to have broken down from a big sideways channel and his next reliable support on the weekly timeframe is around his target at $12,700.

At time of writing, Bitcoin is changing hands for $21,758, down over 16% in the last 24 hours. A move to Brandt’s target suggests a downside risk of over 40% for BTC.

Brandt also says he agrees with the idea that a purge is possible. But over the long-term, he still believes that BTC will make a fresh all-time high.

“In my opinion, we will not make a new all-time high until early 2024 but by then we will be in a giant uptrend.”

The veteran trader is also keeping a close watch on the US dollar index, which he says is threatening to take out its long-term resistance at $106.

“The US dollar could be poised for a big run. If $106 is breached, the chart target would become $119.”

Traders rely on the US dollar index to gauge investor sentiment. A strong USD suggests that investors are selling risk-on assets like equities and crypto in a flight to the safety of the US dollar.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Ironika/Sensvector