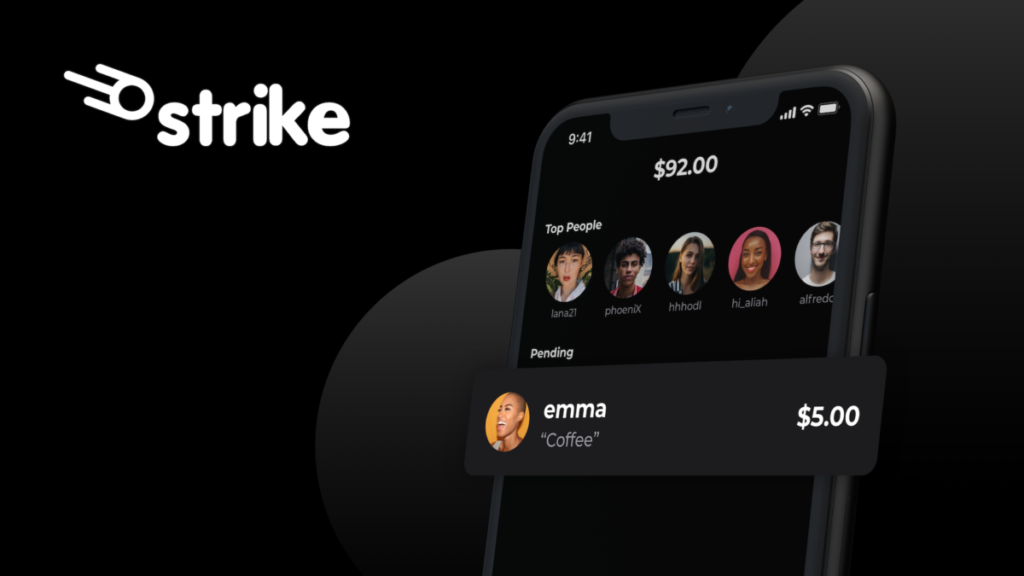

Bitcoin evangelist Jack Mallers’ Bitcoin payments app Strike has launched the eagerly awaited Visa card, the company said on Friday.

The Strike Visa Card allows users to make direct deposits, pay in Bitcoin, buy Bitcoin, send and receive money, use Apple Pay and Google Pay to spend funds, and earn rewards without any fee.

Strike Launches the Much-Awaited Visa Card

Strike in a series of tweets on August 12 announced the launch of the Strike Card offering real rewards for the real world. The Lightning Network-built payments app allows users to make payments and earn rewards on all spending.

Unlike others, the Strike Card will be available to everyone who joins the waitlist in the Strike app. Just follow the instructions on the app and wait for getting a Visa card, which unlocks further rewards.

“The Strike Card is here! A Visa card with real rewards for the real world. You can now take Strike anywhere and earn rewards on everyday spending. Join the waitlist in your Strike app for early access as we begin rolling out the card to everyone.”

The payments app combines the traditional and crypto payments experience with instant rewards on spending. Also, users will be able to use the Strike Card for direct deposits, buy bitcoin, make payments in Bitcoin, send and receive money with friends and family, and use Apple Pay and Google Pay to spend money.

Users will get instant rewards on every spending, with no additional fees. Furthermore, Strike proposes to donate 1% of all Strike Card profits for open-source Bitcoin development. This is likely to drive massive bitcoin adoption.

“Funding Bitcoin with every swipe. Putting our money where our vision is.”

Moreover, individuals who refer friends and family to sign for the Strike Visa Card will get additional gifts from the company.

Strike Drives Bitcoin Adoption

Jack Mallers’ vision is to drive Bitcoin payments’ acceptance globally. In April, Strike partnered with e-commerce giant Shopify to make merchants accept payments in Bitcoin.

Strike’s Layer-2 solution Lightning Network converts Bitcoin to US dollar, making transactions “faster, cheaper, more inclusive, more innovative, more open.” The Visa card will drive further Bitcoin adoption.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.