Key Takeaways

- Ethereum successfully completed “the Merge” from Proof-of-Work to Proof-of-Stake earlier today.

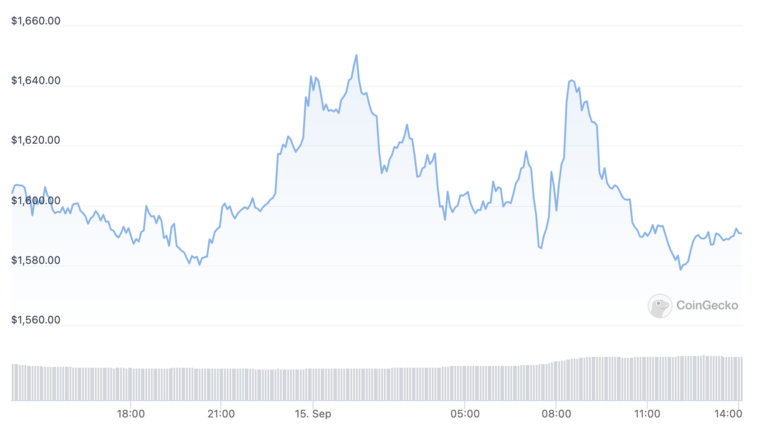

- ETH briefly spiked following the event before retracing minutes later.

- ETH’s supply has decreased since the Merge, but the current macroeconomic environment paint a bleak picture for crypto price action over the months ahead.

Share this article

The circulating ETH supply has decreased since the Ethereum network transitioned to Proof-of-Stake.

ETH Looks Weak Despite Successful Ethereum Merge

It looks like “the Merge” may not be the bullish catalyst ETH holders were hoping for—at least for now.

ETH has put in a rocky performance following the landmark event, briefly spiking to $1,642 before erasing its gains. Per CoinGecko data, it’s currently trading at about $1,593, down 0.5% over the past 24 hours.

Ethereum successfully “merged” from Proof-of-Work to Proof-of-Stake at about 06:43 UTC today, marking a new era for the world’s second-biggest blockchain. The Merge is one of the most significant technological updates in crypto history and has been anticipated for several years. With the upgrade, Ethereum now relies on validators rather than miners to achieve consensus, which brings several benefits to the network. They include a 99.95% reduction in energy consumption and a 90% slash in ETH issuance (Ethereum no longer needs to pay miners to add new blocks to the chain, instead rewarding ETH stakers for validating the network).

With Ethereum reducing its emissions post-Merge, ETH’s supply was widely expected to peak ahead of the event. That’s partly because Ethereum implemented another update called EIP-1559 last year, which introduced a burn on ETH transaction fees. According to ultrasound.money data, ETH’s circulating supply topped out at 120,521,139.31 ETH as the Merge shipped. Since then, it’s decreased by around 170 ETH, meaning ETH is currently deflationary.

Due to the combination of the ETH issuance cut, EIP-1559, and ongoing demand to use the Ethereum network, ETH enthusiasts have long hoped that the Merge could have a positive impact on the asset’s price. ETH looked strong in the weeks leading up to the Merge, soaring over 100% past $2,000 from the June bottom through to mid-August.

ETH Shaken by Macro Picture

However, ETH has struggled against a backdrop of soaring inflation across the world, interest rate hikes, and weak momentum across the broader crypto market. The number two crypto hinted that it could disappoint ETH holders in the days leading up to the Merge, trending down against BTC and then stalling just ahead of the event.

The latest price action suggests that the Merge hasn’t had an immediate impact in the market. It’s worth noting, however, that investors often take time to react to such events despite many arguing that the market is “forward-looking.” BitMEX co-founder Arthur Hayes was one of many crypto commentators to acknowledge this last week when he said on the Bankless podcast that the Merge could be a “sell the news” event with a possible 20% correction after the fact. However, Hayes said in the same interview that he saw the Merge trade as “a no-brainer” due to the supply crunch factor.

If ETH stays deflationary, there’s a good chance that the asset could soar in the future. It may take some time though, particularly as the Federal Reserve has indicated that it’s ready to continue hiking interest rates to curb soaring inflation. As this year has proven, interest rate hikes tend to hit risk-on assets hard, particularly cryptocurrencies like BTC and ETH. Even with a major event like the Merge shipping without a hitch, ETH has an uphill battle ahead as long as it has to “fight the Fed.”

Editor’s note: This article has been amended to add an ETH/USD price chart.

Disclosure: At the time of writing, the author of this piece owned ETH and several other cryptocurrencies.