A widely followed crypto trader claims the uncertainty shrouding Bitcoin’s (BTC) next bull market will be the fuel that ends the bear market.

The pseudonymous crypto analyst Rekt Capital warns their 330,300 Twitter followers that any ‘strong bearish convictions’ may cause them to miss out on the next big bull run.

“People doubting if BTC will experience another Bull Market is exactly what is needed for one to happen

BTC Bull Markets are built on FOMO [fear of missing out]

To FOMO into an uptrend, you need to feel you are missing out

And strong bearish convictions will make you miss out.”

Next, the analyst dives into the psychology of price zones. They use June highs and lows as an example, pointing out that BTC’s June lows are now acting as a resistance level.

“BTC June lows were once a support

Now June lows are acting as resistance

In terms of psychology, people were willing to buy at June lows

But now people are much more willing to sell at June lows

How things have changed within a few months.”

Seemingly advising their followers to be patient, Rekt says that, historically speaking, Bitcoin bear market bottoms take months to settle.

“Typical BTC Bear Market bottoms tend to take months to develop before a new macro uptrend begins

Capitulating into an absolute generational bottom is one thing

The extended consolidation that follows is another.”

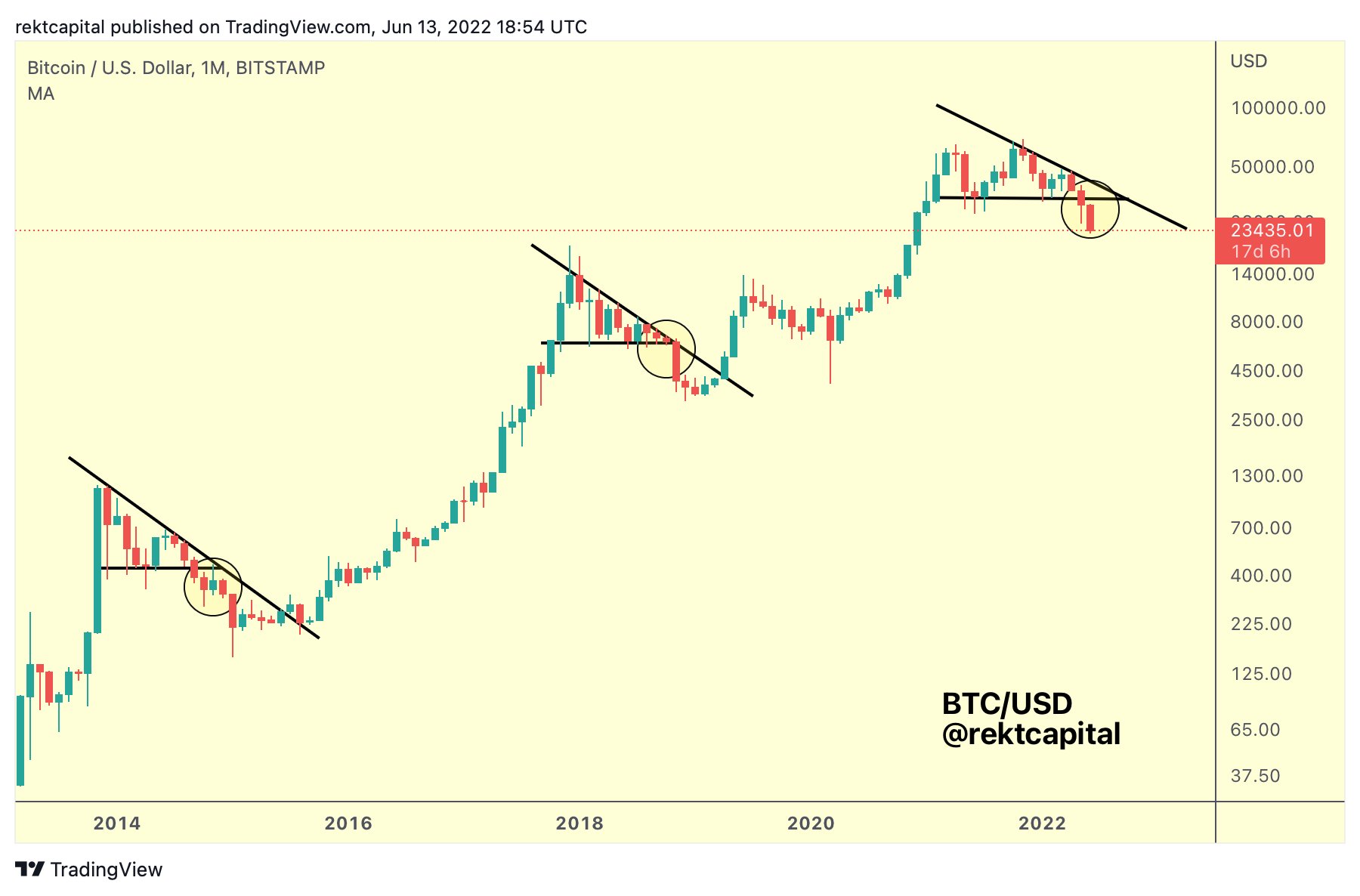

To illustrate their point about bear market bottoms, capitulation, and consolidation, the trader also shares a long-term Bitcoin chart they first shared back in June.

“According to the Three Macro Triangles, BTC is now in the Downtrend Acceleration phase in an effort to form a generational bottom.”

BTC is going for $16,652 at time of writing, up 5.7% on the week but down 76% from the all-time high reached on November 10, 2021.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/johnpluto