- A look at what ETH whales are up to this week as sell pressure tapers off

- Can ETH bulls secure enough momentum for a bigger uptick?

Ethereum (ETH) would have been a healthy option for short traders this month considering its downside so far. However, its bearish preference caught many long traders off guard. Fortunately for them, the cryptocurrency is seeing renewed interest from whales, thus elevating its bullish prospects.

Read Ethereum’s [ETH] Price Prediction 2023/2024

A recent alert from WhaleStats confirmed a major ETH purchase. According to the alert, a single address recently purchased ETH valued at over $2 million. While this purchase alone may not necessarily influence the price, it is a refreshing change of pace. This, because whales mostly avoided large purchases over the last 2 weeks, during which the market was mostly bearish.

🐋 ETH whale “BlueWhale0378” just bought 1,871 $cbeth ($2,099,075 USD).

Ranked #568 on WhaleStats: https://t.co/CRk7mCtBTZ

Transaction: https://t.co/z4ZIBH2t2r#cbETH #ERC20 #DEFI #ETH #whalestats #babywhale #BBW

— WhaleStats (tracking crypto whales) (@WhaleStats) November 23, 2022

Why is this single whale acquisition of ETH worth paying attention to? Well, it might be a sign that savvy deep-pocketed addresses are now considering buying back at recent lows. One of the potential reasons why whales are buying back is the exhaustion of sell pressure.

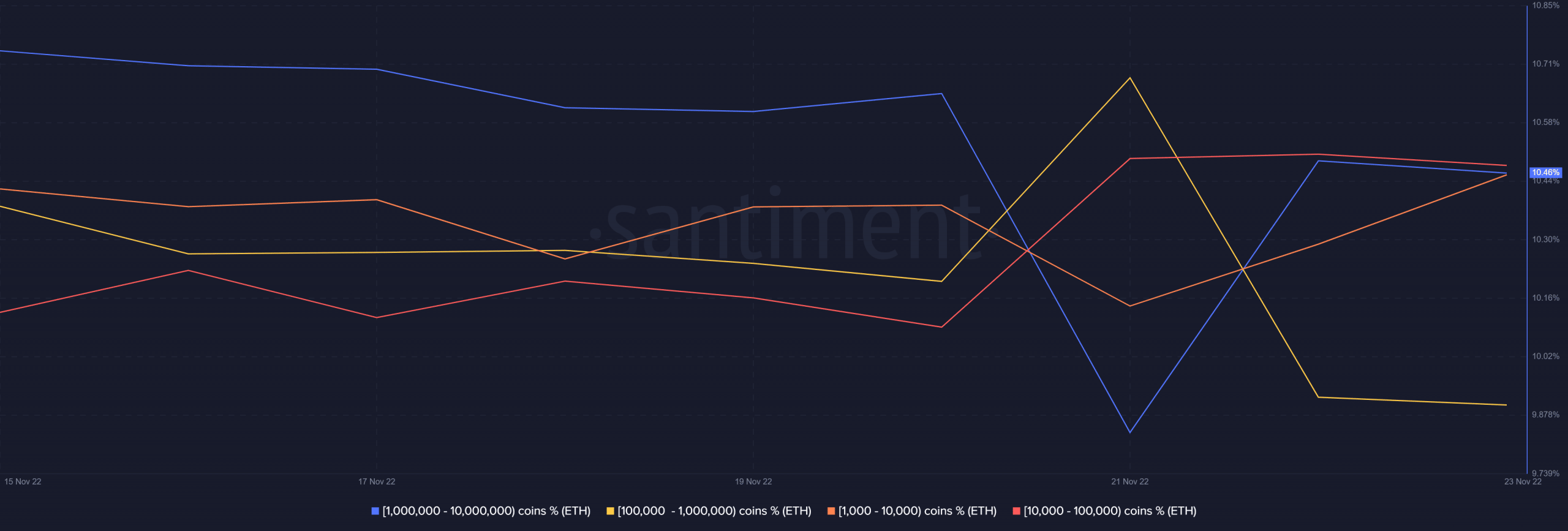

In fact, the same can be demonstrated by ETH’s supply distribution metric.

Source: Santiment

ETH kicked off the week with some sell pressure which mostly came from addresses holding over 1 million coins. However, the same addresses also bought back after the price retested its previous 4-week low.

Addresses holding between 100,000 and 1 million ETH also contributed to the sell pressure up until Tuesday, when the downside levelled out.

Will lower sell pressure pave way for ETH price pump?

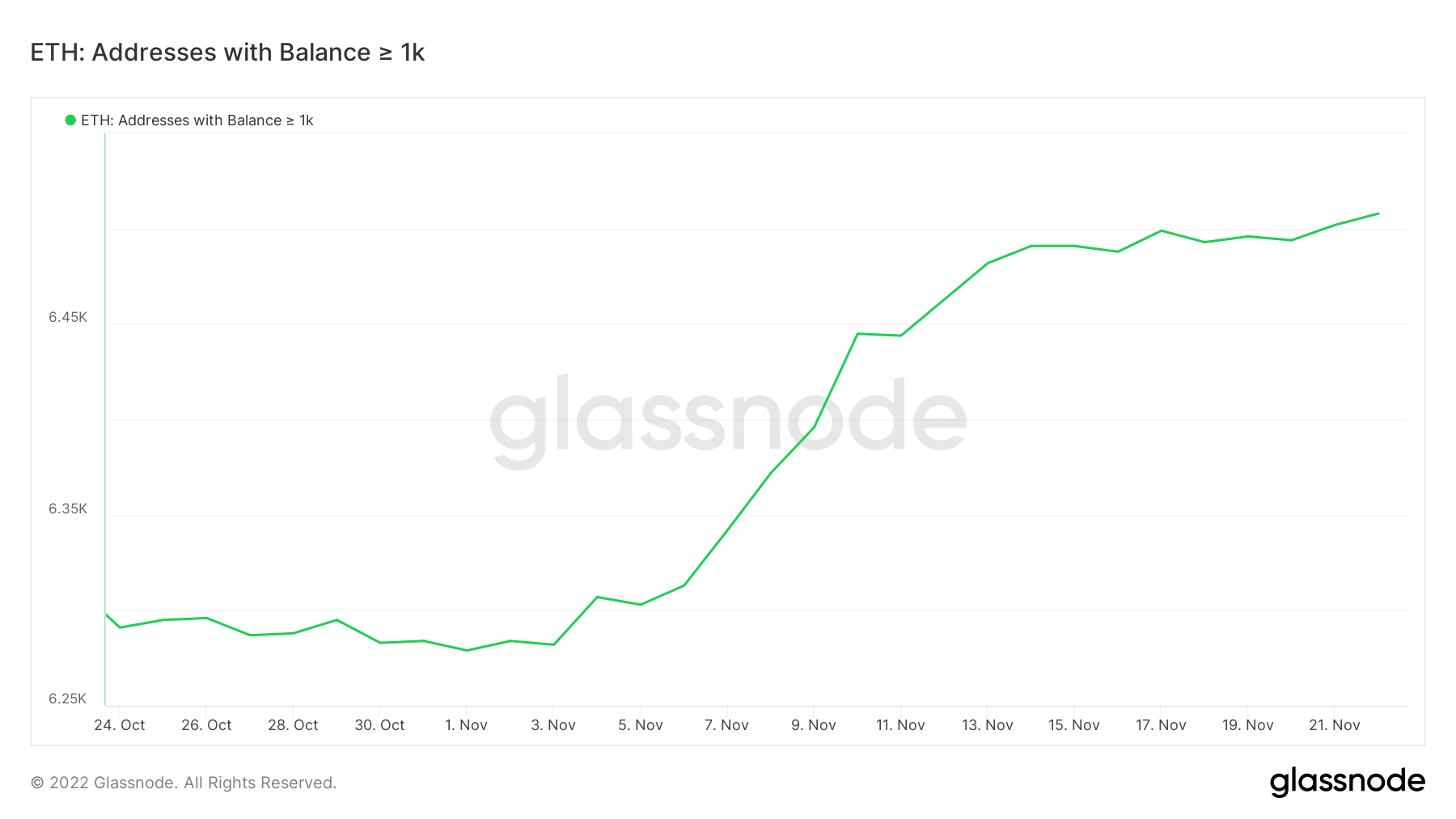

The observed drop in sell pressure means the bulls will have an easier time regaining control, especially if backed by significant accumulation. This is what whales are banking on. The number of address holding over 1,000 ETH balances have been steadily increasing over the last 4 weeks and are now at a monthly high.

Source: Glassnode

This is confirmation that many ETH whales have also been buying the dip. At some point the accumulation is bound to overtake the sell pressure, giving way for the bulls.

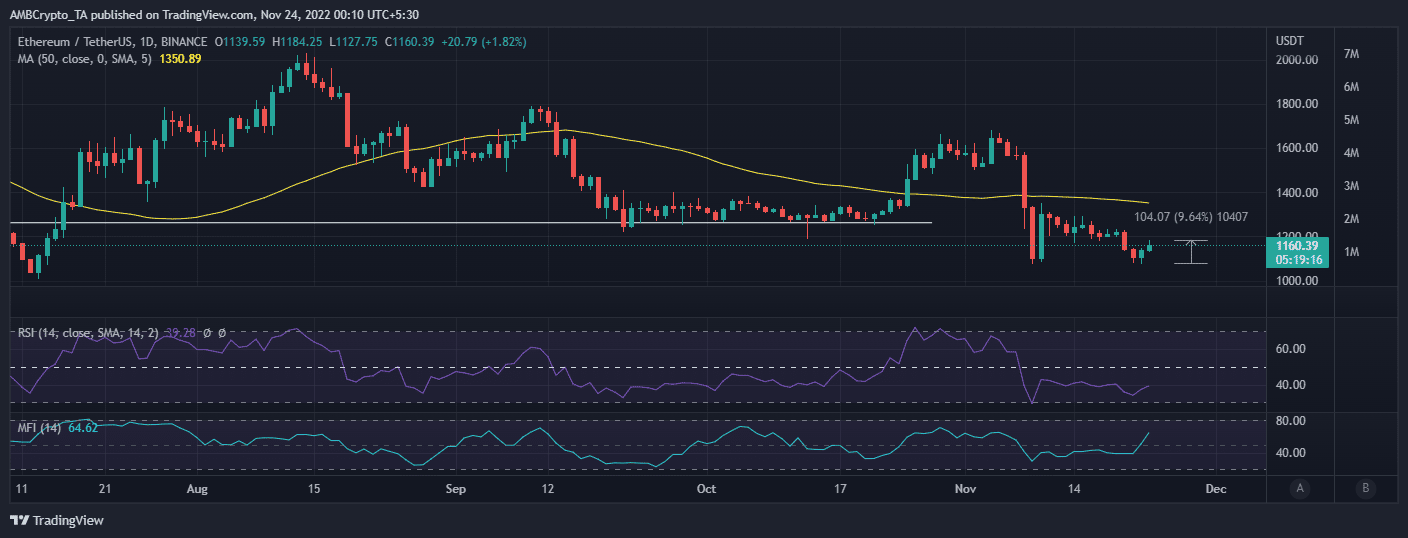

ETH’s price action managed to rally by as much as 9% in the last 2 days. Ergo, the question – Can ETH maintain the ongoing bullish momentum?

Source: TradingView

ETH’s money flow indicator confirmed ETH inflows in the last 2 days, reflecting the observed accumulation in on-chain metrics. Another key observation pertaining to the RSI was that ETH’s retest of the monthly low was a sign of higher relative strength.

Conclusion

Those who have been watching the market keenly may have noticed that the sell pressure and FUD have eased off towards mid-week. ETH might rally back above $1200 towards the end of the week if the current sentiment prevails.

However, the slow pace at which the market is recovering might indicate that investors are choosing to lean on the side of caution. A necessary choice given the bloodbath that we saw in the crypto-market.

![How the latest uptick in whale interest really helps Ethereum [ETH]](https://www.cryptonewsmetaverse.com/wp-content/uploads/2022/11/1669232799693-227aa570-e817-4434-9406-7f88aa73fa78-1000x600.png)