- Key sharks and whales have grown their ETH holdings in the last month.

- Even after a price decline, ETH sees fewer sell-offs.

Despite the continued decline in Ethereum’s [ETH] price due to the collapse of FTX, sharks, and whales (holders of 100 to one million ETH tokens) on the network exhibit no signs of slowing down accumulation, data from Santiment showed.

Read Ethereum’s [ETH] Price Prediction 2023-2024

FTX’s unexpected collapse pushed ETH’s price below its pre-merge levels as FUD overran the market. However, the cohort of ETH investors that hold between 100 to 100 million tokens remained resilient.

Data from the on-chain analytics platform showed that they grew their ETH holdings by 2.1% in the last month. Between 5 and 6 December, they added 561,000 ETH tokens to their bags, the highest daily accumulation in the last three months. For context, the huge accumulation caused the cumulative shark and whale holdings to return to pre-merge levels.

Source: Santiment

Buyers continue to buy

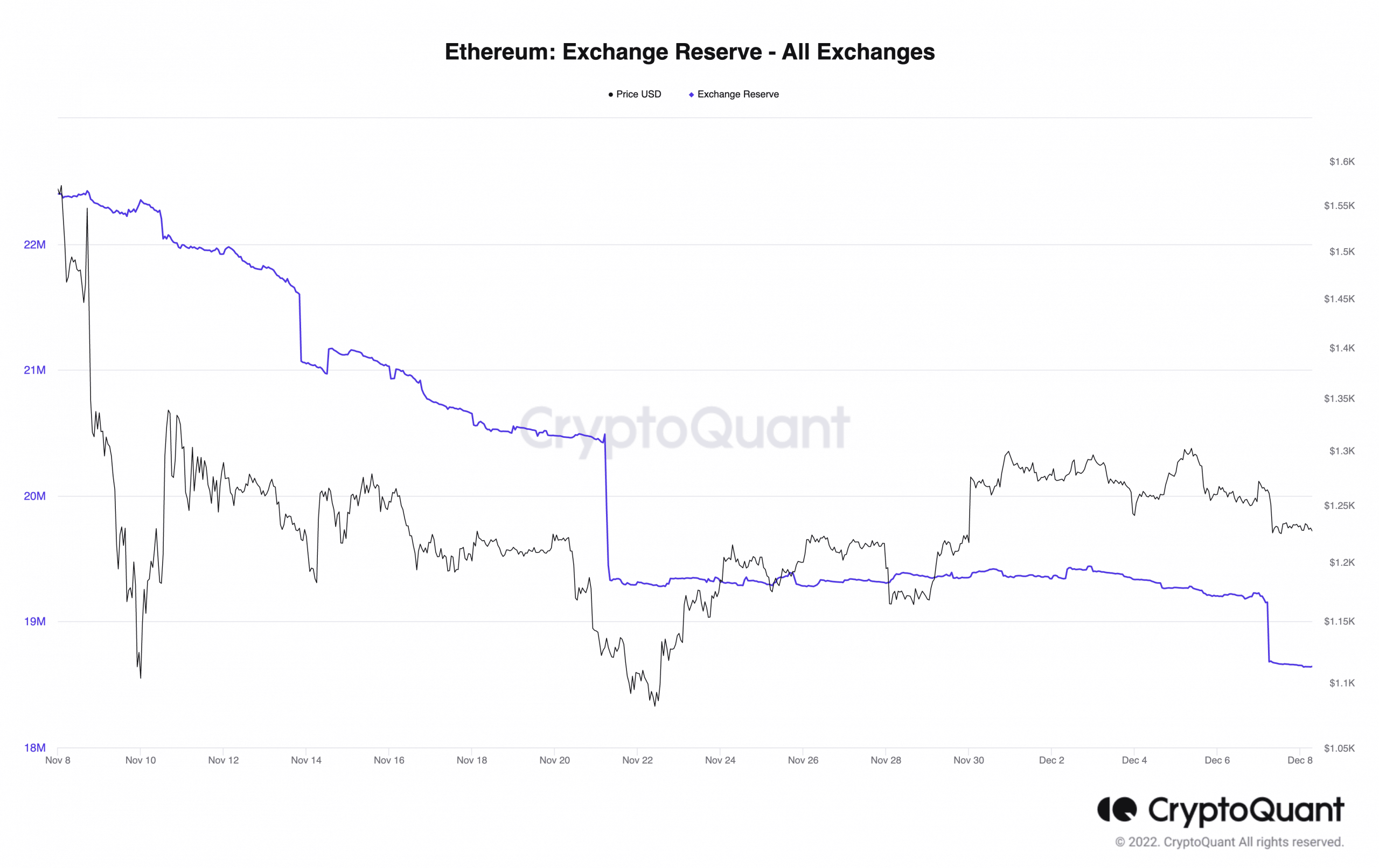

Even as ETH’s price dwindled in the last month, it still recorded few sell-offs. According to data from CryptoQuant, ETH’s exchange reserve fell by 17%. This decline showed that the amount of ETH coins held on exchanges fell.

Typically, investors send their assets to exchanges to sell them, and this would usually grow such an asset’s exchange reserve. Therefore, a decline in an asset’s exchange reserve indicates that fewer sell-offs have taken place.

Source: CryptoQuant

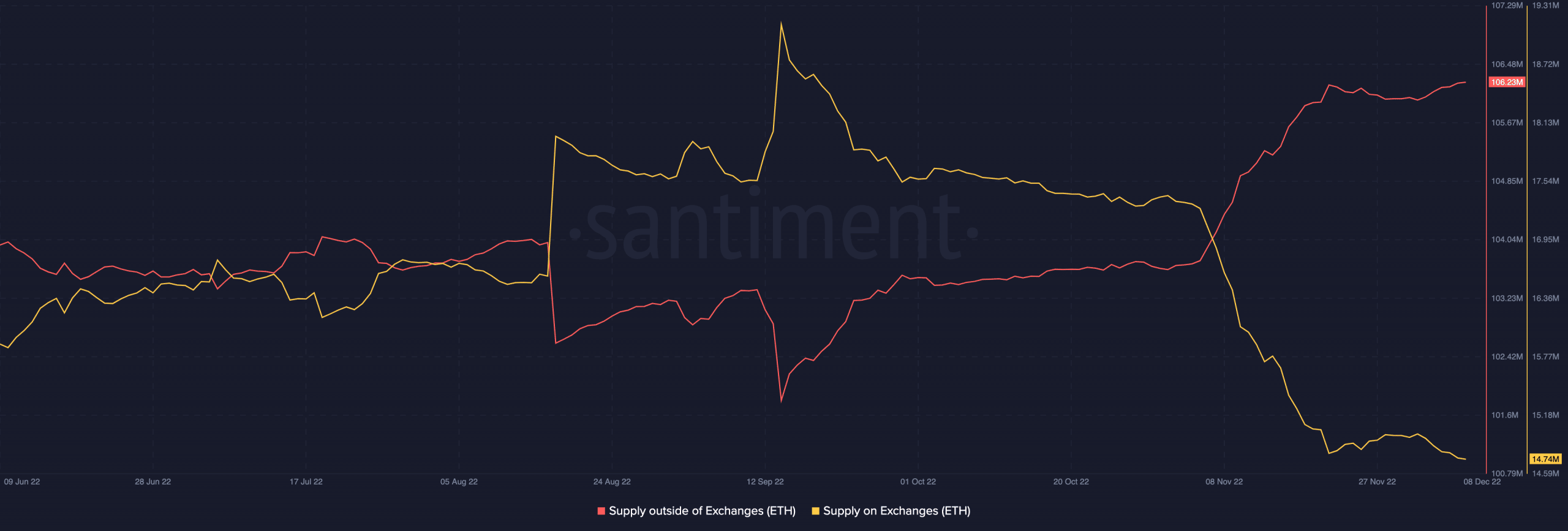

ETH’s supply outside of exchanges rallied by 3% within the same period.

Source: Santiment

Situating ETH’s exchange activity within the context of events in the last month, the decline in the amount of ETH held on exchanges, and the corresponding growth in the amount held off exchanges following FTX’s collapse was due to the fears and doubts that investors had concerning the safety of their assets on centralized exchanges.

Hence, the decision to send them to self-custody and to trade them on decentralized exchanges. Some have also held on to them to realize profit once the price picks up later.

Blame the “weak hands”

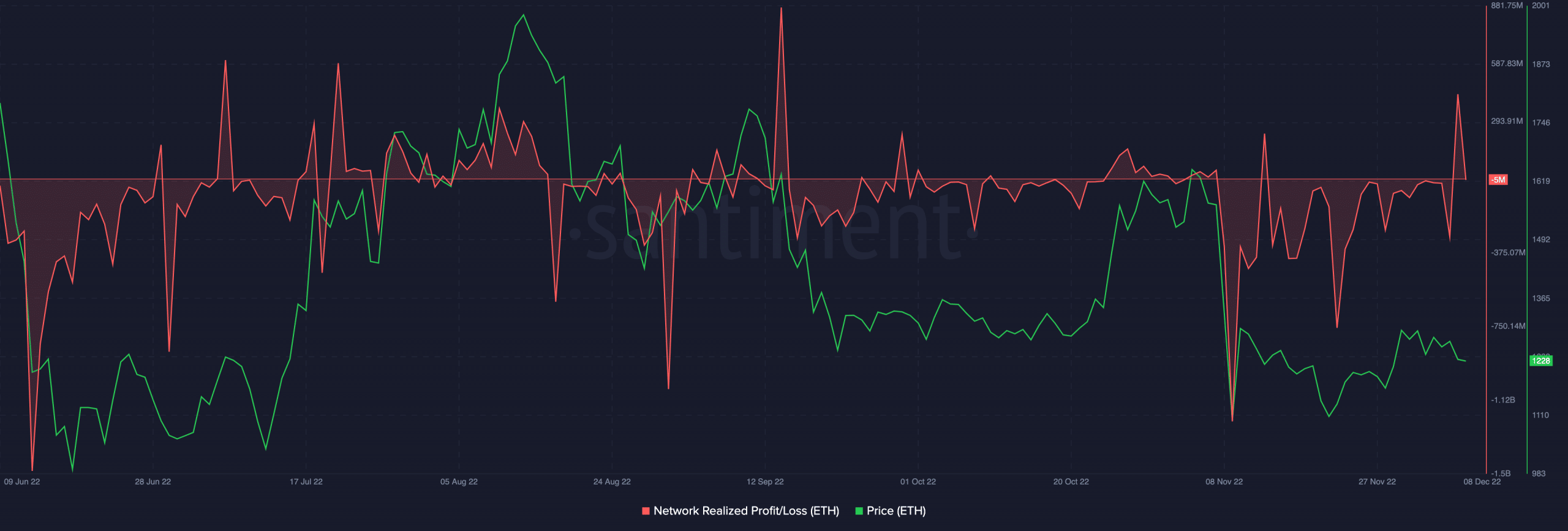

Per data from Santiment, an assessment of ETH’s Network Profit/Loss (NPL) when FTX collapsed showed a huge fall in the metric on 9 November. This indicated that many investors, in an attempt to save their investments, sold at significant losses, a classic case of the short-term capitulation of “weak hands.”

As new money attempted to enter the market to prop up the asset’s value, the FUD that plagued the market was too significant to overcome, and after a one-day jump in ETH’s price, it plummeted.

Towards the end of November, when the general market began to recover, ETH’s NPL dipped again, showing the exit of “weak hands” and the re-entry of “the smart money,” marking the commencement of a local bounce back.

Source: Santiment

Even so, since 22 November, ETH’s price has climbed by 10%, data from CoinMarketCap showed.