- Ethereum witnessed declining revenue per core developer

- Despite this, retail investors and validators continued to support Ethereum

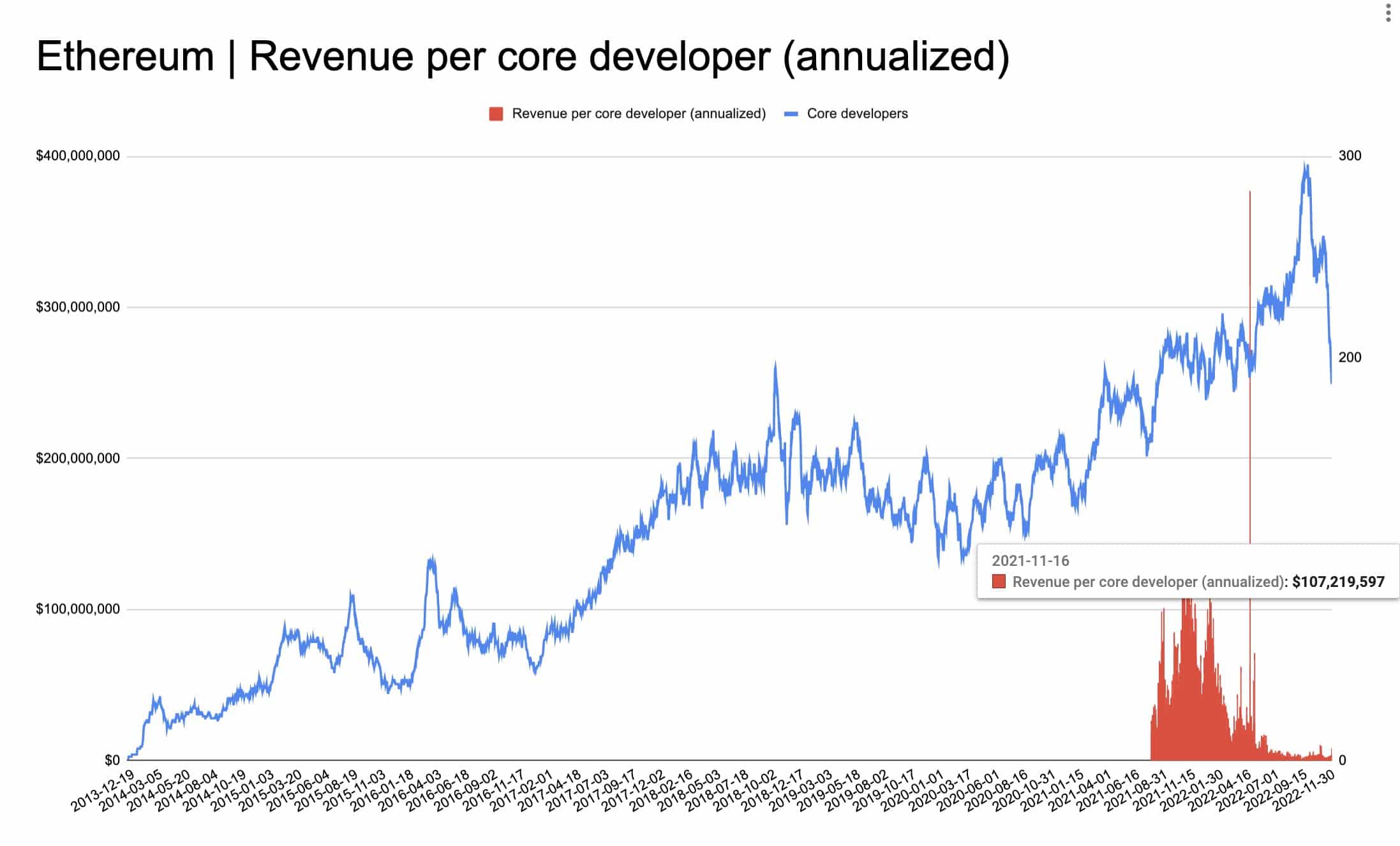

According to a tweet by Token Terminal on 11 December, the amount of Ethereum [ETH] revenue per developer had declined significantly since the beginning of the bull market. With ETH facing increasing volatility after the Merge, declining revenue could pose additional problems for Ethereum.

At the peak of the bull market last year, Ethereum had a ‘revenue per core developer’ figure of ~$100M

At the moment, the figure is ~$3M pic.twitter.com/Q6eaTPt81w

— Token Terminal (@tokenterminal) December 11, 2022

Read Ethereum’s [ETH] Price Prediction 2023-2024

As can be seen from the image below, the revenue per core developer decreased materially. This happened as the overall number of core developers working on Ethereum plummeted over the past few weeks. The same cam be seen in the chart given below.

Source: Token Terminal

Despite this and other FUD surrounding Ethereum, retail investors continued to show their support for the altcoin. According to data sourced from Glassnode, a crypto analytics organization, the number of non-zero addresses on the Ethereum network reached an all-time high of 91.1 million on 12 December.

#Ethereum $ETH Number of Non-Zero Addresses just reached an ATH of 91,104,236

View metric:https://t.co/beS1MtIgAZ pic.twitter.com/d859yPOaRI

— glassnode alerts (@glassnodealerts) December 12, 2022

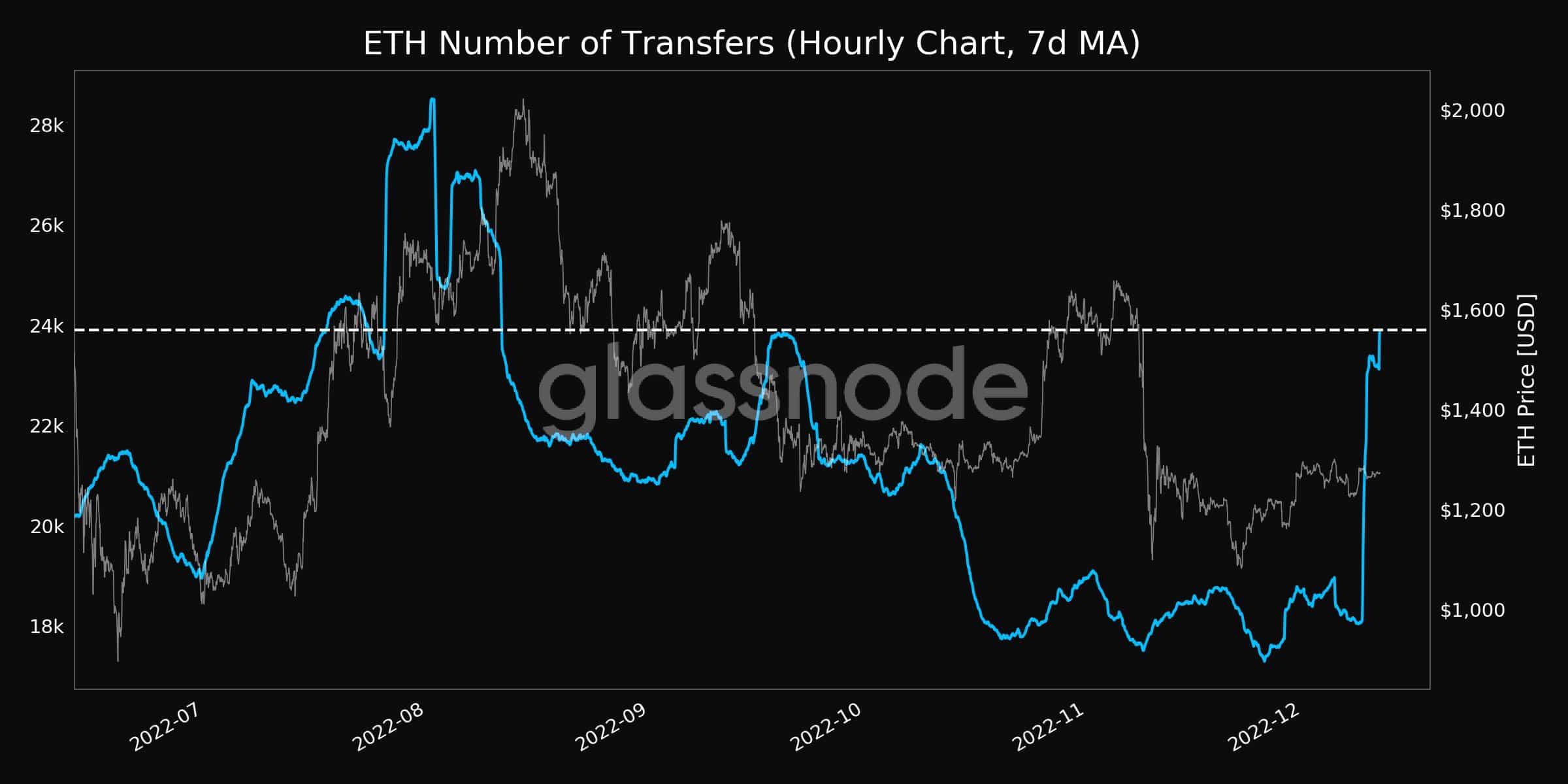

Furthermore, the activity on the network increased as well. From the chart below, it can be observed that the number of transfers on the Ethereum reached a four-month high on 12 December.

Source: glassnode

Validators remain unfazed

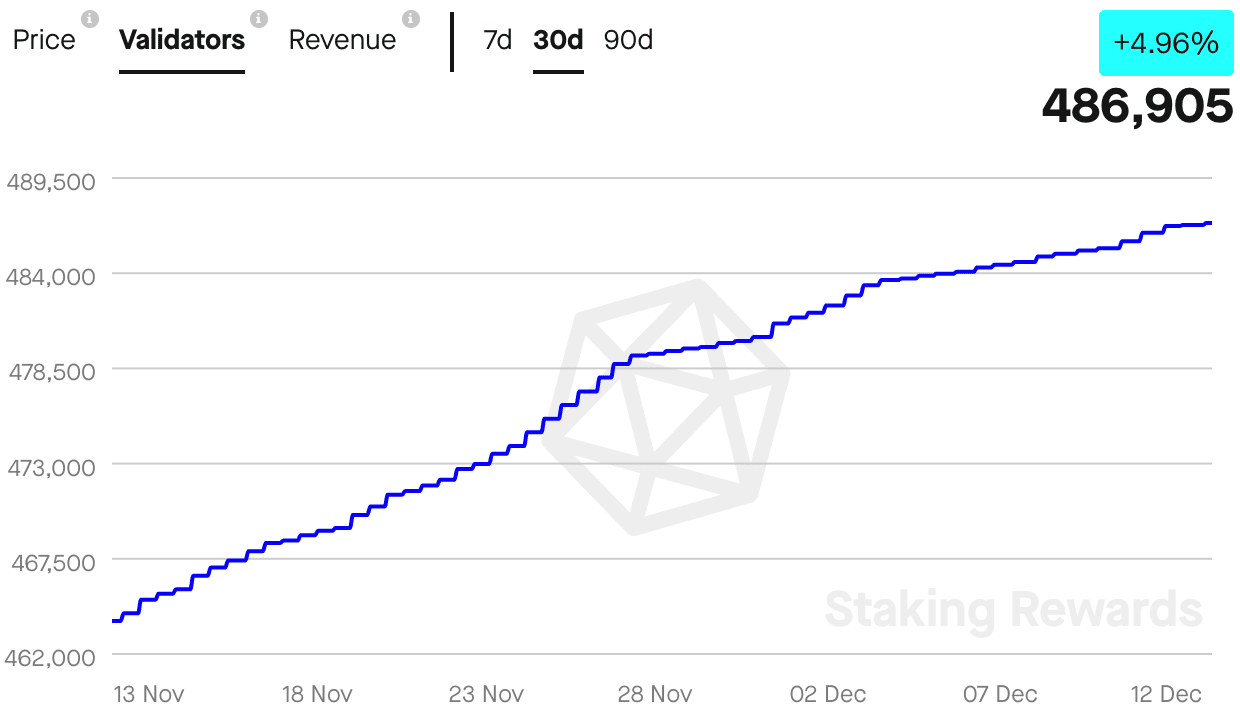

Alongside the aforementioned infromation, the number of validators on the network grew by 4.96% over the last 30 days. At press time, there were 486,000 validators on the Ethereum network.

The network’s validators continued to show support for Ethereum despite the revenue declining by 25.66% in the last 30 days, according to Staking Rewards.

Source: Staking Rewards

Holders are going to HODL

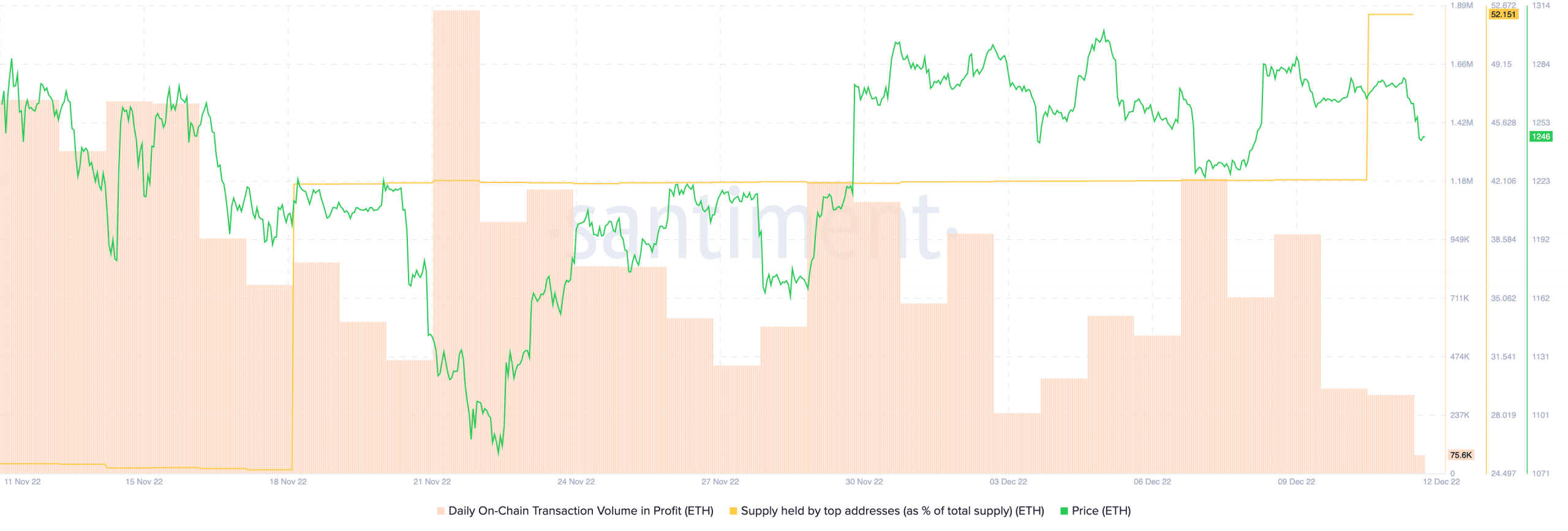

It wasn’t just validators that showed support for Ethereum. From the image below, it can be seen that despite Ethereum’s growing prices, the daily transaction volume in profit decreased.

This indicated that even though many Ethereum holders had a chance to benefit from this recent rally, they decided not to sell and held on to the altcoin. Additionally, whale interest surrounding Ethereum grew over the last few days, according to Santiment.

Source: Santiment

Even though there is a lot of volatility surrounding the crypto market, it appears that the crypto community stood in favor of holding on to their Ethereum tokens.