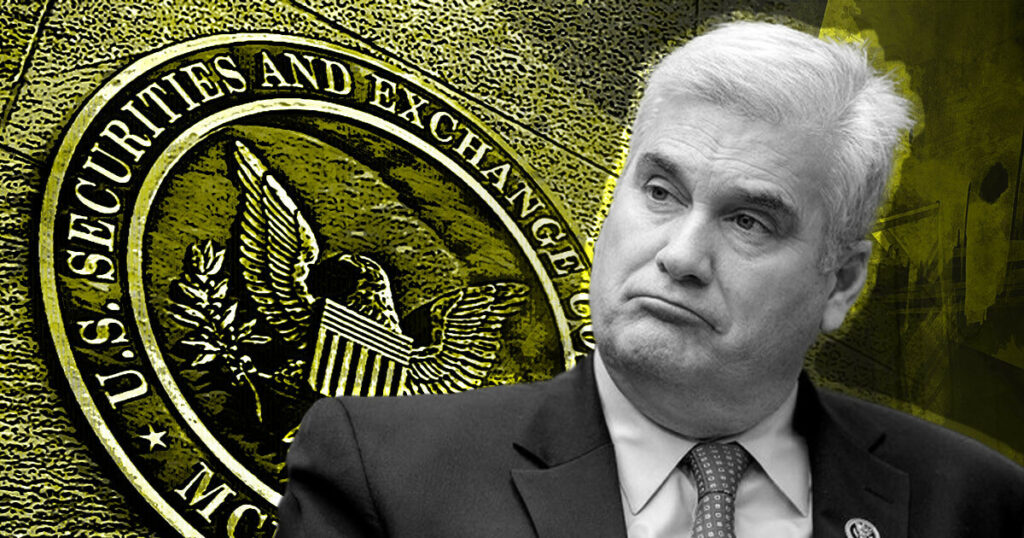

U.S. Congressman Tom Emmer is looking to reintroduce a bipartisan bill aimed at excluding non-custodial blockchain service providers from registering as custodial exchanges.

The pro-crypto lawmaker has severally called on Congress to establish clear regulatory frameworks to check the activities of crypto service providers. Earlier on August 17, 2021, Congressman Emmer introduced the bipartisan Blockchain Regulatory Certainty Act, with a focus on exempting non-custodial service providers from registering as money transmitters.

Emmer argued that certain blockchain developers and service providers like miners do not hold customers’ funds, hence, should not register as money transmitters like crypto exchanges.

In the wake of the FTX collapse, more U.S. lawmakers including anti-crypto Congresswoman Elizabeth Warren have moved to propose bills aimed at establishing clear regulatory guidelines for the crypto market.

To protect the interest of the crypto industry, Congressman Emmer said he is looking to reintroduce the bipartisan Blockchain Regulatory Certainty Act before Congress.

https://t.co/g2g0dFV0WU

— Tom Emmer (@RepTomEmmer) December 14, 2022

If Emmer’s bill is passed, blockchain developers and non-custodial service providers will not be subject to strict licensing and registering requirements as proposed by the Financial Action Task Force (FATF).

Emmer said:

“Blockchain service providers need clear rules of the road to be able to develop and invest in the United States, and this clarity is more necessary than ever as the FATF tires to encapsulate more non-custodial blockchain developers in the money transmission system.”

Emmer defends crypto

In light of the recent contagion, Congressman Emmer said that the collapse of FTX was not about crypto or decentralized finance, but a failure of centralized finance, Sam Bankman-Fried and SEC Chairman Gary Gensler.

Emmer has reportedly been working to investigate Gary Gensler’s role in helping FTX obtain a regulatory monopoly. He also alleged that the SEC Chairam knew that FTX was fraudulent and went ahead to meetings with Sam Bankman-Fried.