A widely followed analyst says investors will have opportunities in the crypto markets this year to realize massive gains in the future.

In a new Youtube strategy session, crypto strategist Benjamin Cowen tells his 780,000 subscribers that the crypto markets will likely dip in value before a recovery could take shape.

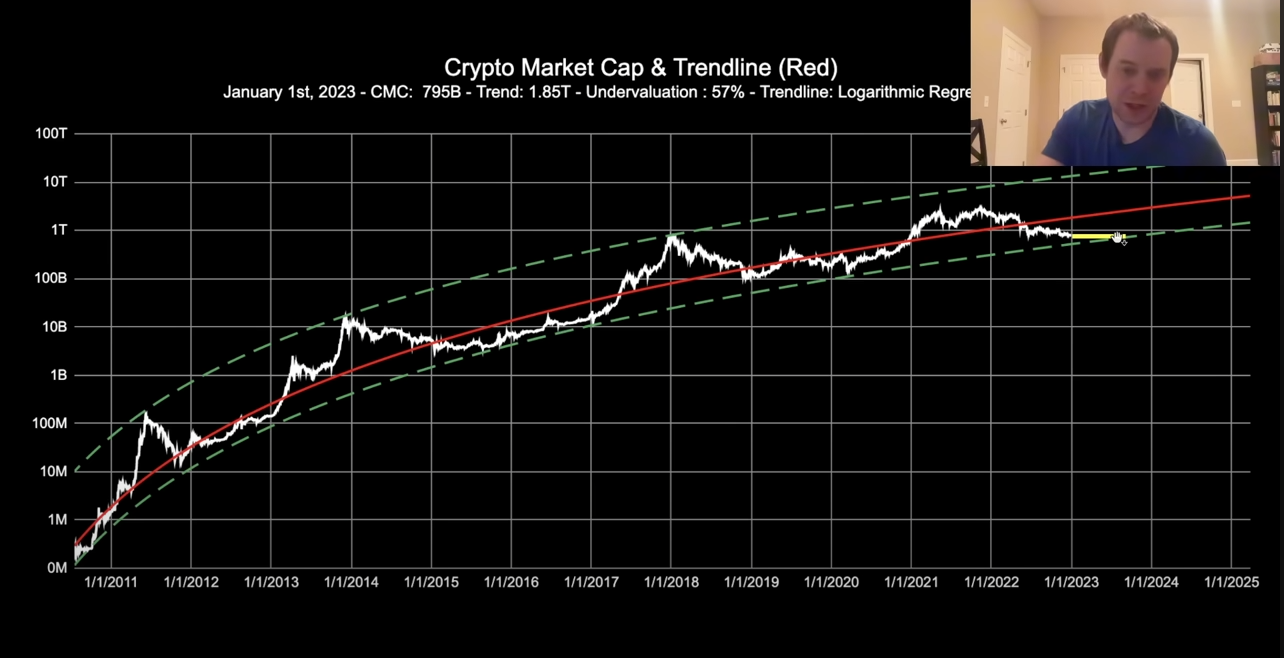

He uses a logarithmic regression chart of crypto’s market cap to show historical upper and lower bounds. He says the crypto market as a whole will likely either capitulate in a quick fashion or trend sideways in the coming months.

“I do think we will eventually get to that lower green trendline. Do we go down into it? Honestly, that’s what I would prefer, because I think it provides more opportunity. Of course, there’s always a chance we go sideways until we hit it. We’ve done that before.

If you look at 2015, it’s a good example of coming out of a year-long bear market and rather than going down into the trendline, we just went sideways until we hit it. Kind of the same thing in 2018. We got down here. We actually poked our head back above the fair value line, but we more or less just went sideways until we hit it and then the bull market began.

I don’t really think a sustained bull market is going to occur until we hit this lower green trend line again. Either we go down to it in short order or we go sideways long enough for it to slowly catch up.”

Looking at Cowen’s chart, he predicts a crypto market bottom around the second half of this year.

Cowen also says the market conditions in 2022 that made cash the stronger position will likely change this year as he expects crypto to present generational accumulation opportunities.

“The good thing is I do think 2023 will bring plenty of opportunities to get into the market. As you guys know in 2022, I’ve often said cash is king, stack cash…

I do think we’re going to have some pretty generational opportunities coming up so stay tuned for that.”

I

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney