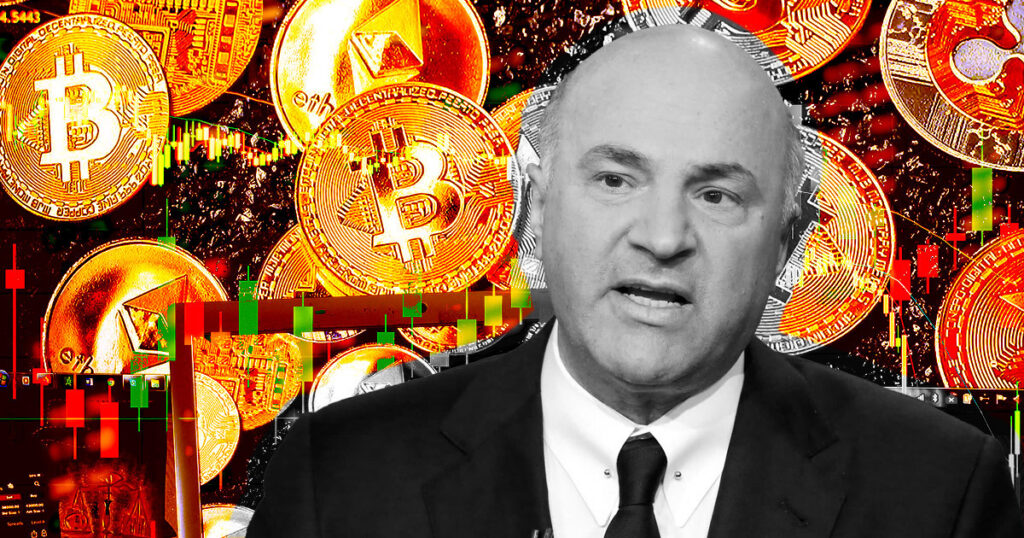

Entrepreneur Kevin O’Leary advocated for an exchange passport system that oversees cryptocurrency regulation on a global scale.

“I think this is all coming, and I think this is how we’ll emerge out of this. It’s going to squeeze out the unregulated rogue exchanges slowly but surely…”

How would a crypto exchange passport system work?

In the wake of the FTX disaster, O’Leary pointed out that lawmakers are tired of crypto scandals and fully intend to clamp down hard on the industry.

The TV personality said, over the last two years, 80% of people who bought crypto lost 82% of their money. Thus heightening investors’ expectations for better protection.

O’Leary disclosed transferring his remaining crypto assets (after his FTX losses) into the Bitbuy exchange. He felt confident doing this because the Ontario Securities Commission heavily regulates this exchange.

“I moved it up to Canada under the eye of the regulators, so I have an account there. It’s highly scrutinized, and the only way that operation gets to keep operating is to stay compliant month by month with proof of assets and total transparency and audit and everything else.”

An exchange passport system would operate with compliant organizations, such as Bitbuy, being granted a passport. Only approved, passported organizations can link to the banking system for on/off ramping.

This format would be copied by all jurisdictions, thus weeding out the centralized bad actors regardless of where they are located.

Self-custody and decentralized exchanges remain an alternative to the scenario O’Leary described.

Big institutions don’t own Bitcoin, says O’Leary

Tying into the lack of a unified global approach to cryptocurrency regulation at this time, O’Leary thought it necessary to dispel the idea that institutions have bet big on Bitcoin and cryptocurrency.

He said institutions “own none of it” because “there’s no compliance platform” to buy crypto even if they wanted to buy it. The FTX disaster has not helped.

Host Scott Melker corrected O’Leary by differentiating types of institutions in that crypto-native hedge funds do invest in digital assets.

O’Leary called these crypto-native hedge funds “a rounding error” and insignificant compared to big players such as sovereign wealth funds. Once regulation allows it, the big players will come, and price appreciation will follow, expects O’Leary.