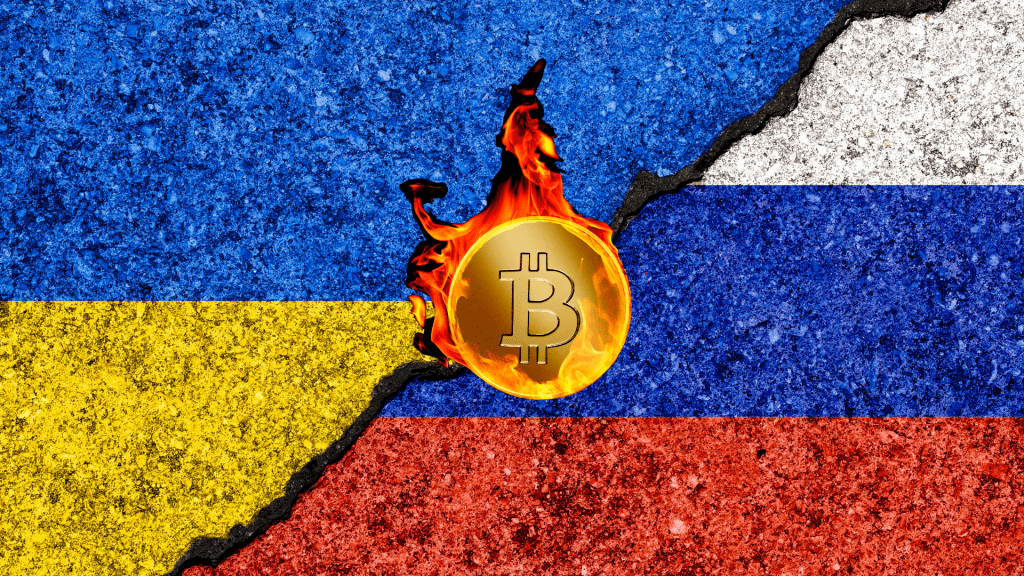

The fears of regulators around the world about Russia using Bitcoin to evade sanctions could be about to come true as a top Russian government executive has revealed that the country’s authorities could be willing to accept Bitcoin payments for its natural gas.

Duma committee deputy Pavel Zavalny revealed this development on Thursday during a news conference that the country could be willing to accept various currencies, including the flagship digital asset for exportations depending on the buyers’ preferred method of payment.

According to Zalvany, Russia could be open to receiving payment in the Chinese Yuan and Turkish Lira as they are friendly nations to its cause.

When it comes to our ‘friendly’ countries, like China or Turkey, which don’t pressure us, then we have been offering them for a while to switch payments to national currencies, like rubles and yuan.

He continued that if these countries also wanted to switch their payment choice to Bitcoin, then Russia would also be open to it.

News of the possibility of Russia accepting Bitcoin has played a role in pushing the value of the asset to around $44k. According to data from Coingecko, the value of the asset has risen by over 4% within the last 24 hours.

Russia, Bitcoin, and the International Community

We have extensively reported that the international community had warned that Russia could use Bitcoin and other digital assets to evade sanctions.

However, the crypto community has vehemently denied the possibility of this happening as the country would require an enormous amount of liquidity to be able to pull this off. At the same time, the community also stated that the nature of blockchain technology would make it impossible for transactions that much to be hidden.

The European Union alongside the US had initiated an extensive amount of sanctions on Russia which had led to the value of the country’s national currency, Ruble, tanking.

Ukraine also enjoyed an enormous amount of goodwill from the crypto community. The community made donations of over $70 million to the war-torn country through digital assets like Bitcoin, Ethereum, Polkadot, and others.