For those who don’t know, NFTs or non-fungible tokens are unique tokens that confer the sole ownership of a digital asset via a blockchain. While many NFTs have been used to trade ownership rights to real-world assets such as digital art or music, this concept is starting to take hold in the real estate sector as well.

As cryptocurrencies have exploded into the mainstream, real estate has also felt the effects. Buyers have started looking at ways in which they can convert some of their digital assets into real property. This has led to the rise of buying and selling homes and properties through the blockchain.

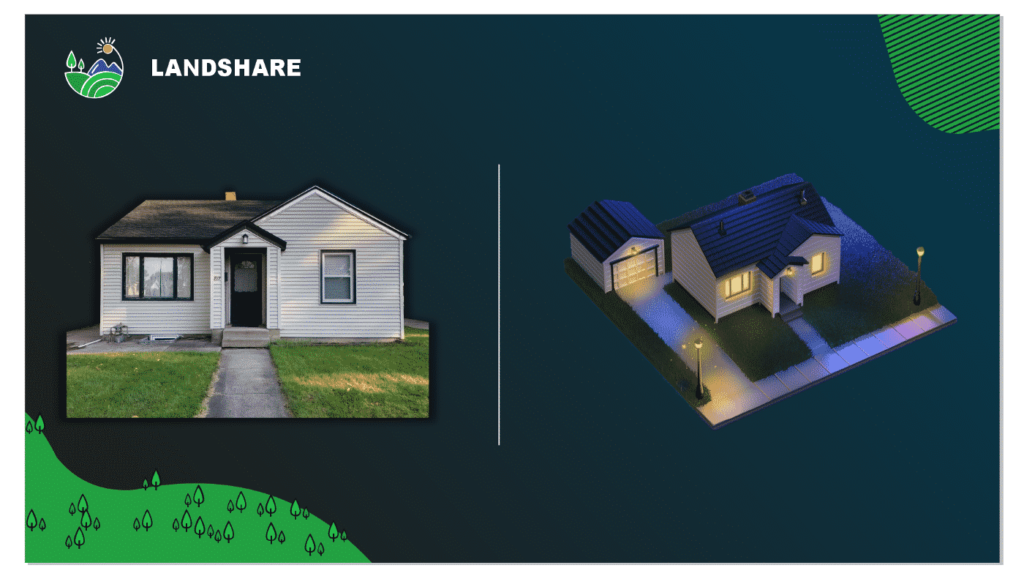

This brings us to the project Landshare, which has createdthe first-ever real estate NFTs that allow you to supplement yields from real world properties. They are given out to users who purchase real estate assets via their tokenization process. Landsharegives users the chance to own real-world property on the blockchain earn yields in the form of rental income and property appreciation.

What is Landshare?

Landshare is a uniquely lucrative investment opportunity as it leverages the value generated by utility NFTs as well as real-world assets. It is a platform that runs on the Binance Smart Chain seeking the disruption of the traditional real estate market.

So users have to just sit back and enjoy the fruits of monthly rental income. They also have the chance to earn additional LAND yields with the NFTs. This allows users to earn upwards of 40% additional APR from asset token yields.

Landshare Real Estate NFTs: Explained

Similar to the real world, the better the NFTproperty the more yields it generates. The main aim of the Real Estate NFT ecosystem is to encourage users to upgrade their houses using visual/structural improvements and renovations.

Real Estate NFTs from Landshareare powered by Asset Tokenization technology. This allows NFT holders to own real estate using the blockchain. Asset tokens represent the ownership over tangible real estate assets. Those who hold asset tokens are treated to monthly rental yields and can take advantage of property value appreciation.

Users can use their NFTs to stake these asset tokens, allowing them to generate LAND yields following a play-to-earn model. LAND generation per user per asset token depends on the yield multiplier of the NFT. Using special resources generated within the ecosystem users can upgrade or renovate their virtual property to increase the yield multiplier.

Production facilities and resources for Landshare

The Landshare NFT ecosystem requires users to manage resources, juggling limited resources between renovations, production and repair. Users have to increase their LAND yields with upgrades. However, to get these upgrades users will have to make use of resources such as power, steel, concrete, brick and lumber. Each of the resources mentioned above is produced from each of 4 facilities – the Steel Mill, Concrete Plant, Brick Factory and Lumber Mill.

How Landshare moves beyond traditional real estate investment

A normal real estate investment trust (REIT) has an annual yield of 4.3%. On the other hand, Landshare’s streamlined blockchain investment technology as well as its NFT staking feature allow users to earn upwards of 57% APR. From a typical REIT yield, this is an increase of 1225%.

Landshare seeks to create a new generation of real estate investment by merging traditional real estate with DeFi. By eliminating management fees, overheads, and addressing the inefficiencies present in the traditional real estate investment marketLandshare offers larger profit margins than traditional REITs can offer. Landshare aims to transform the real estate market and bring it onto the blockchain. The NFT feature provides users with an exciting and engaging way to earn with Landshare.

Conclusion

The tokenized real estate ownership market seems poised to become a hot trend in the coming years. By using a play-to-earn NFT staking model, Landshare NFTs allow users to bolster their asset token returns. With just a single investment, users can earn yields both from a real asset as well as its virtual counterpart. With the LAND governance token, investors have more control over the underlying asset.

Users can invest as little as $50 in fractional real estate investments via the blockchain. To check out more details about the Landshare platform, visit https://landshare.io.

Additionally, you can view Landshare’s current offering athttps://app.landshare.io/property-details.

Disclaimer

Asset Token offerings are not, and will not be, registered under the Securities Act of 1933, as amended(the “Securities Act”) and may be offered or sold to non-US residents outside of the United StatesAccordingly, the Securities are being offered and sold only to non-US residents in compliance withSEC Final Rule Offshore Offers and Sales (Regulation S). Additional jurisdictional restrictions apply, please see below.

The following countries are restricted from participation in Tokenized Asset offerings: United States, Afghanistan, Albania, Barbados, Balkans, Botswana, Burkina Faso, Burma, Cambodia, Central African Republic, China, Cote D’Ivoire, Crimean Peninsula, Cuba, Democratic Republic of Congo, Eritrea, Guinea-Bissau, Iran, Iraq, Jamaica, LNR (Luhansk Republic), Lebanon, Libya, Liberia, Mauritius, Mali, Morocco, Myanmar, Nicaragua, North Korea, Pakistan, Panama, Senegal, Somalia, Sudan, Syria, Uganda, Yemen, Venezuela, Zimbabwe, Anguilla, Dominica, Fiji, Palau, Samoa, Seychelles, Trinidad and Tobago, Vanuatu are restricted from participating. This list is not all-inclusive. Additional restrictions may apply. Token lock periods may also apply to certain jurisdictions.