Bored Ape Yacht Club (BAYC) NFTs saw demand skyrocket in the last 24 hours. The collection’s 24-hour trading volumes surged by 176%. The rise can largely be attributed to increased whale buying, as the floor price of the Bored Ape Yacht Club collection dropped below key levels.

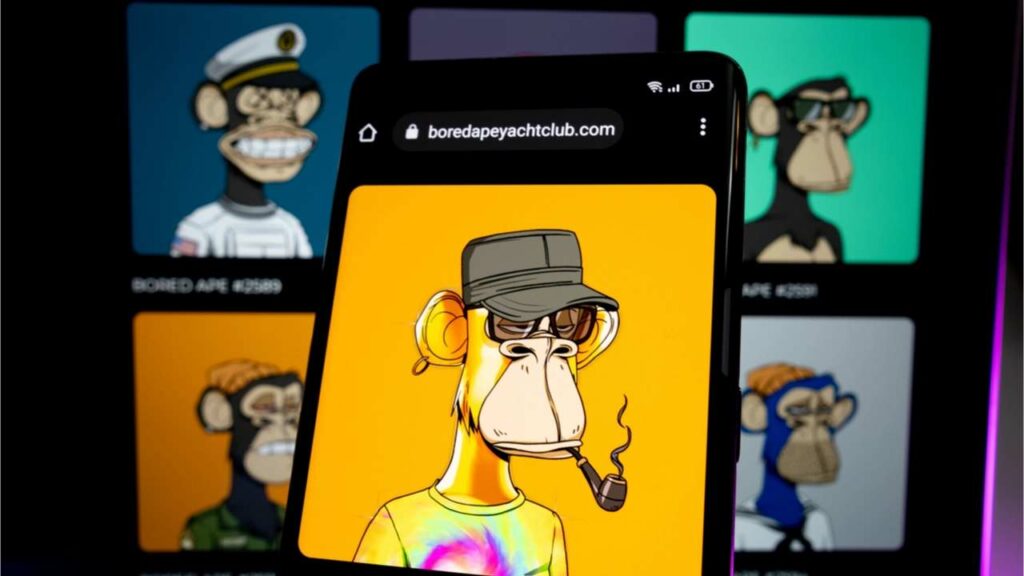

BAYC is a unique collection of NFTs on the Ethereum blockchain, continuing to gain interest from celebrities, businesspeople, and crypto whales. Given that the apes are priced in ETH, their USD floor price has seen a sharp fall in recent weeks, tracking a decline in the world’s second-largest cryptocurrency.

Whales snap up Bored Ape NFTs Amid Price Drip

In the last 7 days, the floor price of BAYC today dropped to a minimum price of 100.85 ETH. The significant decrease in floor price in the last 24 hours attracted interest from whales.

According to data from NFTGo.io, whales acquired 5 out of 11 collections near the floor price of 109 ETH in the last 24 hours. The current price of the BAYC collection is 109.50 ETH. Moreover, the total market value is $996 million, and the number of addresses held is 6,419.

Crypto whale Jeffrey Huang bought the Bored Ape Yacht Club #7858 NFT at the highest price of 140 ETH, worth $423,433.41.

Furthermore, the BAYC and Mutant Ape Yacht Collection (MAYC) remained in the top 5 NFT collections in the last 24 hours as the collection continues to be in demand.

Meanwhile, the Bored Ape Yacht Club collection will be featured in the three-part film “The Degen Trilogy” by Coinbase next year, and the company is currently asking BAYC owners to submit Bored Ape characters and story ideas.

ApeCoin (APE) Price Awaits Uptrend

The ApeCoin (APE) price has rallied significantly higher in the last 7 days, making a high of $13.46. The news of BAYC and ApeCoin featuring in the Coinbase film trilogy and rumors of APE listing on Robinhood pushed APE price 20% high from April 12-14. Currently, the price is moving sideways in the $12-$12.50 range.

Nevertheless, the price BAYC linked APE will rise higher with rising in interest from whales and an improvement in market sentiments.