Crypto analytics firm Santiment is issuing an alert to traders, warning Ethereum (ETH) may be facing an increase in bearish momentum.

In a new report, Santiment says Ethereum is tightly following the price action of the S&P 500 amid a bleak macro environment.

“ETH continues to follow very closely with the S&P as global uncertain remains.

If indeed S&P leads the way, then it’s important that the retest levels see a bounce for bullish continuation else it’s highly unlikely that ETH will hold its ground.”

According to Santiment’s chart, the S&P needs to stay above 4,100 points for ETH to have a shot at bullish continuation. The S&P 500 closed the trading week at 4,057 points following a 3.37% decline on Friday.

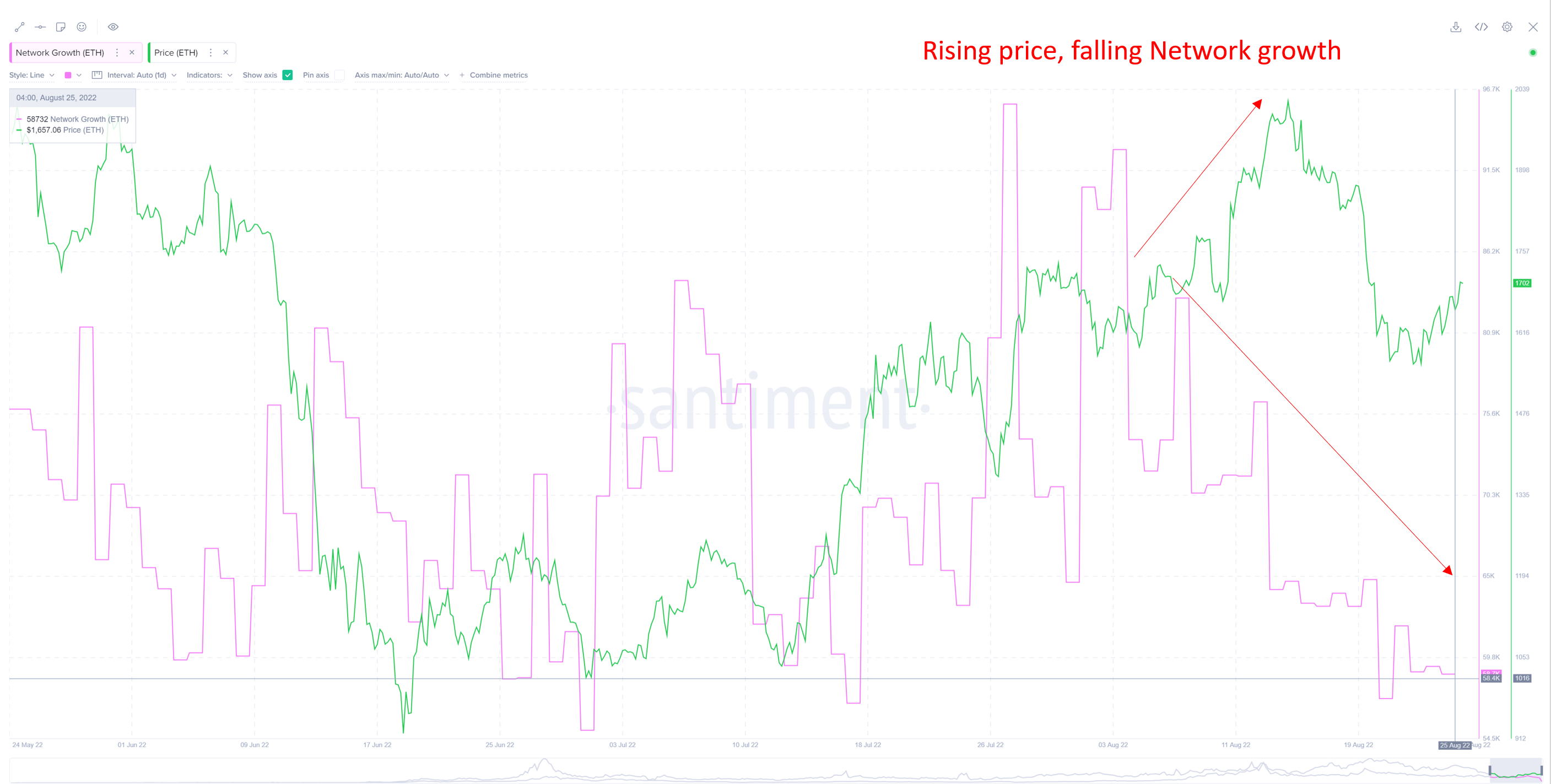

The firm is also keeping a close watch on Ethereum’s network growth, and says the on-chain metric is flashing a red flag.

“ETH’s network growth have been declining steadily since the start of August while price continued to climb. This divergence is generally not a healthy one as it indicates that there’s very little new market participants coming in to support the price.

Everyone that wanted a position is likely already in.”

Ethereum is currently valued at $1,503, down over 10% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Vec.Stock/monkographic