- Uniswap kicked its NFT pursuits into high gear through its new aggregator.

- UNI’s bullish prospects watered down as sell pressure mounted.

Uniswap [UNI] has finally jumped on the NFT bandwagon. The DEX has announced the launch of a new NFT aggregator in its latest effort to secure a piece of the NFT market.

Are your UNI holdings flashing green? Check the Uniswap profit calculator

A 10 January tweet from Uniswap revealed that the aggregate would compile NFT listings from different marketplaces so that they could be viewed from one interface. These platforms included LarvaLabs, LooksRare and OpenSea.

1/ Uniswap launched an NFT aggregator to help you find the lowest prices across the most popular marketplaces.

Wondering what an aggregator is and how it’s different from a marketplace? 👇

— Uniswap Labs 🦄 (@Uniswap) January 10, 2023

The Uniswap NFT aggregator aims to make it easier for NFT traders to compare prices. But more importantly, it offers a level of efficiency to counter the fragmented nature of the market. This means that users do not have to hop from one platform to another to find the best prices or offers.

Boosting the NFT volumes of Uniswap

Though it was too early to say anything until press time, Uniswap’s NFT trades volumes may experience a surge after this announcement. However, the surge will depend on whether the efficiency of this new offering could attract more users.

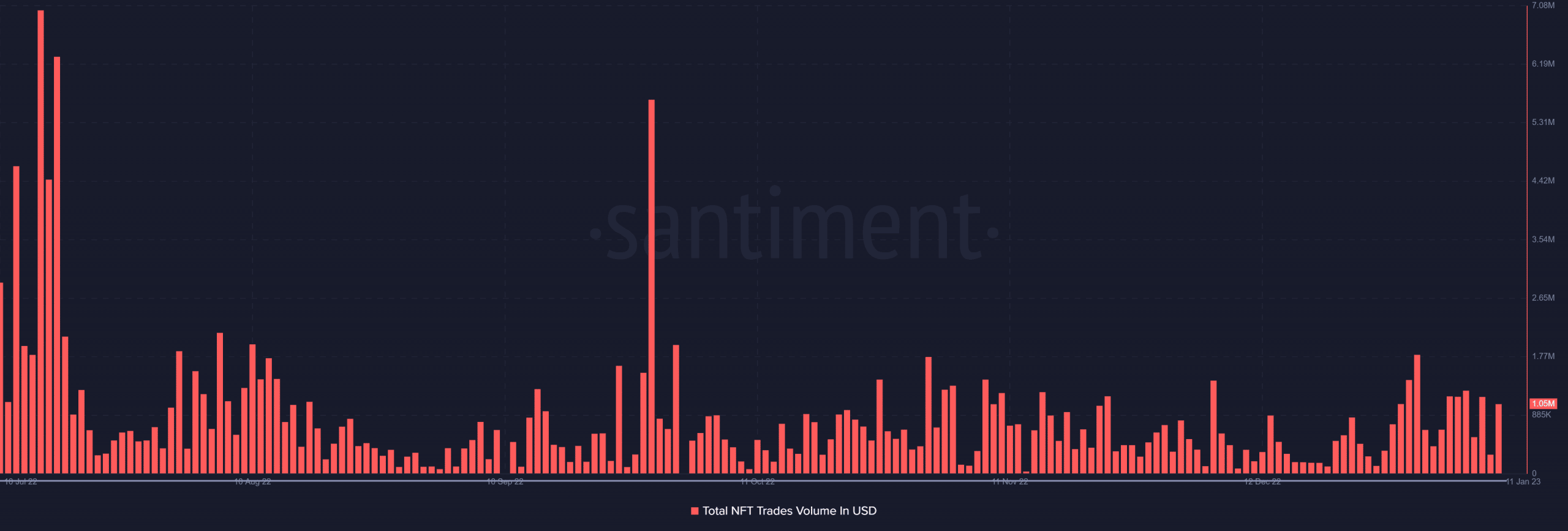

A look at its past performance revealed that the trade volumes of Uniswap’s NFTs have dipped considerably from their six-month highs. This reflected the overall drop seen in the NFT market over the last 12 months.

Source: Santiment

However, despite the drop, the market still maintained a noteworthy amount of trading volume. The new NFT aggregator thus has the potential to boost NFT trades volumes in the next few months.

Can UNI maintain its rally?

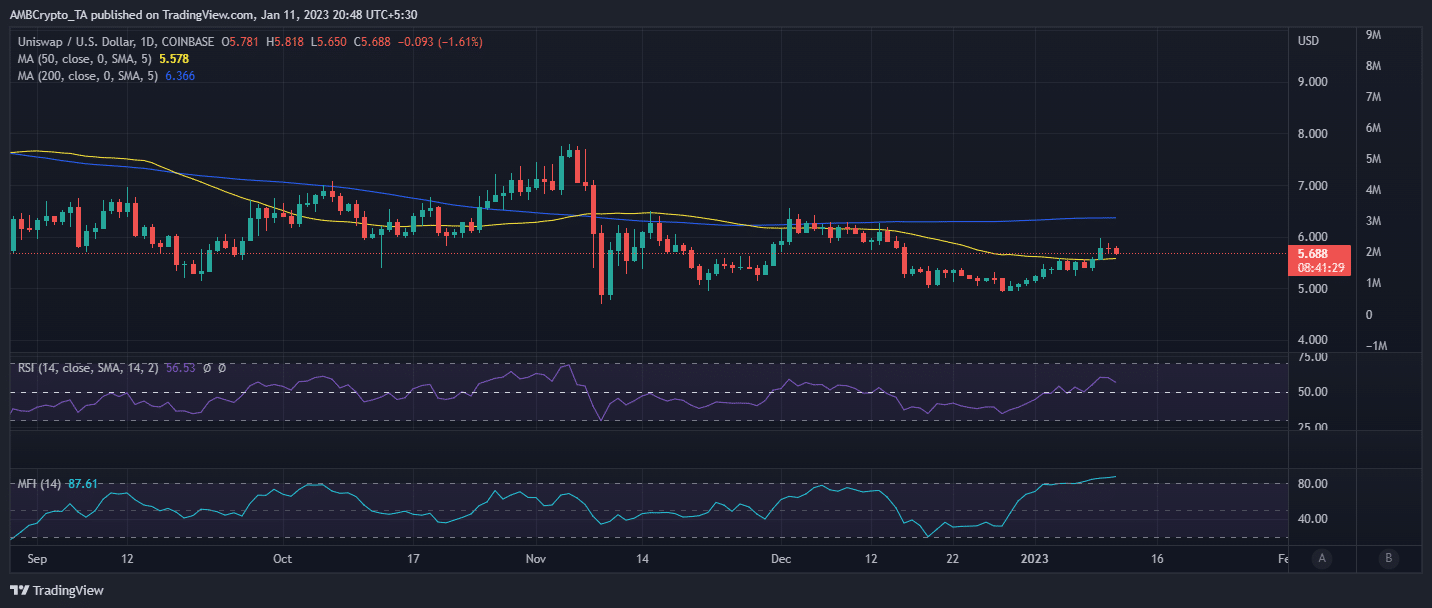

Uniswap’s native token UNI has experienced some sell pressure after a healthy rally since the end of December 2022. It traded at $5.69 at press time after a slight pullback in the last three days.

Source: TradingView

UNI may still have some room for upside, especially since it was not overbought until press time. However, its MFI was already in the overbought zone, which increased the chances of a potential drawback. This was further supported by the current observations regarding the exchange volumes.

A 76.84x hike on the cards if UNI hits Bitcoin’s market cap?

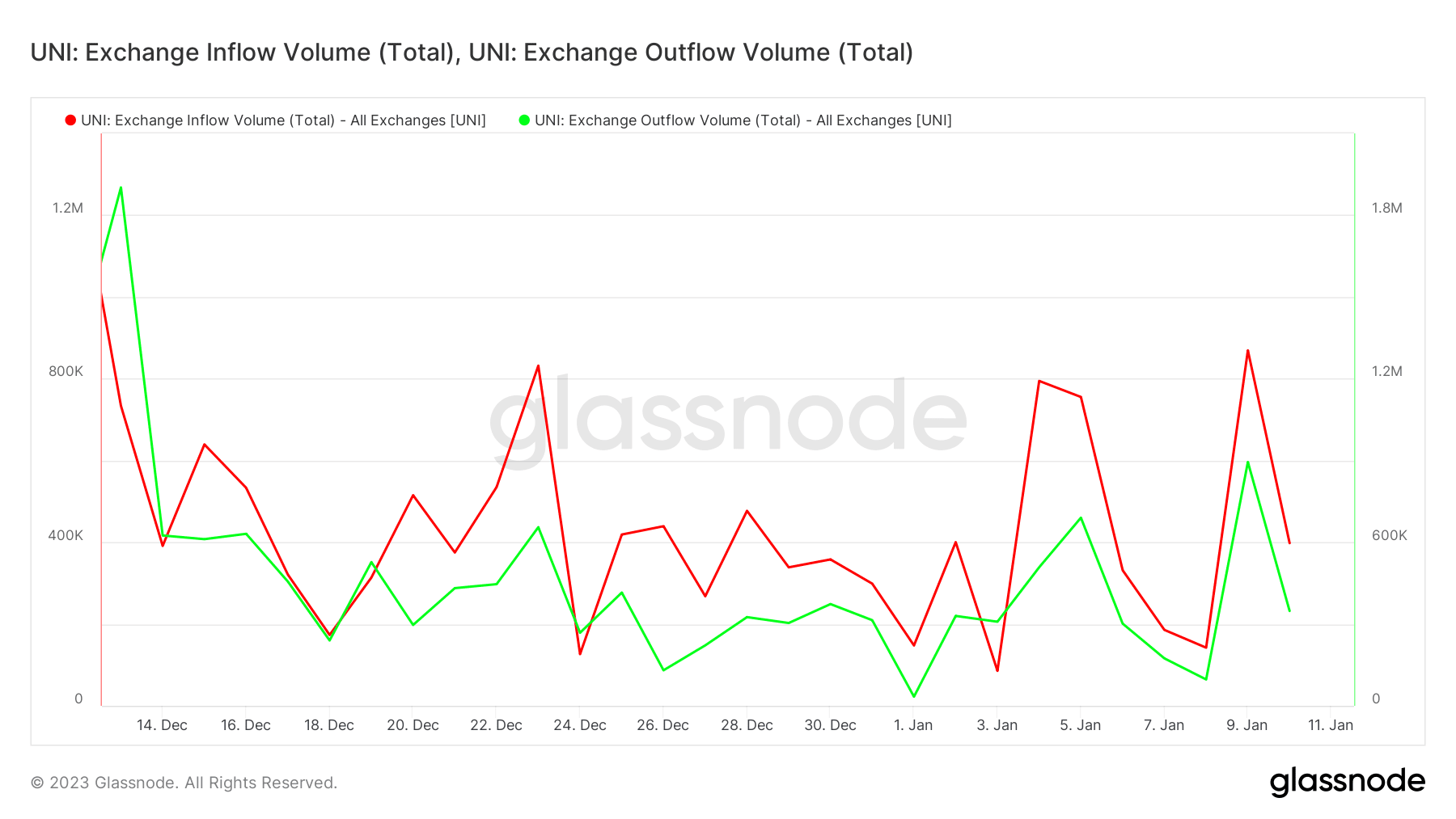

UNI’s latest exchange volume data confirmed a decline in trading activity at press time after a price rally conclusion at the start of the week. The ratio of inflows vs outflows suggested that the bulls were more dominant.

Source: Glassnode

UNI’s exchange inflows outweighed the exchange outflows at the time of writing, confirming less demand than sell pressure. Therefore, there would probably be more sell pressure if this trend continued, but the bulls might make a comeback if market sentiment allows.