Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- The market structure was strongly bearish

- Ethereum perched precariously above a zone of demand

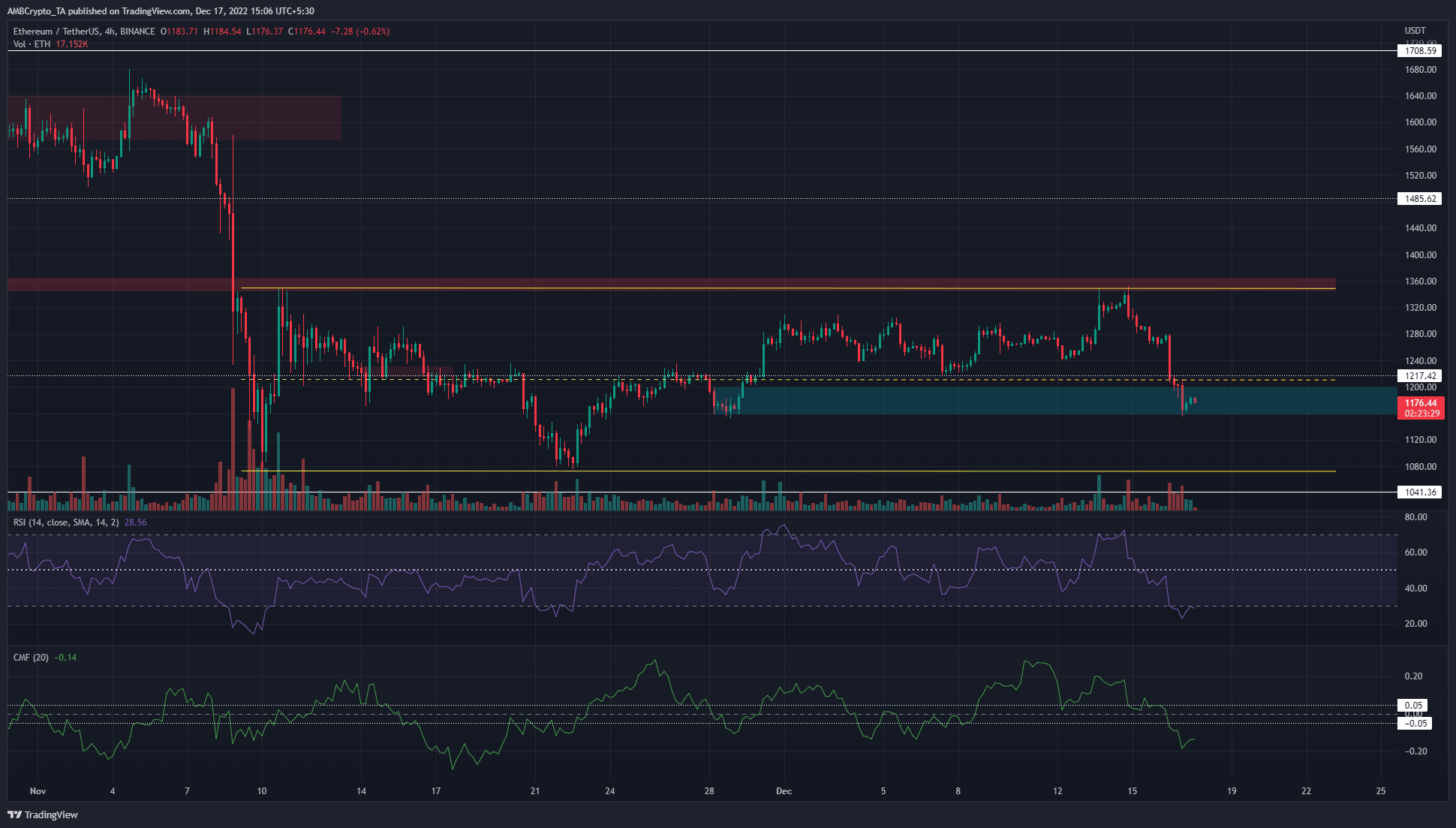

Ethereum [ETH] posted losses of 12.5% since the $1,351 high that it reached on 14 December. The bulls fought to defend the 12-hour order block near $1,160. This area has acted as support since late November.

Read Ethereum’s [ETH] Price Prediction 2023-2024

A move below $1,150 could see ETH drop quickly to the $1072 level. This marked the lows of a range that Ethereum has traded within since the first week of November. The technical indicators reinforced bearish sentiment as well.

The bullish order block has been defended so far but the bears remain dominant

Source: ETH/USDT on TradingView

The cyan box that ETH traded within at press time represented a 12-hour bullish order block. So far, the 12-hour trading session has not closed below this OB. The four-hour chart showed that momentum and selling pressure were firmly in the bears’ hands.

The Relative Strength Index (RSI) dropped below neutral 50 in recent days and retested it as resistance. Although it stood at 28.5, indicating oversold conditions, that did not mean further losses could not follow for Ethereum. The Chaikin Money Flow (CMF) was also well below -0.05 and showed significant capital flow out of the market.

Short sellers can wait for a move beneath $1,160 and a retest of the $1,160-$1,200 area to place sell orders targeting the range lows near $1,080. For a bullish bias to materialize, ETH bulls have to haul the prices back above the mid-range mark at $1,211.

MVRV ratio drops as holders experience drawdown once more

Source: Santiment

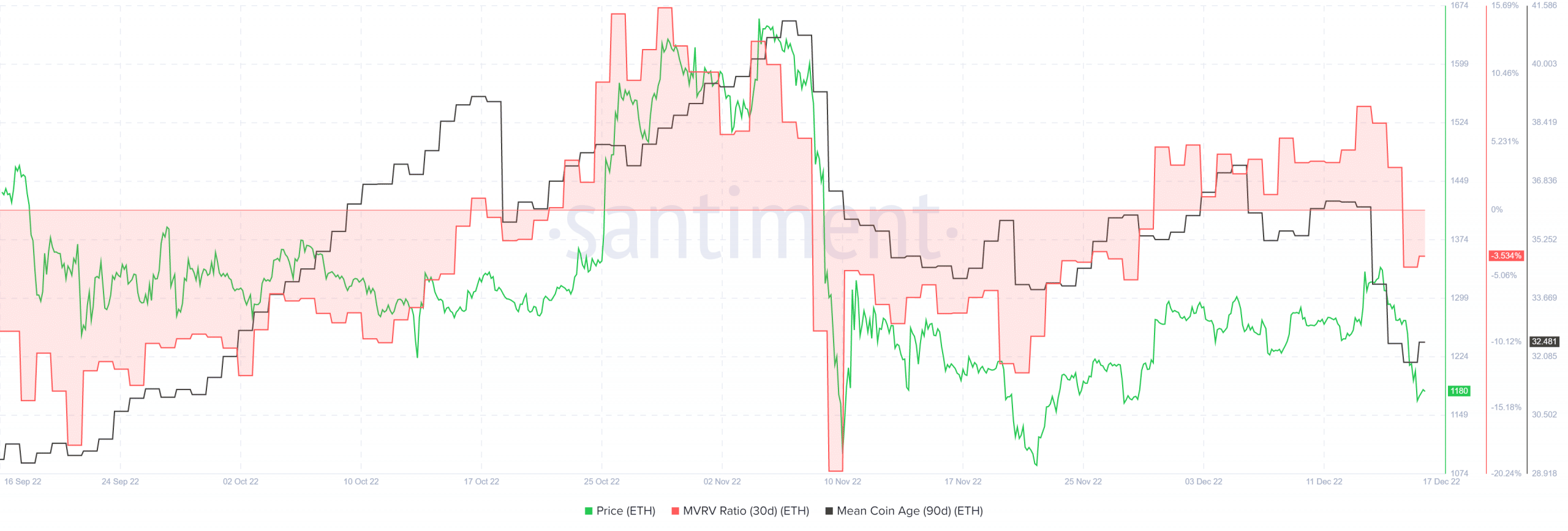

The Market Value to Realized Value (MVRV) (30-day) picked up above the 0 mark early in December. It stayed above for nearly two weeks and signaled that short-term holders were at a profit. However, the recent wave of selling saw Ethereum rejected at the range highs at $1350. Alongside the drop in price, the MVRV also dropped to show holders saw their profits wiped out.

The mean coin age (90-day) metric made feeble attempts to establish an uptrend from mid-November to early December. The past few days saw the mean coin age drop swiftly as well, indicating increased ETH movement between addresses.