- Does ETH’s current derivatives demand match the spot market outcome?

- Assessing the level of leverage, whale activity, and liquidations in the market.

Glassnode alerts just revealed that the ETH supply last active in the last one to four weeks has increased to a monthly high. This is a refreshing take from the relative inactivity we have observed in the first half of this week.

Read Ethereum’s [ETH] Price Prediction 2023-2024

The observed return in supply activity is a refreshing change of pace. This is because we previously observed a drop in ETH’s supply last active, and as a result, its price action has been relatively subdued. In other words, low activity results in lower volatility.

#Ethereum $ETH Amount of Supply Last Active 1w-1m (1d MA) just reached a 1-month high of 12,454,114.970 ETH

Previous 1-month high of 12,449,731.490 ETH was observed on 07 December 2022

View metric:https://t.co/4oRFTXW5WE pic.twitter.com/i18Yx1MRn3

— glassnode alerts (@glassnodealerts) December 8, 2022

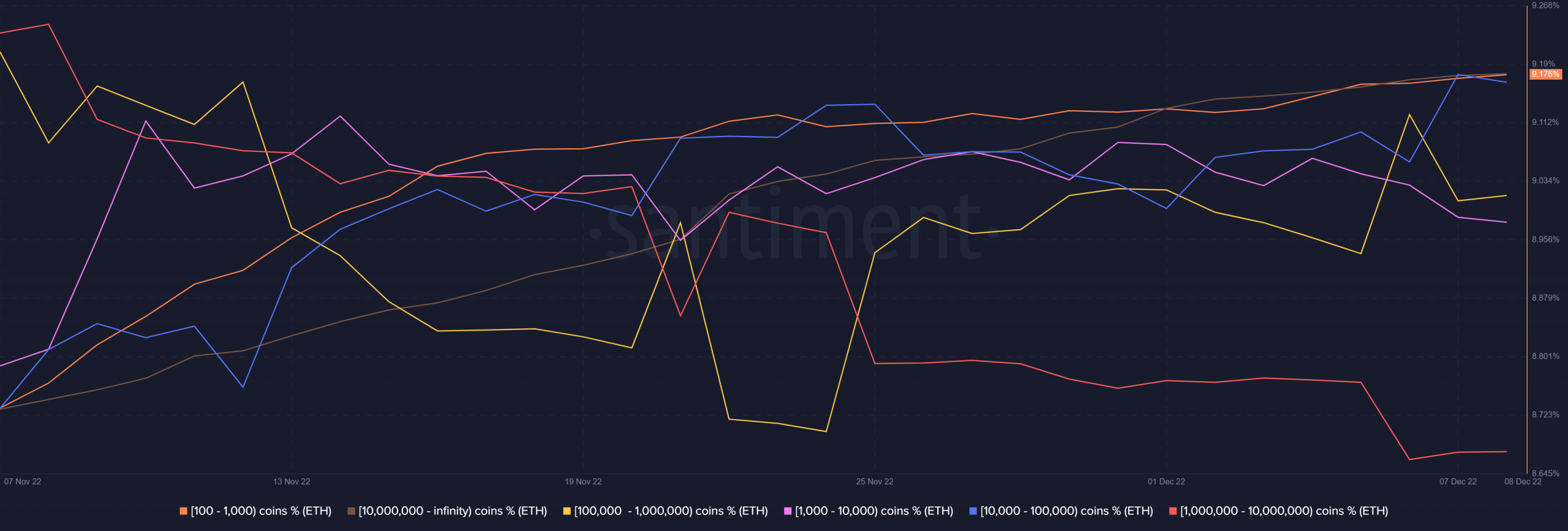

An assessment of Ethereum’s supply distribution reveals an interesting observation from ETH’s top addresses. It turns out that top addresses have been more active, especially in the last four days. Some of the top addresses including those holding between 10,000 and one million ETH added to their balances this week.

Source: Santiment

Meanwhile, addresses holding between 1,000 and 10,000, as well as those holding between one million and 10 million coins slashed their balances. These observations confirm that there is mixed activity among the whales, hence it is more difficult to predict the outcome.

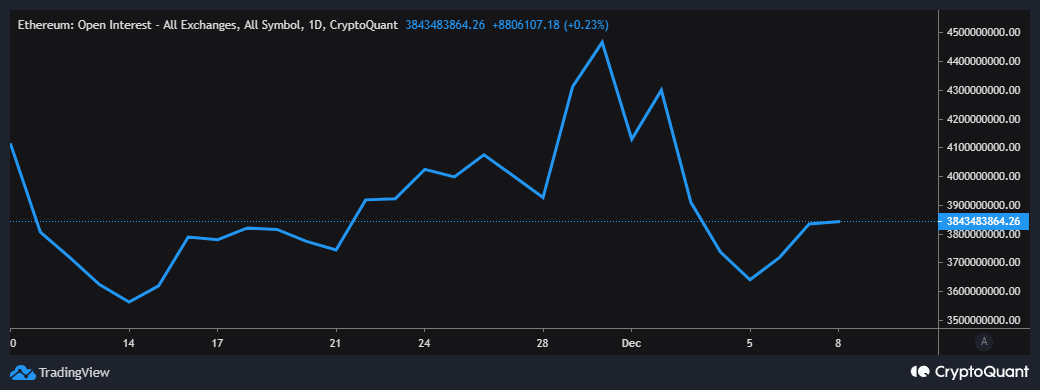

Can ETH derivatives demand unify the outcome in the spot market?

The first key observation from the derivatives market is that the demand for ETH from this segment has improved slightly in the last few days. This is reflected in the uptick in ETH’s open interest from 5 December.

Source: CryptoQuant

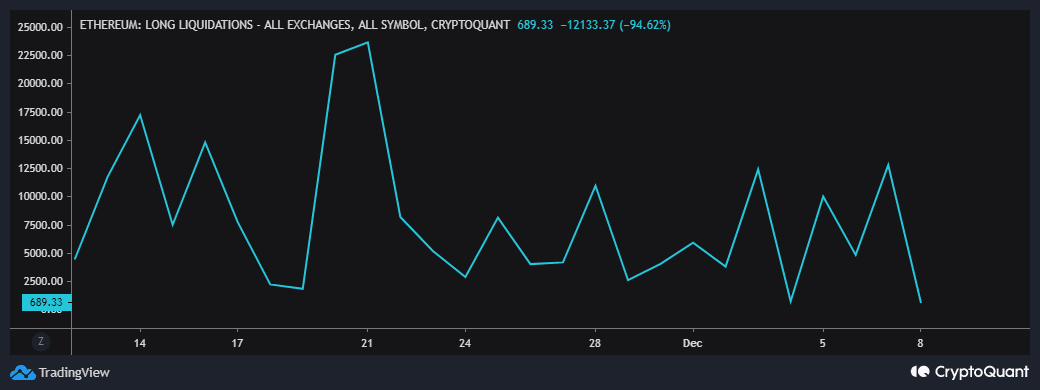

Nevertheless, the uptick demonstrates low enthusiasm among investors, hence suggesting a lack of strong demand. The Ethereum long liquidations metric has achieved an overall net downside in the last three days. This confirms a drop in the number of liquidated long positions.

Source: CryptoQuant

A potential reason for the above outcome is that ETH’s price action has been limited since the start of the month. It could also be that investors are less incentivized to execute long trades.

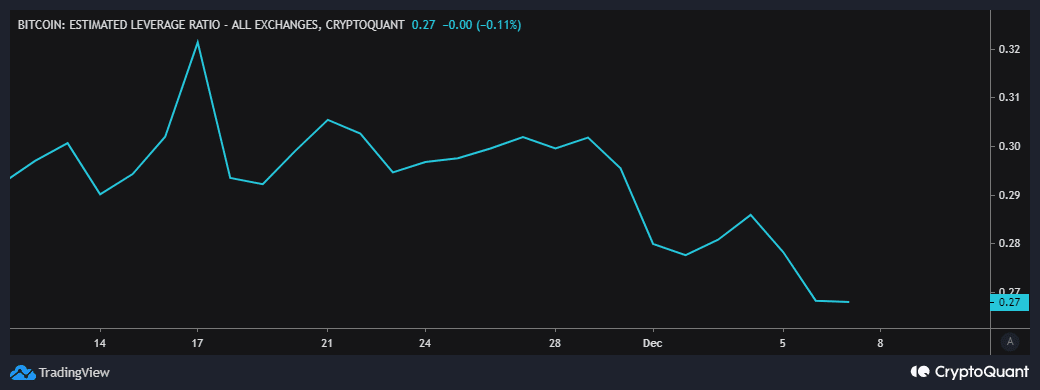

This is likely the most probable outcome given the downside observed in the estimated leverage ratio. The latter has been on an overall downward trajectory for the last three weeks.

Source: CryptoQuant

Conclusion

Judging by the above observations in the derivatives market, we can conclude that demand is starting to recover. However, investors are still avoiding leverage likely due to the high levels of uncertainty in the market.

Why is this important? Well, when the markets shifted to a preference for short-term trades due to lower volatility, traders opted to use leverage to achieve significant profits.

Unfortunately, recent conditions underscore a shakeup seemingly targeting leverage traders. As a result, ETH’s price action has demonstrated low volatility. An increased preference for leverage will likely mark the return of directional volatility.

![Assessing Ethereum [ETH] derivatives demand behavior ahead of 2023](https://www.cryptonewsmetaverse.com/wp-content/uploads/2022/12/alex-devera-g5_cvlInJU0-unsplash-1000x600.jpg)