- Ethereum’s upcoming technological update could have a positive impact on its validators.

- The king altcoin’s MVRV ratio and transaction count declined over the past few days.

In the coming days, one of the key developments for the Ethereum network could be its DVT (Distributed Validator Technology). According to Messari’s new report, this update might help the network to increase the security and safety for its validators.

Are your ETH holdings flashing green? Check the profit calculator

Something to look forward to

The DVT would be responsible for helping multiple nontrusting parties to collectively operate a validator. This in turn would help improve the security of the network as there would be fewer points of failure for the validators.

At-home validators, staking services, and institutions could benefit from this update.

The anticipation of this update could be one of the reasons why the number of validators on the Ethereum network continued to grow despite the declining revenue generated by them.

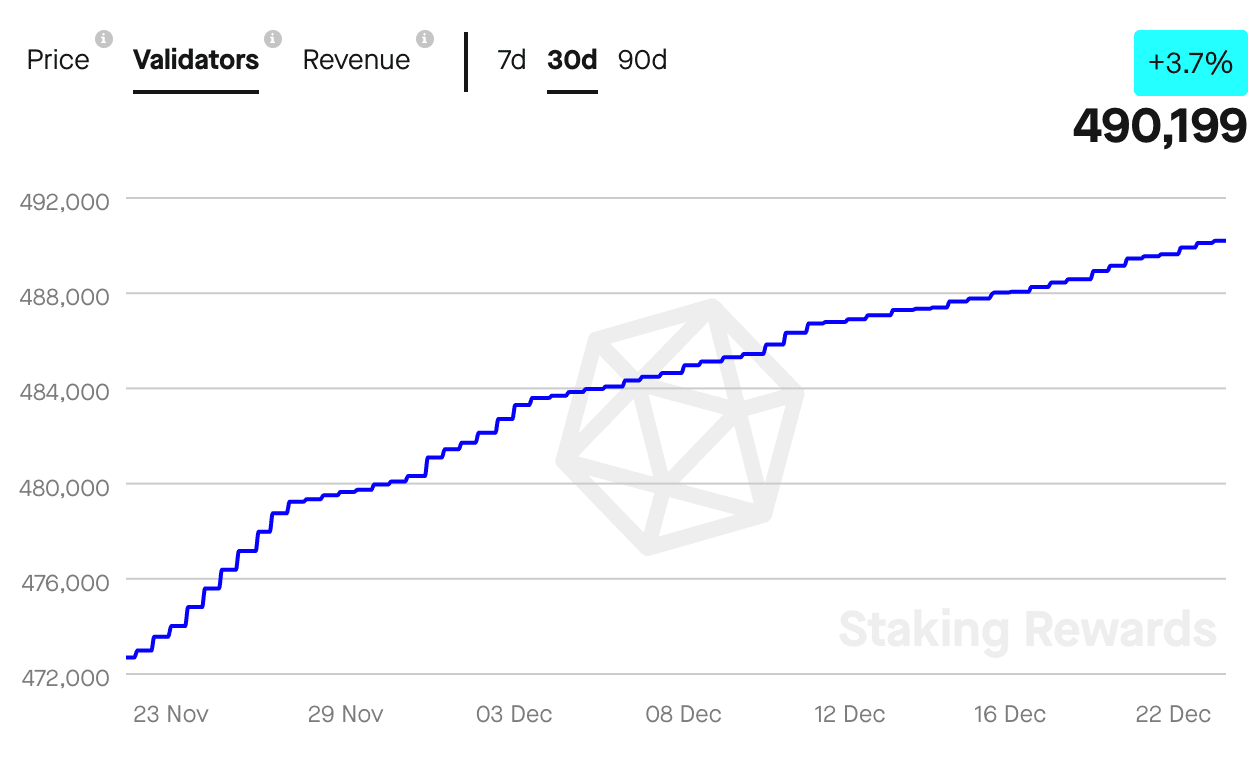

According to Staking Rewards, the number of validators on the Ethereum network grew by 3.7% over the last 30 days. The revenue generated by them, however, declined by 19.74% during the same period.

At the time of writing, however, the overall revenue generated by the validators was $828.46 million.

Source: Staking Rewards

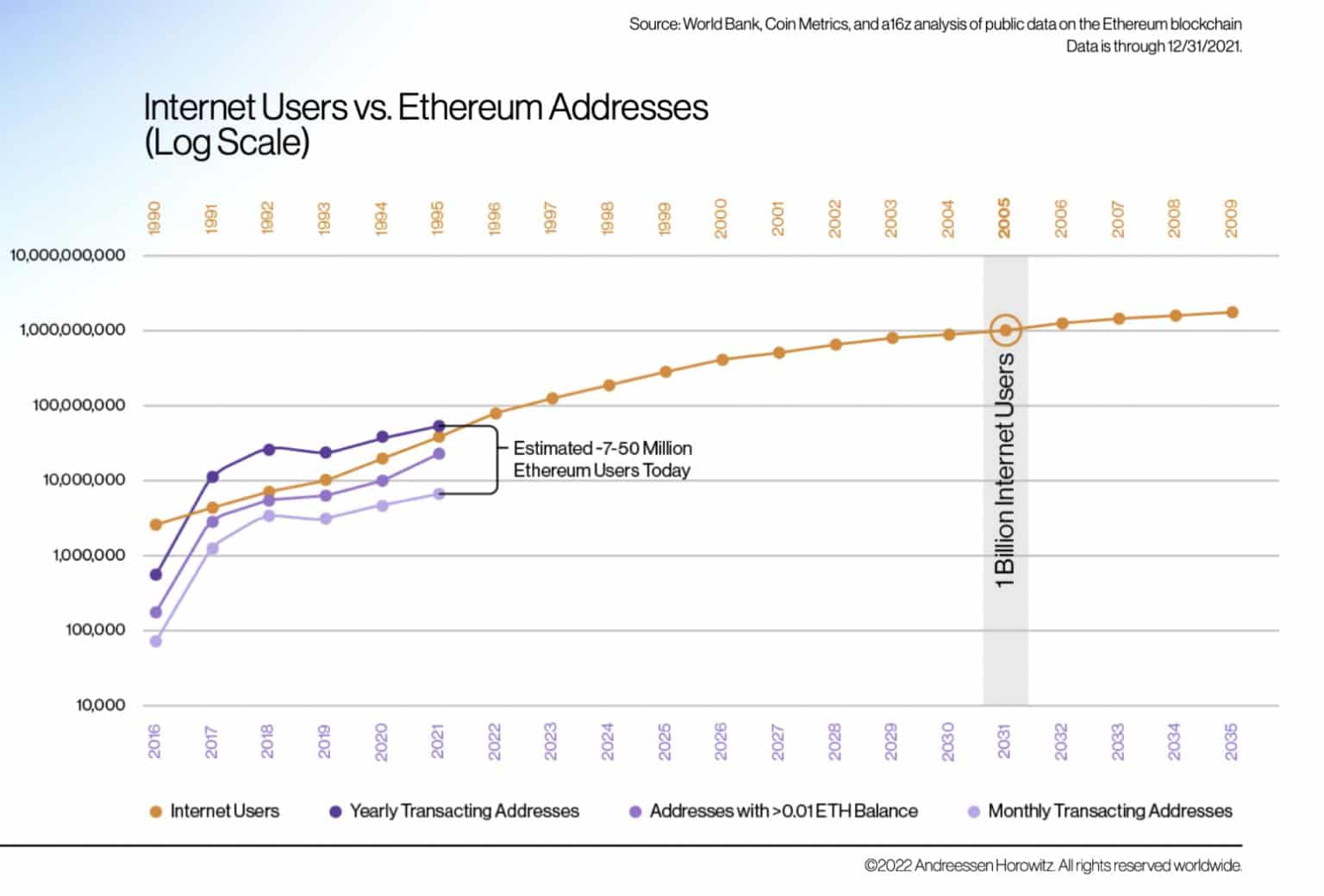

Furthermore, there was also improvement observed in terms of the adoption of Ethereum. As evidenced by the chart below, the number of users on the Ethereum network had been growing rapidly and the growth was observed to be similar to that of internet adoption in the early 90s.

Source: a16z

This growing level of adoption could be one of the reasons why large addresses showed faith in ETH.

How much Ethereum can you get for $1?

Whales make their moves

According to data provided by glassnode, the number of addresses that were holding more than 100 Ethereum had increased and reached an all-time high of 48,266.

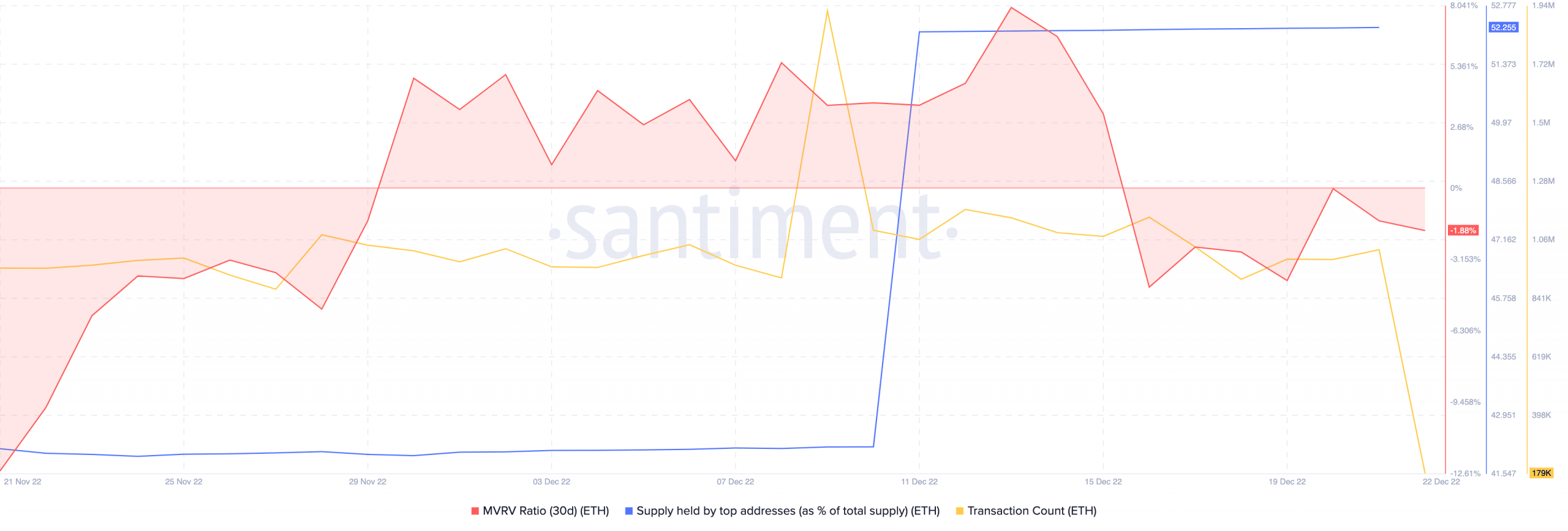

These large addresses had also taken a majority portion of the Ethereum supply. This was indicated by the data provided by Santiment which suggested that top addresses were holding 7.064% of the overall Ethereum supply.

A large concentration of ETH being held by a few powerful addresses could make Ethereum susceptible to price fluctuations.

However, it appeared that most Ethereum holders won’t be selling their holdings. At the time of writing, the MVRV ratio had declined, indicating that most ETH holders would end up with a loss if they decided to sell.

Along with a declining MVRV ratio, the transaction count on the Ethereum network decreased too. This implied that the activity on the Ethereum network had fallen.

Source: Santiment

It is yet to be determined whether new technological developments and faith from validators would be enough for Ethereum to overcome its obstacles.

Well, at the time of writing, Ethereum was trading at $1,216.94 and its price had increased by 0.59% in the last 24 hours.