Binance CEO “CZ” on Monday said Binance never shorted FTX Token (FTT). He said the crypto exchange still has a significant amount of FTT holdings, but stopped selling it after Sam Bankman-Fried (SBF) called him a few days ago. Recently, Binance CEO decided to liquidate its FTT token holdings after revelations regarding Alameda Research.

As a result of ceasing to liquidate FTT tokens after the price fell, Binance is losing nearly $500 million. In fact, Binance CEO “CZ” already committed to burn trading fees on Terra Classic (LUNC) spot and margin pairs for the Terra Classic community.

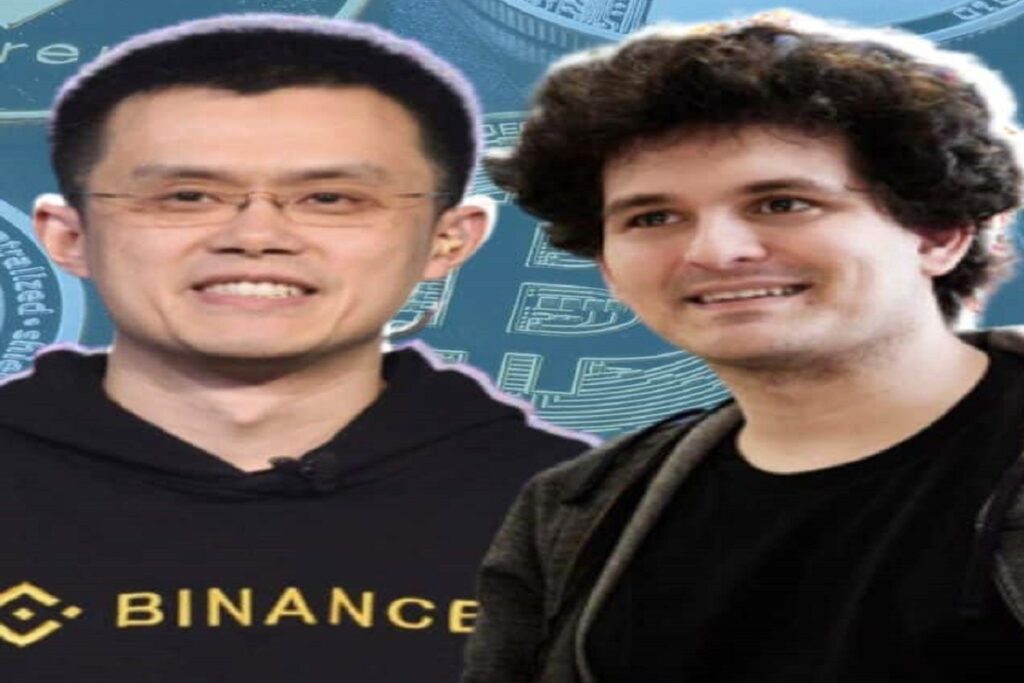

Binance CEO “CZ” on FTX Token (FTT) Holdings

Binance CEO Changpeng “CZ” Zhao in a tweet on November 14 disclosed that crypto exchange Binance never short-sold FTX Token (FTT). Moreover, Binance stopped selling FTT tokens after former CEO Sam Bankman-Fried called to halt FTT tokens as it was impacting liquidity at FTX and Alameda Research.

On November 13, Binance CEO announced that Binance will no longer accept deposits of FTX’s FTT tokens and urged other exchanges to do the same.

“Full disclosure: Binance never shorted FTT. We still have a bag of as we stopped selling FTT after SBF called me. Very expensive call.”

Binance also tweeted regarding the suspicious movement of a large amount of FTT tokens by the token’s contract deployers. The crypto exchange revealed that 100% of FTT was unlocked on May 1 as per data by FTT Unlock Schedules. Moreover, the large number of FTT movements was likely due to FTX’s internal asset consolidation. The Binance team is in contact with the FTX team to further clarify the situation regarding the FTT tokens.

As per the official announcement, Binance will remove and cease trading of several FTT trading pairs including FTT/BNB, FTT/BTC, FTT/ETH, and FTT/USDT. The trading is available only till 04:30 UTC on November 15. However, users can still trade FTT with BUSD pair. The decision was made after a recent review of the listed FTT token.

BNB Token Jumps Amid Recovery

Binance’s BNB token and other cryptocurrencies recovered after CEO “CZ” announced an industry recovery fund to help projects affected by the liquidity crisis.

The crypto prices have crashed and institutional investors are losing confidence and trust after one of the largest crypto exchanges FTX filed for Chapter 11 bankruptcy.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.