- Binance’s CEO shared a solution to help avoid exchanges using customer funds as presented by Vitalik Buterin

- BNB continues to prevail in static positions, according to its on-chain information

The CEO of Binance, CZ, agreed with Vitalik Buterin that Centralized Exchanges (CEXes) needed to produce public evidence showing user safety. Of course, CZ had initially pushed the Proof-of-Reserves idea in response to the calamity that befell FTX users, with several exchanges adopting the model.

However, Ethereum’s [ETH] co-founder proposed that the model could be improved, with CZ confirming that the exchange team could implement the idea.

I don’t understand all the equations in there either. Our team says we will implement it and make it open-source, for the industry.

— CZ

Binance (@cz_binance) November 19, 2022

Read BNB’s price prediction 2023-2024

Get ready to prove solvency

Vitalik, in his post published via HackMD, noted that it was more important for exchanges to prove solvency than sticking with reserves data alone. According to the ETH founder, it was better for the crypto sector to have its own method instead of depending on fiat-backed systems.

Defending his position, he referred to the ability of zk-SNARKs to help with the design, as the cryptographic technology could provide robustness and privacy to the ecosystem. Vitalik also noted that the system could drive centralized exchanges into becoming non-custodial platforms. He said,

“In the future, we may also see cryptographically ‘constrained’ CEXes where user funds are held in something like a validium smart contract. We may also see half-custodial exchanges where we trust them with fiat but not cryptocurrency.”

Stalemate in Binance Coin kingdom

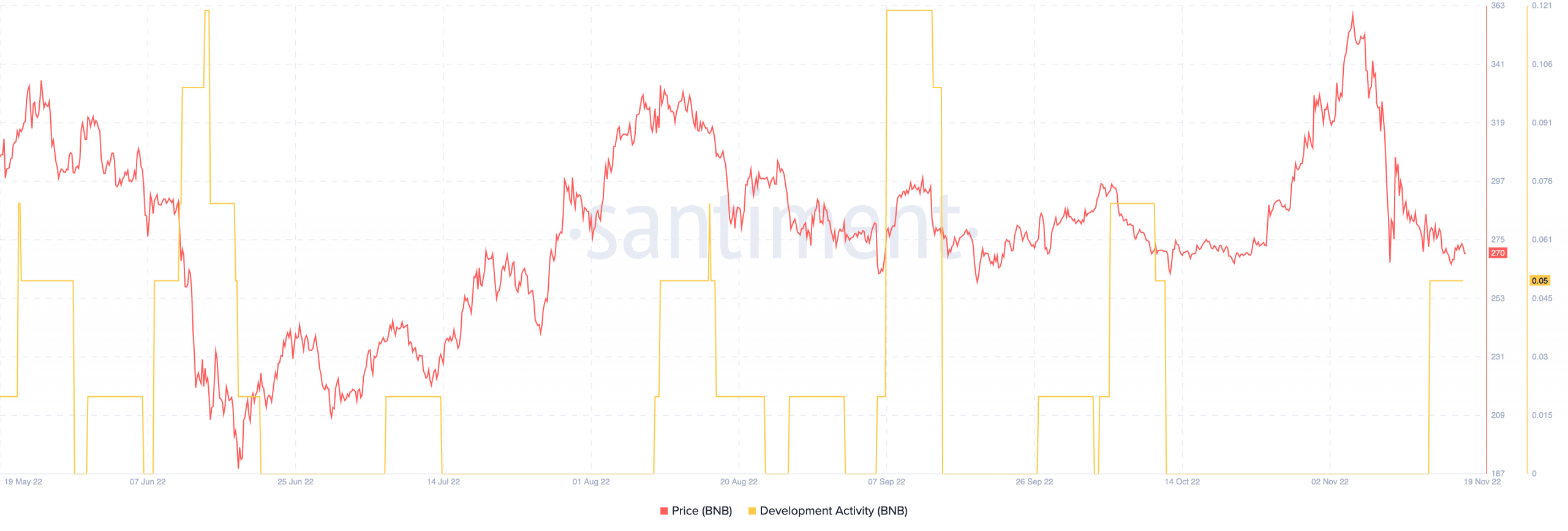

Regardless of the development, Binance Coin [BNB] preferred to remain at a standstill. At press time, the exchange coin was trading at $270, according to data by Santiment. This price represented a 0.40% decline in the last 24 hours.

However, BNB’s development activity did not react to the update immediately as it also hung around the same spot since 14 November. At 0.05, the development activity value showed that the Binance chain had not seen major upgrades recently.

Source: Santiment

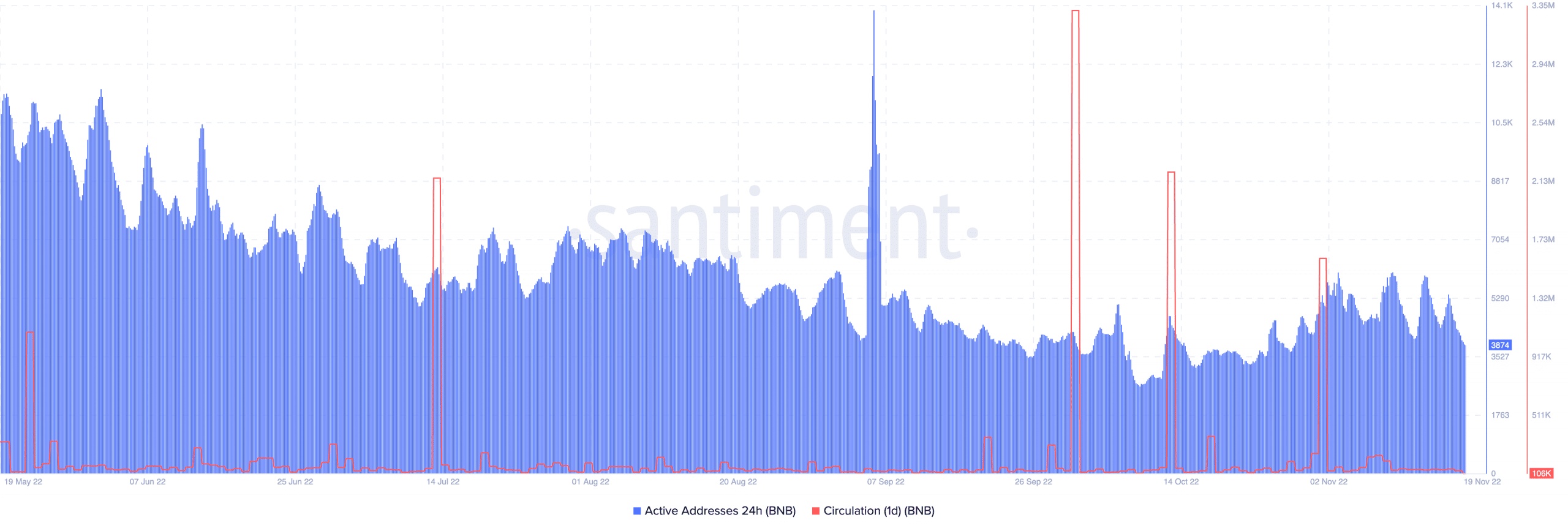

In addition, the 24-hour active addresses seemed in unison with the abovementioned metrics. According to Santiment, the on-chain status of BNB’s active addresses was 3874. As of this writing, the count was extremely close to the records of 18 November.

Although it was a decline, the status implied that the unique deposit on the BNB chain had mildly decreased. With the one-day circulation in a similar position at 106,000, addresses on the chain also resorted to fewer transactions.

Source: Santiment

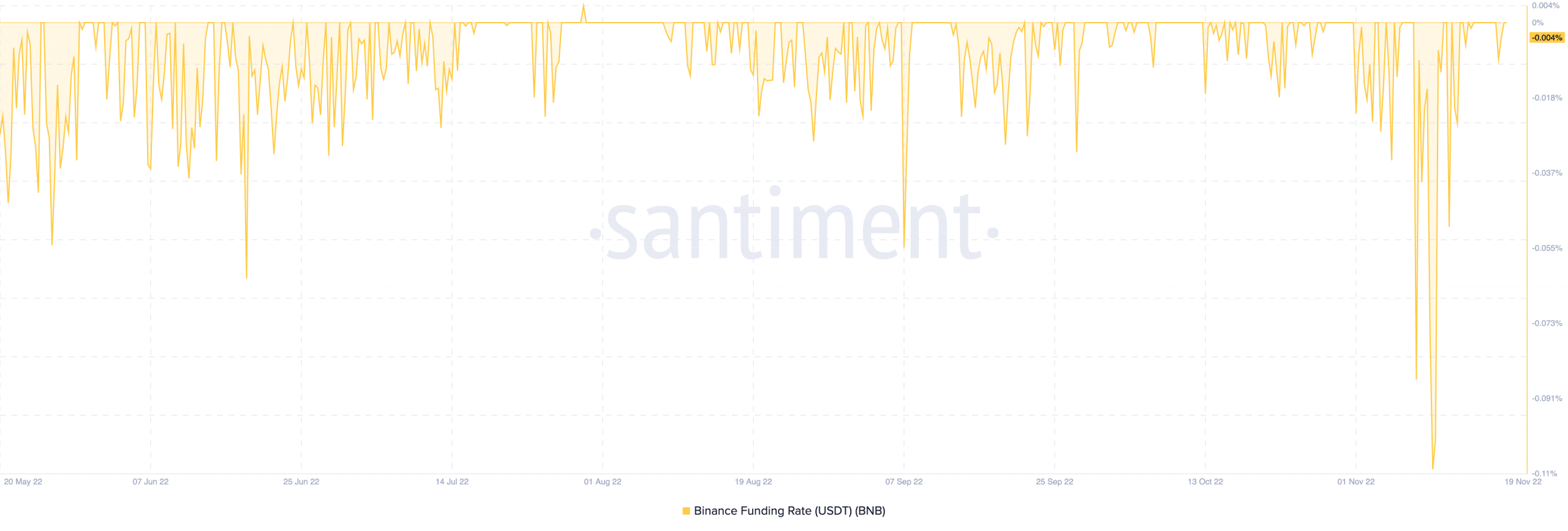

As for its condition in the derivatives market, BNB was not in a spectacular position. This was because of the Binance funding rate which had decreased to -0.004% at press time. This meant that futures and options traders had not reignited their interest in the coin. Hence, it would also result in low volumes in the market.

Despite the stagnant position of BNB, Vitalik reiterated the long-term objective was for CEXes to function in a non-custodial manner. CZ agreed in accordance.

Source: Santiment