Summary:

- The number of Bitcoin addresses holding 0.01 or more BTC has hit a new all-time high of 10.088 million.

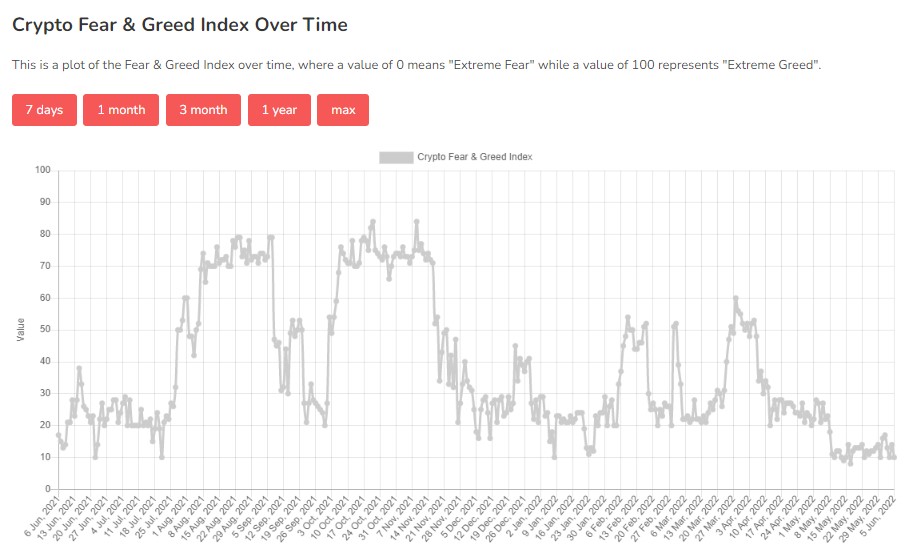

- The new milestone is despite the Crypto Fear and Greed index hitting an almost record low of 10, hinting that crypto traders are cautious about the short-term future of digital assets.

- Bitcoin is once again trading below the crucial $30k resistance level that could signal further losses in the month of June.

The number of Bitcoin addresses holding 0.01 or more BTC has hit a new milestone. According to the team at Glassnode, the number of such addresses has hit a new all-time high of 10.088 million. The Glassnode team shared their observation on the number of Bitcoin holders with 0.01 or more BTC through the following tweet, which includes a chart showing the encouraging growth of such investors.

#Bitcoin $BTC Number of Addresses Holding 0.01+ Coins just reached an ATH of 10,088,913

Previous ATH of 10,088,419 was observed on 02 June 2022

View metric:https://t.co/oyguxpaA2y pic.twitter.com/iYQMfLEp56

— glassnode alerts (@glassnodealerts) June 5, 2022

Crypto Fear and Greed Index Hits an Almost Record Low of 10.

The number of Bitcoin holders with 0.01 BTC or more hitting an all-time high comes when the general mood in the crypto markets is one of fear. This points to the possibility of retail investors accumulating Bitcoin at current levels despite the overall mood of fear in the crypto markets.

At the time of writing, the Crypto fear and greed index is at a value of 10, which is an indicator of extreme fear.

Furthermore, a value of 10 is the second-lowest value of the crypto fear and greed index in the last 12 months. May 17th’s fear index was the lowest in the same period, at a value of 8, due to the crypto-wide selloff catalyzed by UST’s depegging event.

Bitcoin Continues to Struggle to Maintain a Level Above $30k.

With respect to price action, Bitcoin is trading below the crucial $30k resistance level at its current value of $29,700. In addition, Bitcoin remains in bear territory, trading below the 50-day (white), 100-day (yellow), and 200-day (green) moving averages, as seen in the chart below.

Also, from the chart, it can be observed that the daily MFI, MACD, and RSI are all hinting at a scenario of reduced buying of Bitcoin.

Consequently, Bitcoin has a high chance of either continuing its consolidation between $30k and $29k or falling lower to retest $28k or even the local low of $26,700 experienced in early May due to the Terra/UST saga.