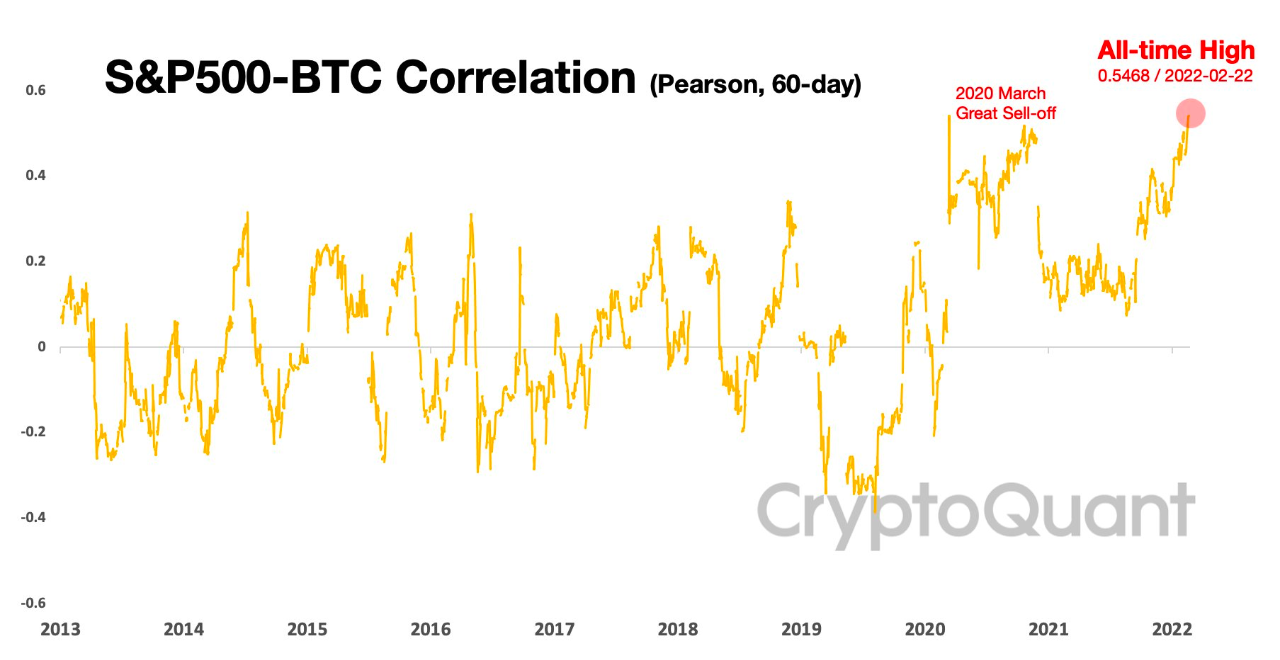

Knowledge exhibits the Bitcoin correlation with S&P 500, and therefore the inventory market, has now set a brand new all-time excessive (ATH).

Bitcoin Correlation With S&P 500 Reaches New Excessive

As identified by an analyst in a CryptoQuant post, the BTC correlation with the inventory market is presently at an all-time excessive, additional damaging the “secure haven” narrative.

The “Bitcoin correlation with S&P 500” is an indicator that measures how strongly the worth of BTC reacts to volatility in S&P 500, in addition to the path of the response.

When the indicator has values higher than zero, it means there’s a constructive correlation between the inventory market and the worth of the crypto in the intervening time. “Constructive” right here signifies that BTC strikes in the identical path as S&P 500.

However, correlation values lower than zero indicate that BTC reacts to S&P 500’s worth modifications by shifting in the wrong way.

Associated Studying | Bitcoin Plunges Under $40 As Russia Has Reportedly Given Its Forces Order To Assault Ukraine

Values of the indicator precisely equal to zero naturally imply that there isn’t a correlation between the 2 belongings. Now, here’s a chart that exhibits the development within the S&P 500 and Bitcoin correlation for the reason that yr 2013:

The indicator's worth over the historical past of the crypto | Supply: CryptoQuant

As you possibly can see within the above graph, the correlation between Bitcoin and S&P 500 swung between constructive and unfavorable whereas remaining low for probably the most a part of BTC’s historical past.

Associated Studying | Why Bitcoin Received’t Crack Over Recent Bear Assault, Subsequent Potential Goal For BTC

Nonetheless, since late 2019-early 2020, the 2 belongings have change into strongly, positively correlated. Throughout 2020, the metric had a crash because of the COVID unload, however the indicator sharply rose through the 2nd half of 2021 and 2022 to date.

The correlation between the Bitcoin and the inventory market has now set a brand new all-time excessive (ATH) of +0.5468 this month.

Such excessive correlation between the belongings has additional put a dent on the narrative of “digital gold” because the crypto is not the secure haven it as soon as was.

BTC Worth

On the time of writing, Bitcoin’s worth floats round $39k, down 12% within the final seven days. Over the previous month, the crypto has gained 10% in worth.

The beneath chart exhibits the development within the worth of BTC during the last 5 days.

BTC's worth appears to made some restoration during the last couple of days | Supply: BTCUSD on TradingView

A number of days again, the worth of Bitcoin plunged down, touching as little as $36.4k. Since then, the worth of the coin has proven some restoration, breaking above the $39k degree once more at present. In the mean time, it’s unclear whether or not this recent uptrend will final.

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com