A leading analytics firm says that the Bitcoin (BTC) futures market is flashing a reading that has previously marked market bottoms.

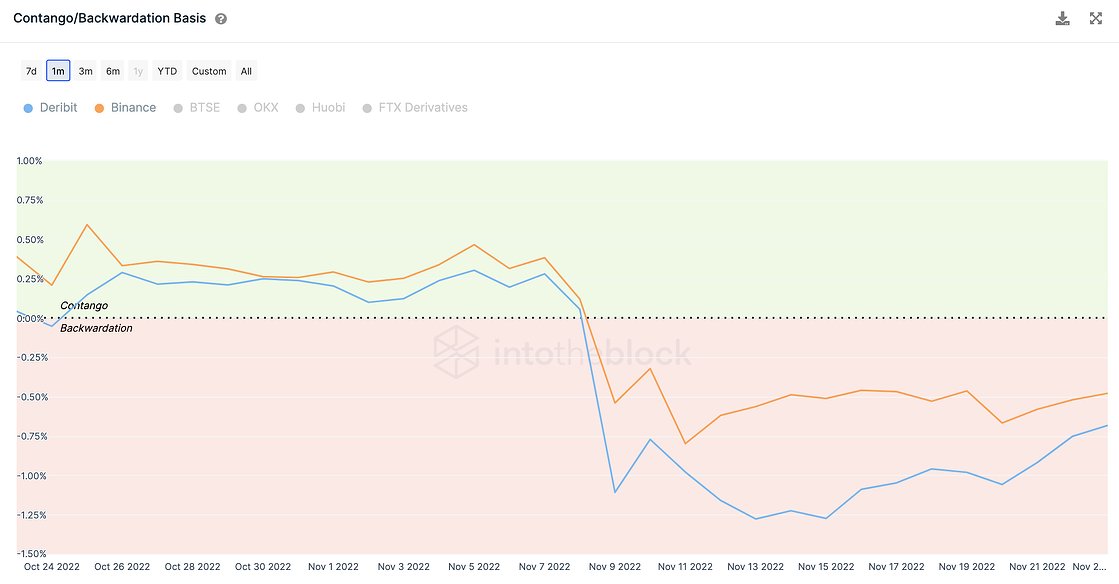

IntoTheBlock reveals that Bitcoin is witnessing steep backwardation, a condition where BTC futures contracts are priced significantly lower than the value of the king crypto in spot markets.

According to the analytics firm, backwardation indicates high selling pressure for Bitcoin in the last two weeks.

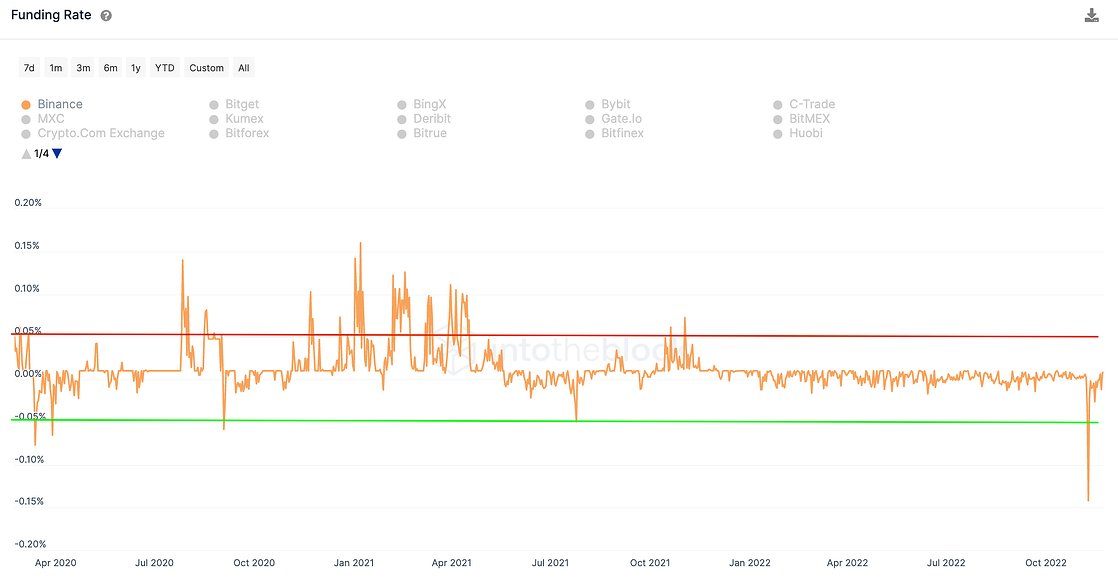

IntoTheBlock adds that while the futures markets are in backwardation, funding rates for Bitcoin are currently in highly negative territory, indicating that traders are heavily shorting BTC, or betting that the king crypto’s value will continue to go down.

Traders tend to take note of extremely negative funding rates as it primes the market for a short squeeze.

A short squeeze takes place when market participants who borrow units of an asset at a certain price in hopes of selling them for a lower price to pocket the difference are forced to buy assets back as the trade moves against their bias.

Explains the analytics firm,

“Times where futures contracts are in backwardation tend to align with market bottoms, as happened in March 2020 and May 2021. A similar trend can be observed with highly negative funding rates. Is Bitcoin bottoming?”

At time of writing, Bitcoin is changing hands for $16,610, up nearly 7% from its 2022 low of $15,546.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Alexander56891/Sensvector