The world’s largest cryptocurrency Bitcoin (BTC) continues to show strength moving past $44,000. With this, BTC has extended its weekly gains to more than 8%.

The recent BTC price rally comes amid renewed optimism from investors. Besides, geopolitical events are also adding fuel to the rally. On Thursday, March 24, Russia announced that it will be accepting Bitcoin payments for oil and gas transactions.

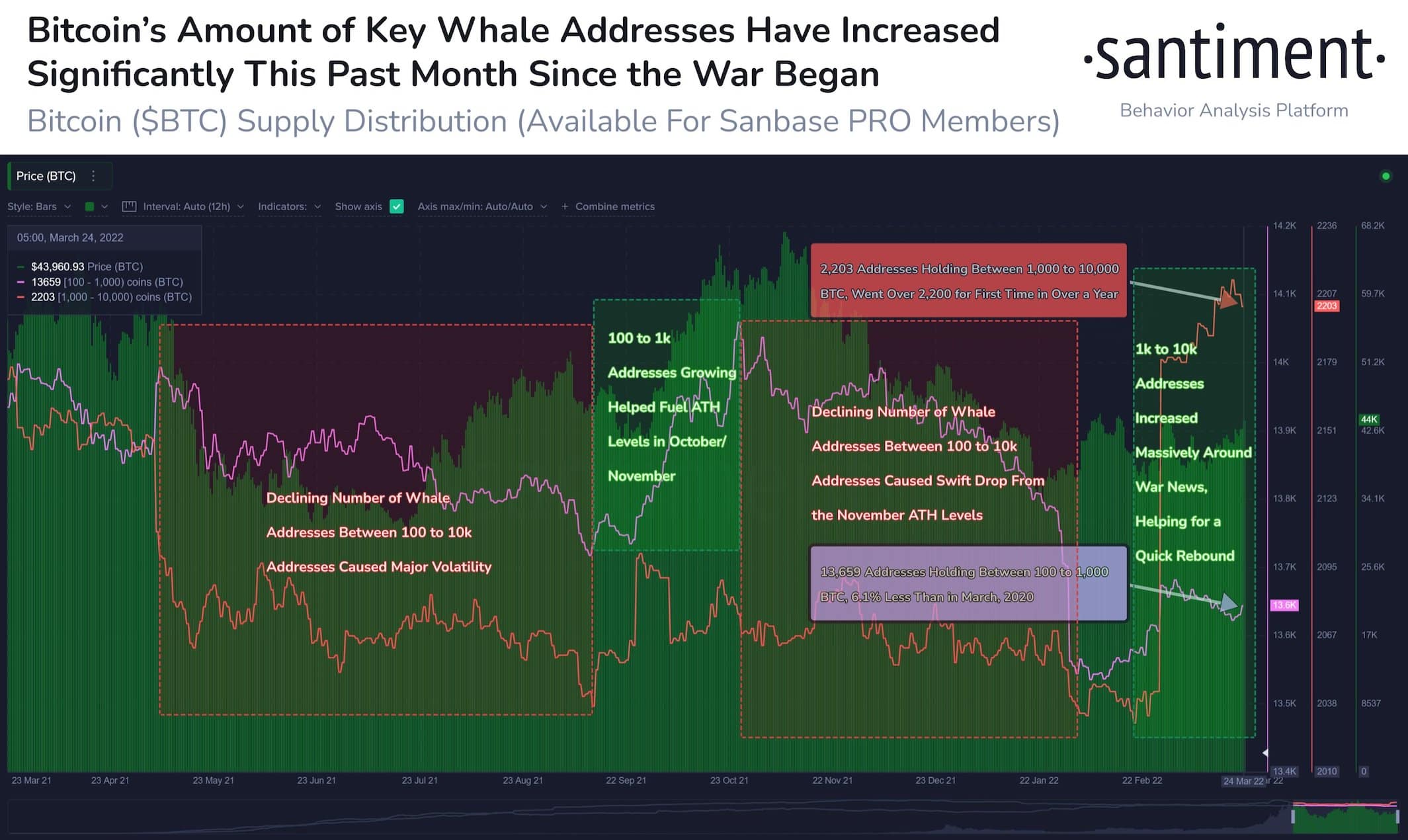

Besides, on-chain data provider Santiment reported that the whale transactions have picked up since the declaration of the Russia Ukraine war. It notes:

The amount of Bitcoin addresses holding 1k to 10k $BTC has jumped by 8.3% since the #Russia–#Ukraine #war was made official. The 2,203 addresses is at a 1-yr high. Both this tier & the 100 to 1k $BTC tier have historically foreshadowed price moves.

While the Bitcoin price is making new highs, let’s have some look at the technical charts. Popular crypto analyst Lark Davis said that Bitcoin is still trading under its 200-day moving average. A daily breakout above $45,500 would assure an uptrend.

#bitcoin currently showing a lower high, we need to crack over that top orange line and get a daily close above $45,500. If so then we could be ready for a new major bull phase. pic.twitter.com/esxeiyuSEY

— Lark Davis (@TheCryptoLark) March 24, 2022

Exxon Mobil Explores Bitcoin Mining

As per the Bloomberg report, U.S. oil giant Exxon Mobil is exploring Bitcoin mining as part of its pilot program thereby using the excess production of natural gas.

S0urces familiar with the matter said that Exxon Mobil has signed an agreement with Crusoe Energy Systems wherein they would be redirecting their excess gas, that would otherwise be wasted, and use it for Bitcoin mining operations.

ExxonMobil had launched one such pilot project last year in January 2021 in North Dakota’s Bakken. The oil giant is looking to replicate its success in Alaska, the Qua Iboe Terminal in Nigeria, Argentina’s Vaca Muerta shale field, Guyana and Germany.

Exxon Mobil is not the first among the oil companies to explore the Bitcoin mining operation. Last month, Oil and gas giant ConocoPhillips said that it is willing to sell excess gas to Bitcoin mining farms operating in the nearby regions.