intermediate

There are few things that are scarier to both novice and experienced traders alike than losing money rapidly. The markets are often treacherous, and many investors have been unfortunate enough to find out just how ruthless trading can be.

What Is a Bull Trap?

Bull traps are technical signals that show a false trend reversal. A bull trap occurs when the price of an asset on the Forex, crypto, or stock market suddenly surges upward after a prolonged decline only to continue falling soon afterwards.

A bull trap can also be called a “dead cat bounce”.

How Does a Bull Trap work?

Typically, bull traps occur in the middle of bear markets and create a false signal that can trick investors into thinking that the price of an asset they’re trading has begun to recover.

When a bear market is happening, investors often look for buying opportunities while anticipating a price recovery to offload their assets and make a profit. When the price of an asset seemingly recovers and shoots up, many see it as a chance to make a quick buck.

Oftentimes during bull traps the price of an asset rallies beyond key resistance levels as more traders enter the market in anticipation of a mooning. However, since it’s just a bull trap and not a real rally, not too long after it rises, the price falls again. As the bull trap reveals itself and the price begins to decline, many investors begin to panic and sell their assets en masse to try and minimize their losses, pushing the price even lower.

The traders that bought assets in the short period when the price action was bullish end up getting caught in a bull trap.

How to Identify a Bull Trap

Bull traps are rather common in all markets and Forex trading, but they unfortunately occur especially often in the crypto market. Learning to identify them is key to minimizing the risk of losing your funds while trading.

While the best way to identify a bull trap involves performing technical analysis and reading charts, there is an easier way to do it, too. Sometimes you don’t need actual market data to see that the rally is a trap: it can be enough to just observe the community. If nobody is fired up about a rally and people are mostly looking for opportunities to sell, and especially if there was no news that could inspire strong moves and bullish price movements, then you are likely facing a bull trap.

Trading volume is shown in almost all trading terminals, and is a great indicator of whether a rally is genuine or not. The general rule of thumb is that if there are strong moves in the market but the trading volume hasn’t changed, then it’s likely to be a trap.

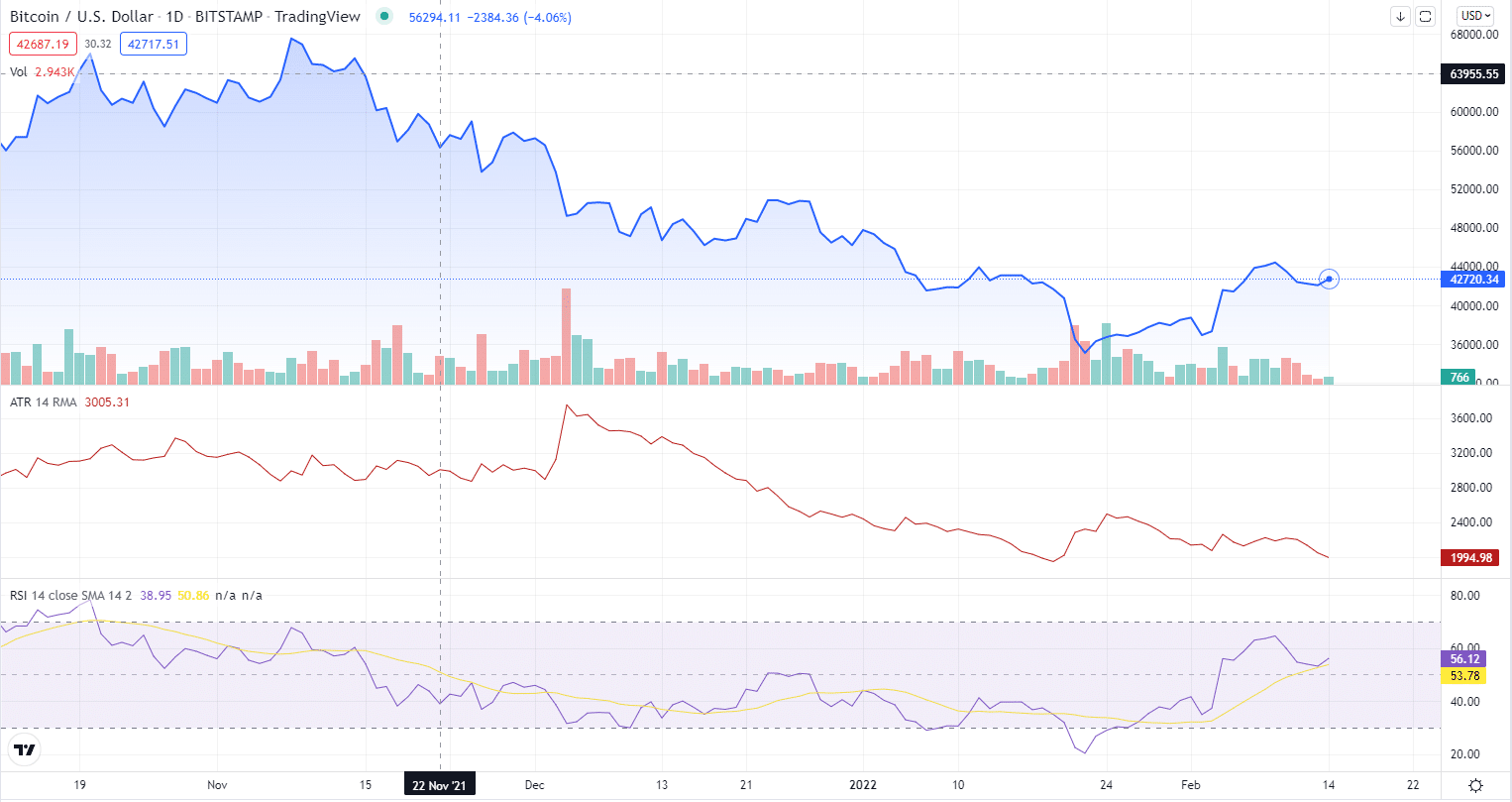

The technical indicators that can help you to identify a bull trap are “Average True Range” and the RSI (Relative Strength Index). If the former is declining during bullish price action and the latter cannot break through the 50 centerline reading, then the price rally is likely to be a bull trap. Here’s an example of what these two indicators look like. Most trading terminals clearly display the 50 reading for the RSI.

What is the difference between bull traps and bear traps?

A bull trap is the opposite of a bear trap: the former tricks traders into buying an asset and opening long positions, whereas the latter catches traders who open short positions and scares many novice investors into selling off their assets at a loss.

Here are the main differences between the two.

| Bull Trap | Bear Trap |

| Signals a false upward trend | Signals a false downward trend |

| Tricks bullish investors | Traps short sellers and “weak hands” |

Bull Trap Example

There are many examples of bull traps in the crypto market – after all, they unfortunately happen rather often.

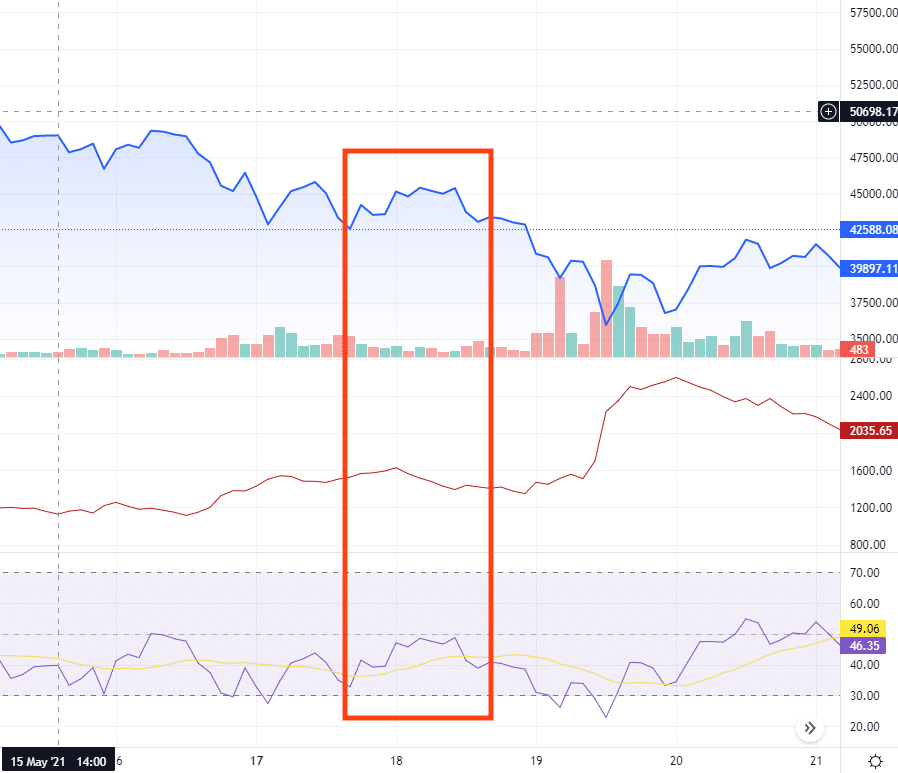

Here’s an example from May 2021. It was a bear market, and BTC was in decline after an incredibly long and successful rally. On May 16th, there was a brief price recovery, with Bitcoin going from 46K USD to 49K. However, as you can see on the chart, the ATR – the red line – did not go up at that moment, and the RSI – the purple line – stayed firmly below 50. It was a bull trap, and the price of BTC continued to decline soon after.

How to Avoid Bull Traps?

Please note that we cannot give you actual investment advice. However, there are some general rules that every trader can follow to avoid losing their funds to a bull trap.

First of all, never neglect doing market research. The more you study patterns and price action, the easier it will become for you to identify bull traps and other false patterns on the market.

You can also either try to learn how to perform technical analysis and study various technical indicators or perform market research by following people and websites that do all this for you, e.g. TradingView.

Many traders use stop loss orders when they suspect there is a bull trap happening. This order type can be a great tool for mitigating risk in a volatile market.

How Do You Trade a Bull Trap?

Bull trap trading is rather risky, but realistically not very avoidable in crypto markets. Most traders that want to benefit from bull traps turn to short selling – selling borrowed assets while the rally is still on and then buying them back as the trap closes and the prices go down. They operate on the belief that the overall downward momentum will continue.

However, we would advise against using this strategy unless you fully understand all the risks involved (of which there are many) and are an experienced trader that has a fully-fleshed out investment strategy and understands the market well. If you do choose to trade a bull trap, we recommend using stop loss orders.

What Happens After a Bull Trap?

Bull traps end in a continuation of a bear market. The temporary rally they cause may last anywhere from a few hours to a few days, and sometimes even longer, but it will still be relatively short-lived – and will always be followed by further decline.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.