- ETH could herald profits in 2023, according to the founder of Union Ventures Fund.

- Traders remained optimistic, and validators on the network grew.

Fred Wilson, the co-founder of Union Ventures Fund, showed faith in the potential for Ethereum [ETH] to grow over this year. In a statement on 3 January, Fred predicted that even though a lot of web3 projects would fail in 2023, Ethereum would still show growth.

He also predicts that the large caps in web3 (BTC and ETH mainly) will start to attract more interest from investors and should do well in 2023. He is more bullish on ETH personally because it has the best underlying economic model of any web3 asset. https://t.co/CGVsaCSJcc

— Wu Blockchain (@WuBlockchain) January 3, 2023

How many ETHs can you get for $1?

Year of the bull for ETH?

The reason for this bullish sentiment was because Fred believed that Ethereum had the best underlying economic model of any web3 asset. There were other reasons why investors were feeling bullish about ETH.

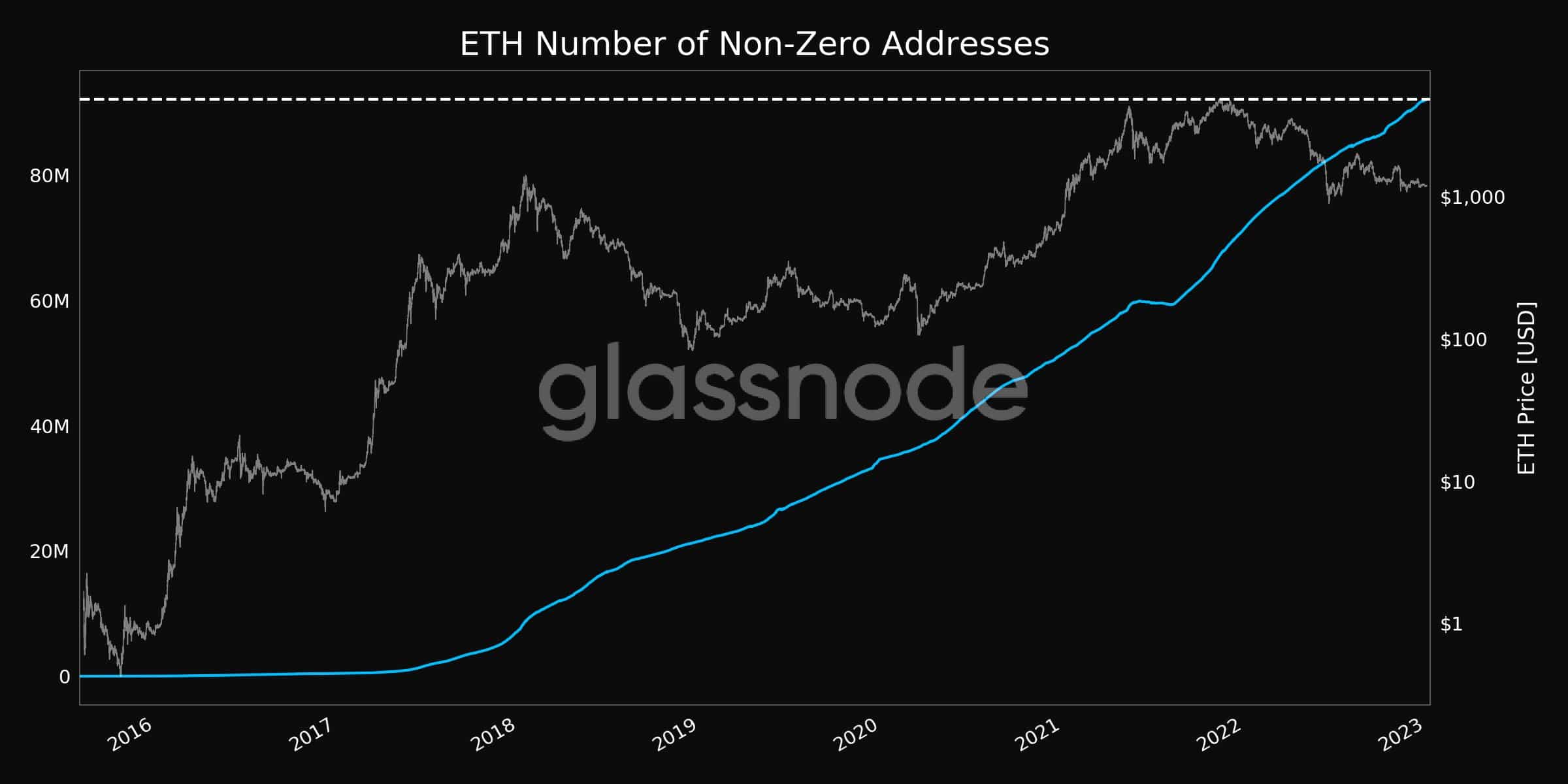

One of them would be the growing number of addresses on the Ethereum network. According to data provided by Glassnode, the number of non-zero addresses grew significantly over the last few months and reached an all-time high of 92 million addresses.

Source: glassnode

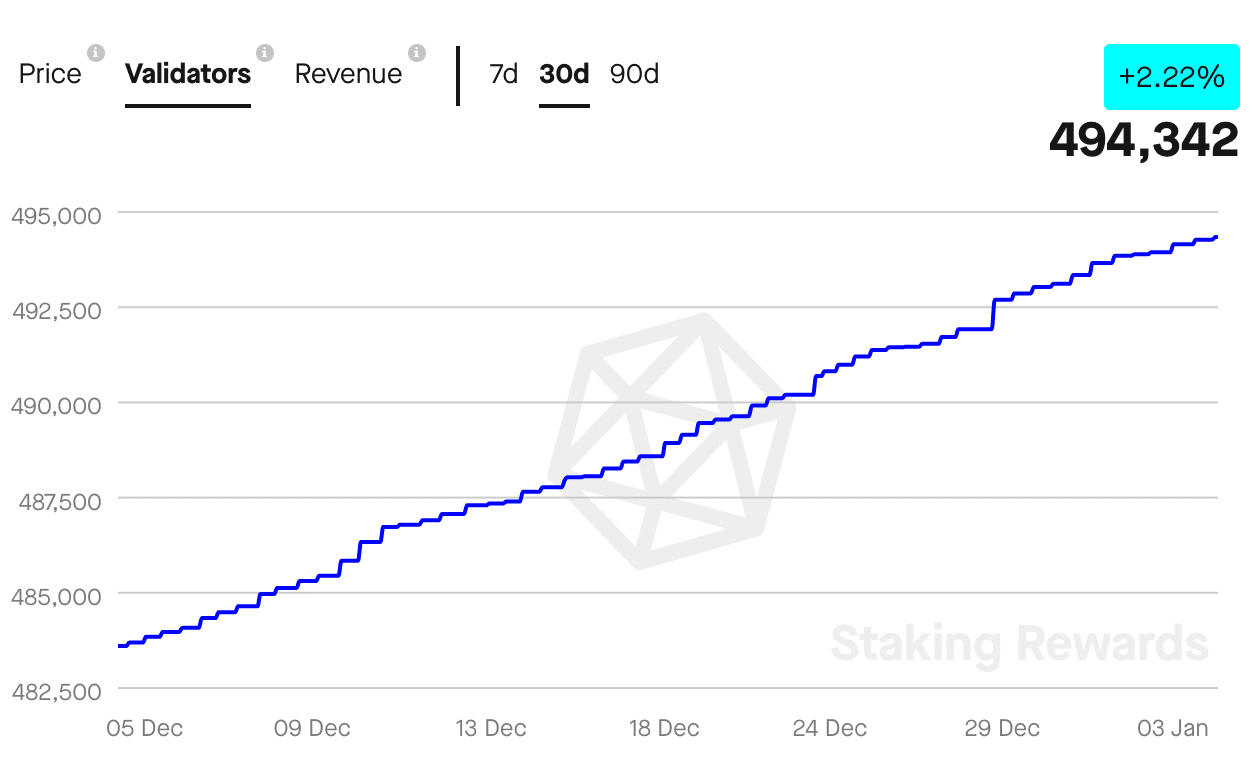

Along with the addresses, the validators on the Ethereum network grew as well. The number of validators on the network increased by 2.22% over the last month. Moreover, the revenue generated by these validators increased by 1.65% in the last seven days.

At the time of writing, the number of validators on the Ethereum network stood at 494,342.

Source: Staking Rewards

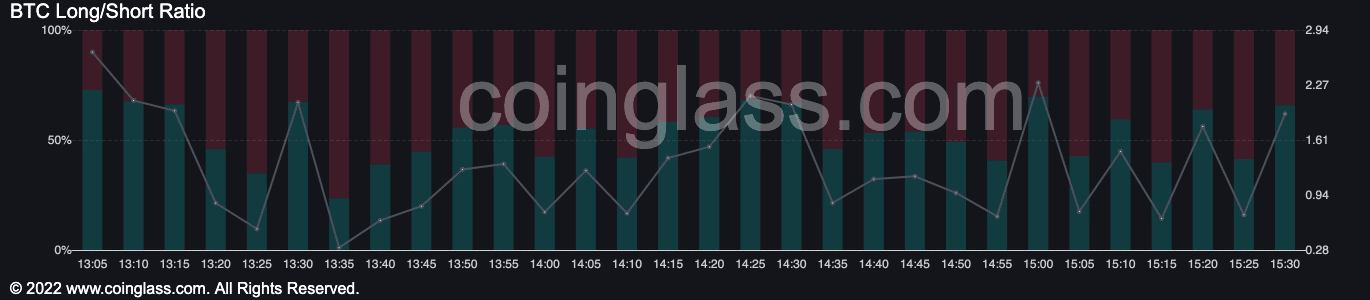

The validators were not the only group of people that showed faith in Ethereum, as traders also showed optimism in favor of ETH.

According to data provided by Coinglass, the number of long positions being held in favor of Ethereum surpassed the short positions by a huge margin. At press time, 65.82% long positions were being held by traders.

Source: Coinglass

ETH holders and developers

However, even though the general sentiment for Ethereum seems bullish, there were a few areas where Ethereum could show improvement.

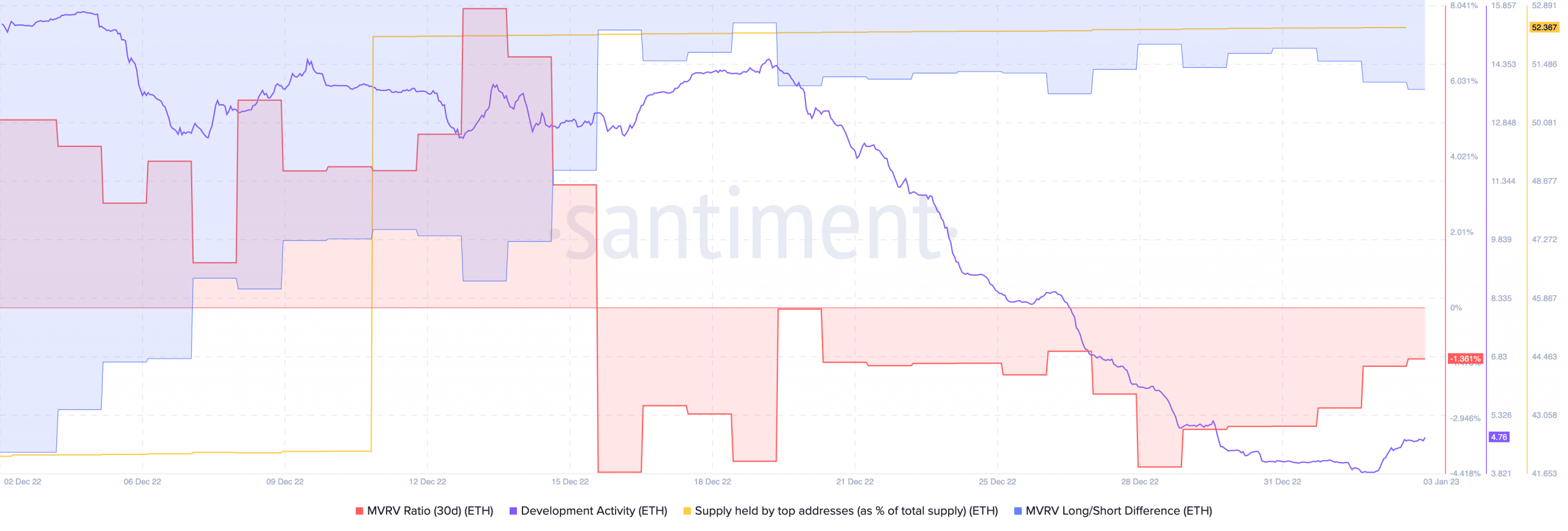

For instance, the development activity for Ethereum declined immensely over the last month. This implied that the contributions being made by Ethereum’s team on its GitHub decreased.

However, the declining development activity did not deter Ethereum whales. The percentage share of Ethereum being held by large addresses observed a massive surge over the last two weeks. But this interest from whales wasn’t enough to impact ETH’s price positively.

Are your ETH holdings flashing green? Check the profit calculator

The decline in price resulted in a declining Market Value to Realized Value (MVRV) ratio. This implied that most Ethereum holders would take a loss if they sold their holdings. The negative long/short difference suggested that it was mostly short-term investors that would bear a loss.

Source: Santiment

It is yet to be seen whether the short-term holders would sell their positions. At the time of writing, ETH was trading at $1,216.88. Its price fell by 0.66% in the last 24 hours, according to CoinMarketCap.

![Bullish on Ethereum [ETH]? This venture fund founder might agree with you](https://www.cryptonewsmetaverse.com/wp-content/uploads/2023/01/1668951909537-98a709a6-52a9-46e8-9139-11de4bf3fc69-1-1000x600.png)