- Ethereum’s burning rate was more than minting activities, resulting in a good supply rate

- Staking activities were actively operational, although it was insignificant to ETH’s price

Ethereum [ETH] seemed to have sustained a good performance despite the unpleasant nature of the crypto market. This was the opinion of Easy OnChain, a CryptoQuant analyst.

According to his publication, which he tagged “Ethereum Better Every Day,” the on-chain reviewer opined that ETH has remained resolute even though investors might not be content with its less than $1,200 value.

Read Ethereum’s Price Prediction 2023-2024

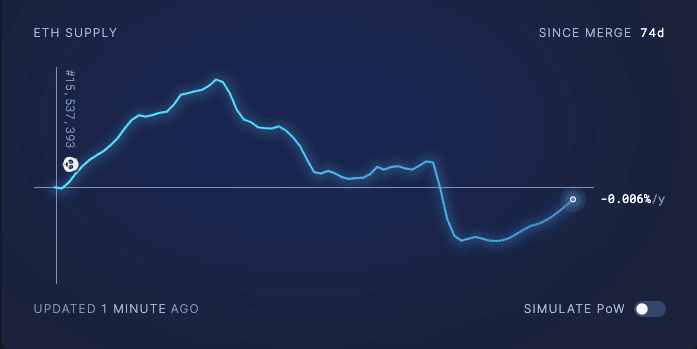

In furthering the basis for his opinion, Easy OnChain said that ETH’s deflationary status since the burn proved the altcoin’s strength. This condition meant more ETH had been burned in verifying transactions since the switch to Proof-of-Stake (PoS).

According to Ultra Sound Money, about 383,000 ETH were burned in the last 24 hours. This number portrayed a 0.20% supply growth within the same period.

Data from the Ethereum-focused platform also showed that Ethereum’s annualized inflation rate had decreased to -0.006%. This value indicated that the blockchain was burning more tokens. Hence, it was unavoidable not to have an increase in supply.

Source: Ultra Sound Money

Nothing lasts forever

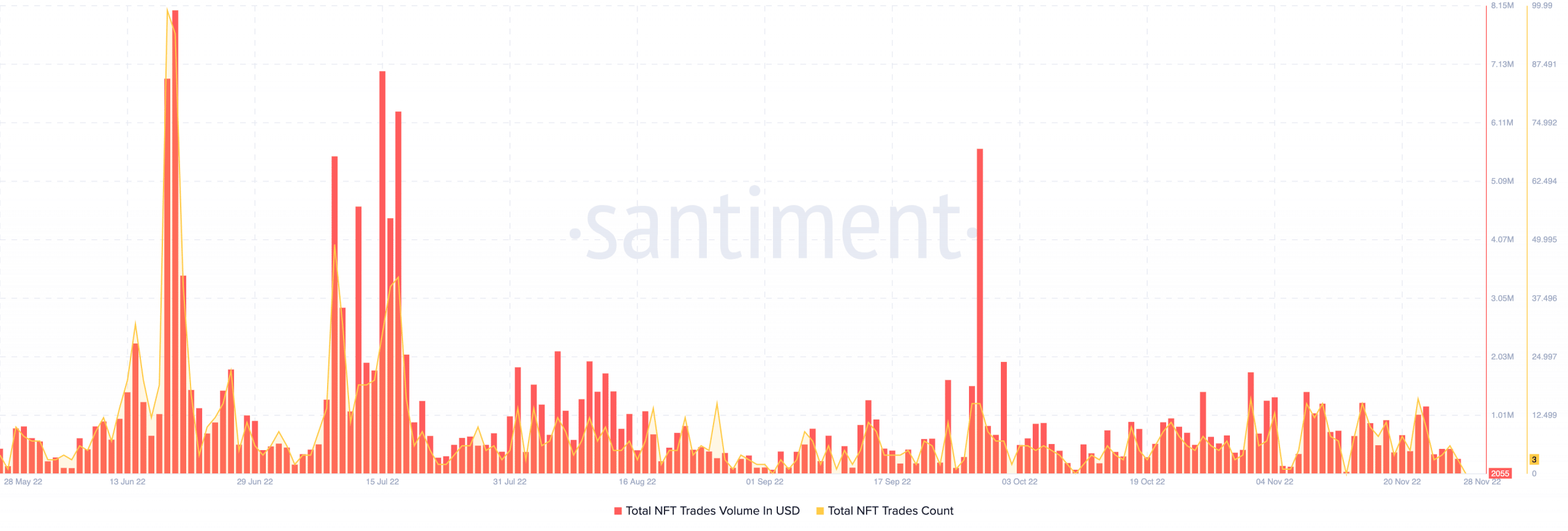

While it might be great to see Ethereum in such an excellent supply condition, the case of NFT on its blockchain could not replicate a similar show. According to Santiment, the total NFT trade volume was 2055 at press time. Considering how these Ethereum blockchain collectibles performed on 23 November, the current volume could be described as messy.

The value mentioned above implied that NFT traders were hardly interested in accumulating ETH assets, especially as this chaotic state had been prevalent for the past five days.

Source: Santiment

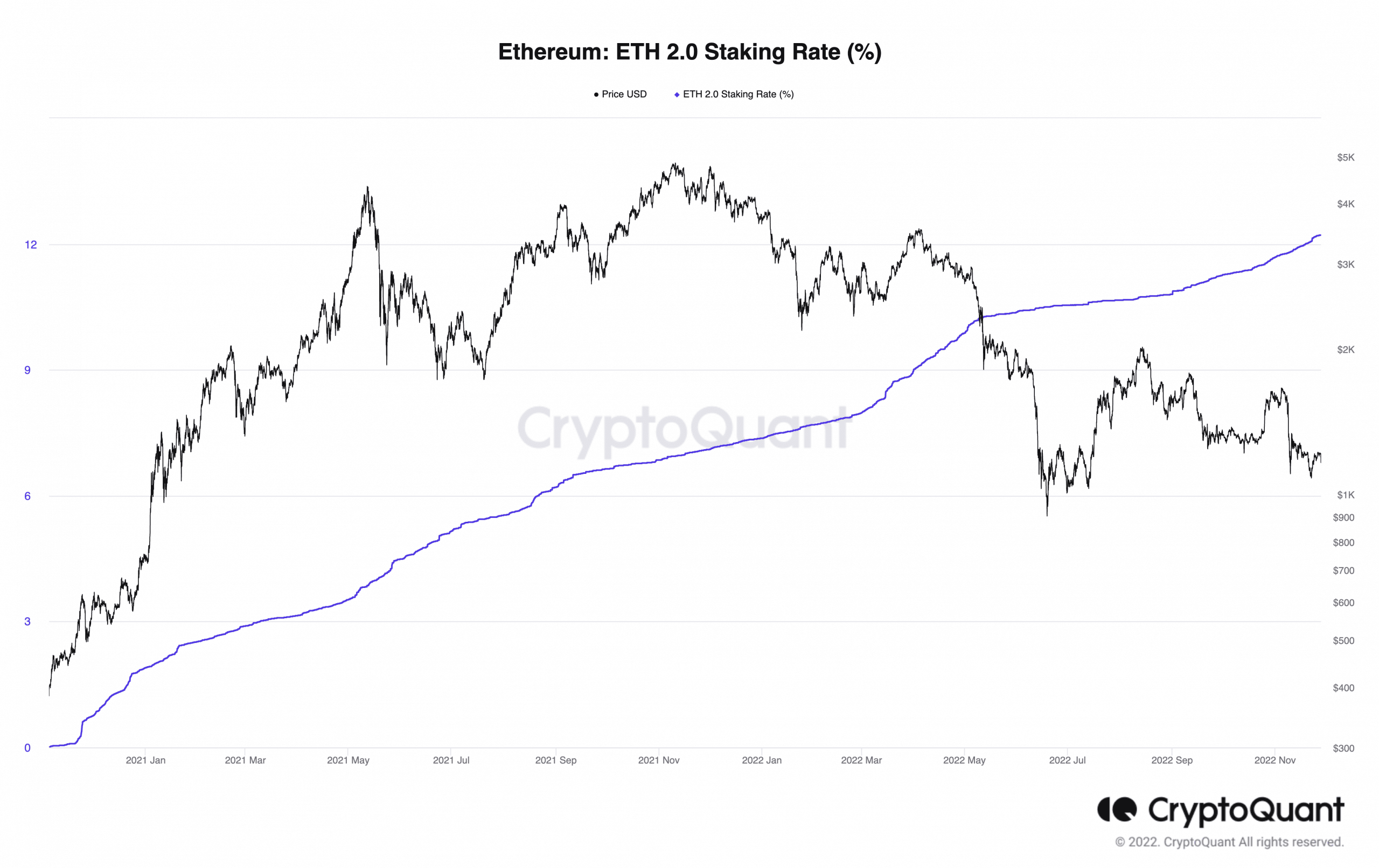

ETH 2.0 and the staking surge of Ethereum

Bringing on the beaming light from the dark shadow of the NFTs was staked Ethereum. Interestingly, Easy OnChain pointed out the ETH locked in staking. According to CryptoQuant, the ETH 2.0 staking rate was growing at 12.2% at the time of writing.

Source: CryptoQuant

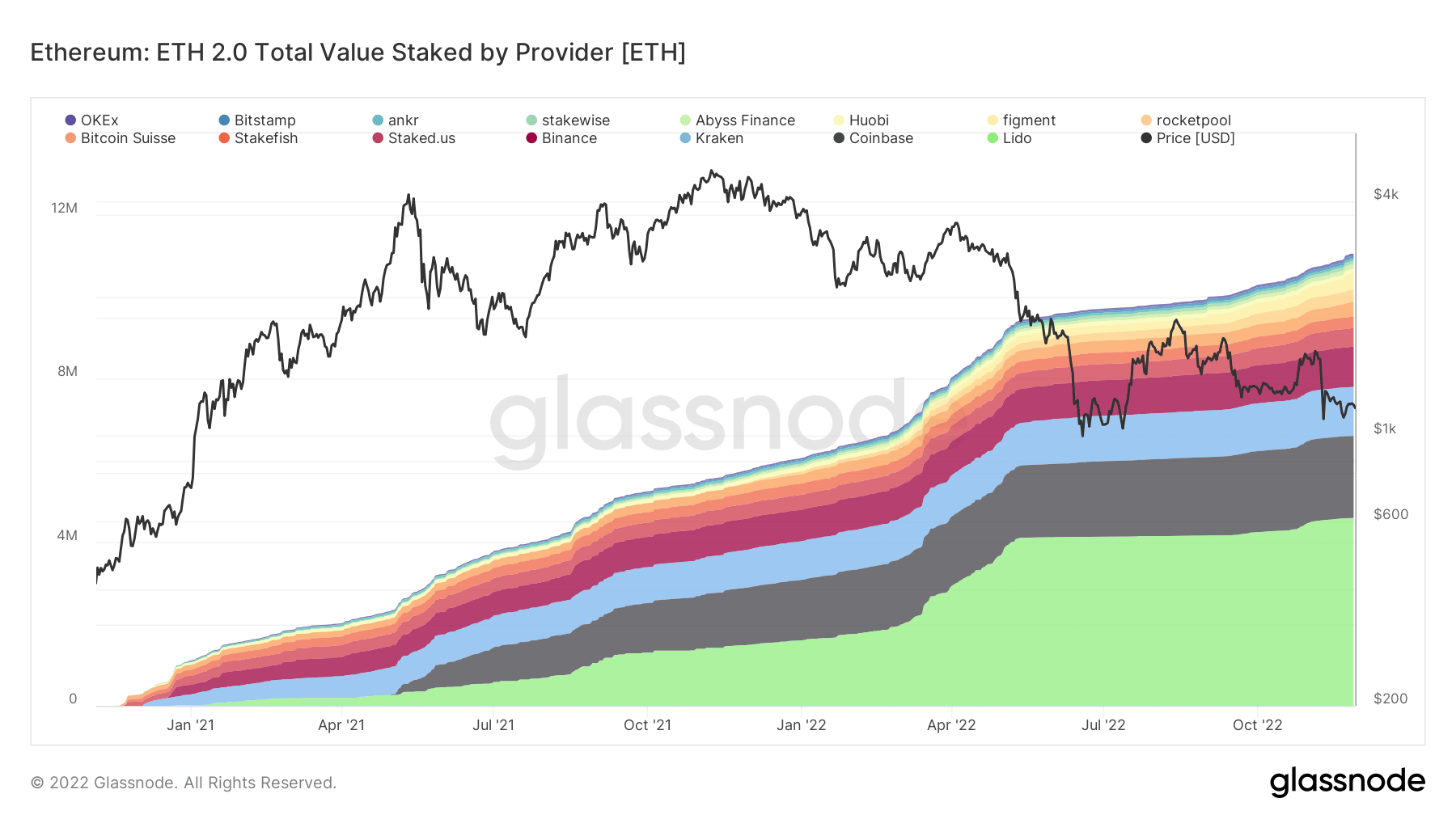

In addition, staking activities were only one of many positive things with ETH 2.0. According to Glassnode, the participation rate showed good reception.

At press time, the participation was 99.262%. This implied that there was satisfactory network validator responsiveness. So, the validators hardly missed slots of Ethereum staked. This also led to the sustenance of the increment as per the total value staked across all exchanges.

Source: Glassnode

In conclusion, these metrics showed that the Ethereum network was performing excellently. However, this performance might not translate to a price hike. Nevertheless, it was likely that ETH might sustain its deflationary condition unless a significant network impact occurred.

![Can Ethereum [ETH] maintain its stability despite the hawkish circumstances?](https://www.cryptonewsmetaverse.com/wp-content/uploads/2022/11/pexels-david-mcbee-730552-1000x600.jpg)