- ETH reserves moving out of centralized exchanges had not decreased.

- Investors who accumulated in the last 365 days were still in losses.

- Chances of short-term revival remained low.

Ethereum [ETH] reserves on Centralized Exchanges (CEXes) had massively diminished by a far greater momentum, a CryptoQuant publication revealed. According to the disclosure, published by Easy OnChain, the altcoin transfers from these exchanges were a tremendous 30% increase more than that of Bitcoin [BTC].

Source: CryptoQuant

Read Ethereum’s Price Prediction for 2023-2024

Follow the leader, stay true to the cause

This occurrence was not strange especially as the FTX collapse propelled investors toward CEX distrust. Moreso, Ethereum’s co-founder, Vitalik Buterin made comments encouraging self-custody during the same period.

Meanwhile, that was not the only inference from the continuous exodus. In a circumstance like this, it inferred that investors were not only concerned about asset safety.

However, the action signified belief in ETH and resolve to hold for the long term. The settlement for long-term ownership could also be borne out of Ethereum’s yearly performance which produced a 69.95% decline.

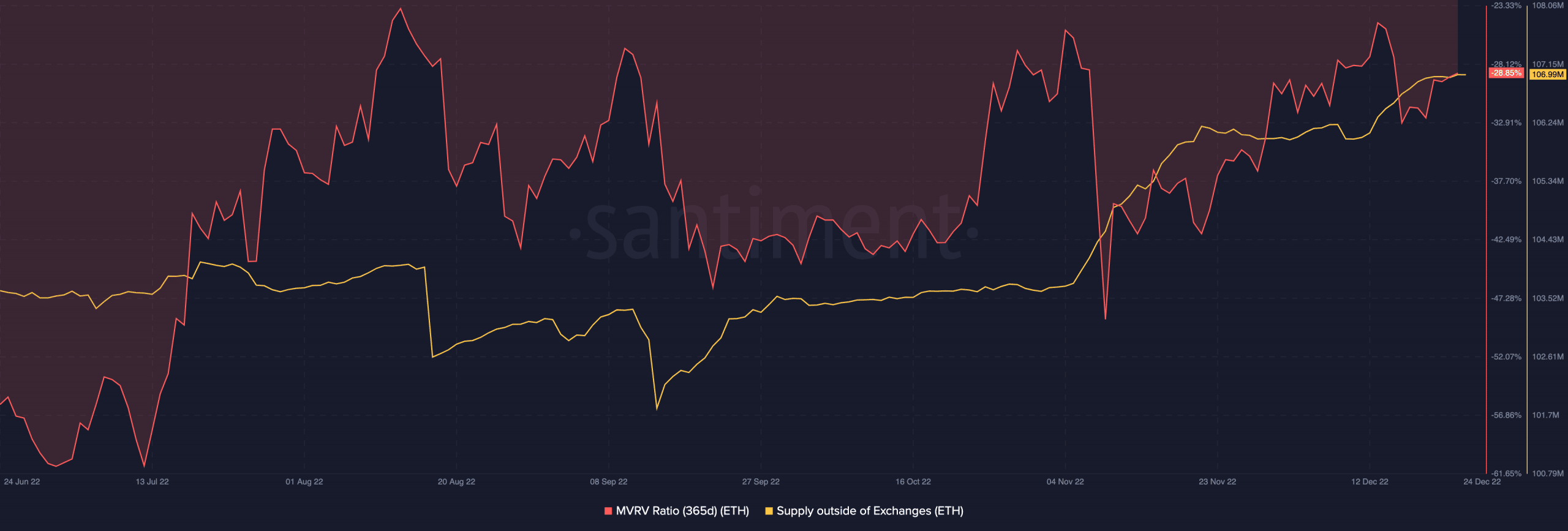

On assessing the 365-day Market Value to Realized Value (MVRV) ratio, Santiment showed that ETH was relatively unimpressive at -28.85%. Although it was a step ahead of the unfortunate decrease in July.

For context, the MVRV ratio shows the relationship between the current price of an asset and the average price it was acquired at. Since this was still in a low region, it indicated that the ETH price had fallen below the aggregate cost by a far margin. Hence, investors were coping with low profits and large unrealized losses.

Source: Santiment

The supply outside of exchanges further aligned with Easy OnChain’s opinion of a CEX exit. At press time, Santiment data revealed that ETH’s supply into custodial wallets was on an incredible increase to 106.99 million

A 0.21x value increase if ETH hits Bitcoin’s market cap?

During the interval, investor sentiment towards Ethereum changed. This was shown by the fear and greed index as it left the extreme fear zone while edging toward the neutral position. With its condition at the time of writing, Ethereum was less likely to produce a full-blown market fluctuation.

Ethereum Fear and Greed Index is 38 — Neutral

Current price: $1,220https://t.co/UNTtngVEMChttps://t.co/pkmBdi9X26 pic.twitter.com/Sy0X1p8EIg— Ethereum Fear and Greed Index (@EthereumFear) December 24, 2022

In for the long ride?

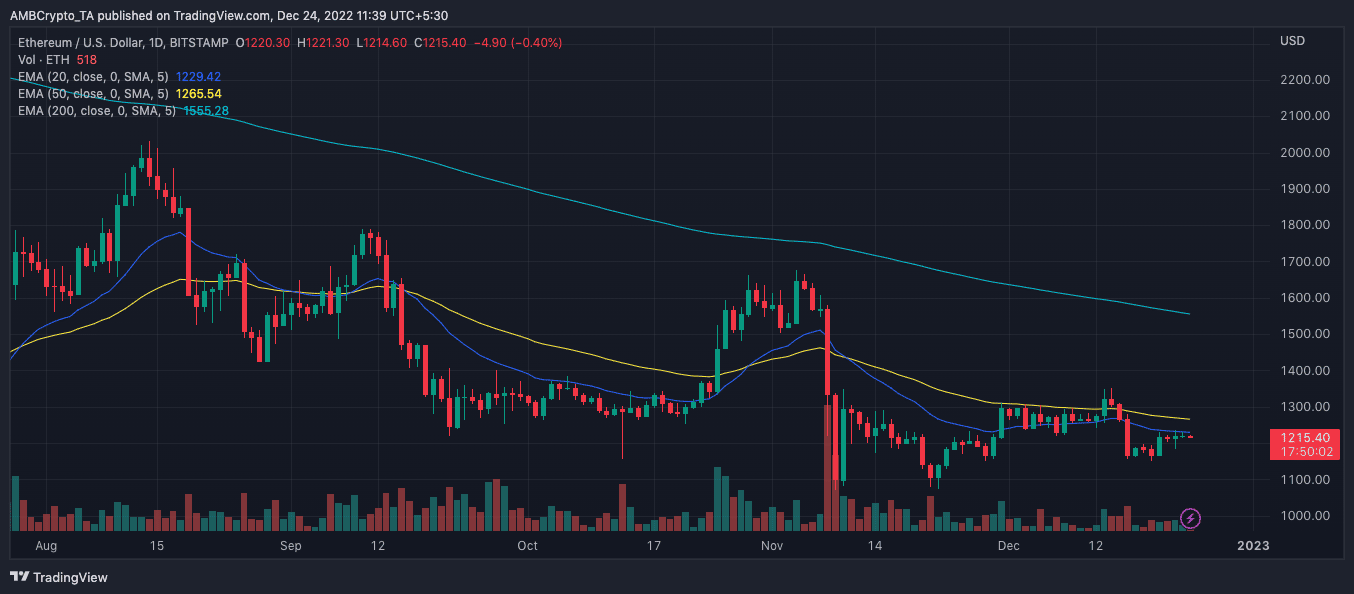

On the charts, ETH’s short-term projection indicated a struggle between the bulls and bears. Per the Exponential Moving Average (EMA), ETH might find it challenging to trade beyond the $1,200 region.

This was because the 50 EMA (yellow) was positioned above the 20 EMA (blue). A situation like this translates to lagging weakness from the buying section.

On the longer timeframe, there was, however, hope for respite. At press time, the 200 EMA (cyan) entrenched above the 20 and 50 EMAs. This status implied that investors could look forward to the mid and long-term for possible significant upticks. This might be the case barring any further negative occurrences that could push for capitulation.

Source: TradingView