Amid the extreme market conditions, a June 13 report by CipherTrace details positive developments in the crypto ecosystem, suggesting a decline in crypto-related crimes.

The report showed increased crypto trade volumes from $4.3 trillion in 2020 to $16 trillion in 2021. The firm claims that this exponential growth is why regulators are looking into the crypto ecosystem.

A decline in crypto crime

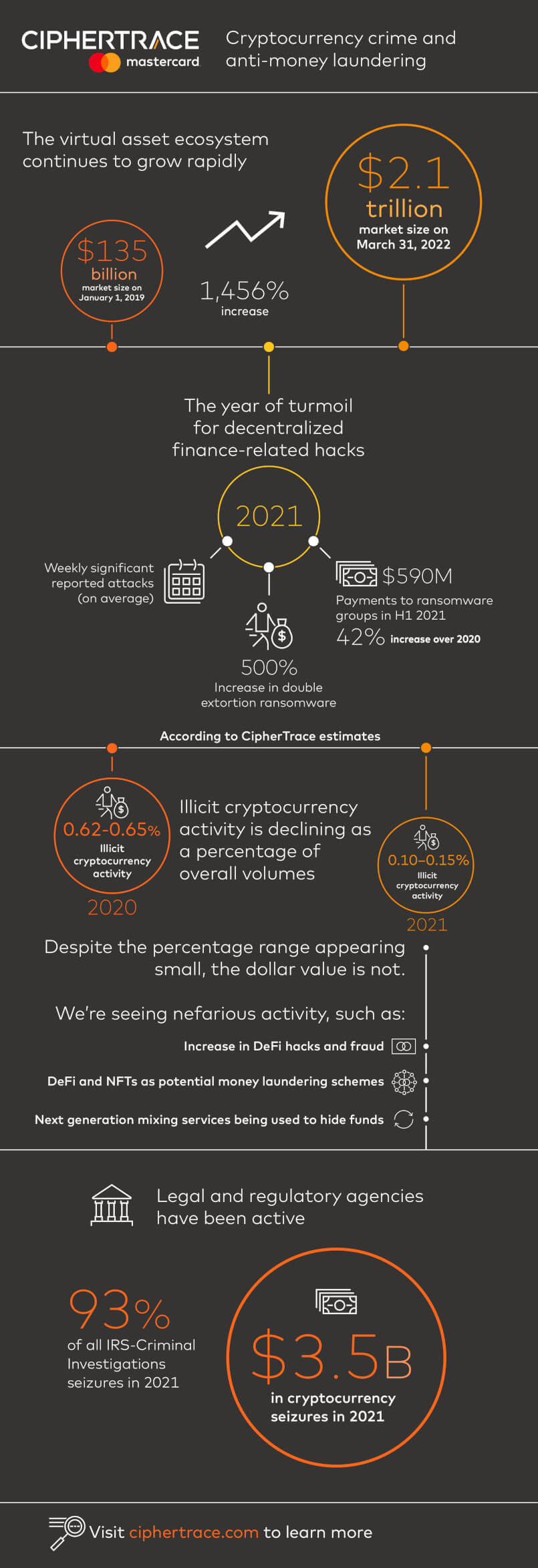

According to CipherTrace, illicit activities have declined and now constitute a small fraction of the entire crypto ecosystem. The firm estimates that illicit activity, which constituted 0.62% and 0.65% of overall cryptocurrency activities in 2020, has dropped to between 0.10 in 2021.

CipherTrace estimates that hackers netted $2.4 billion on an analysis of the top ten DeFi hacks in 2021 and Q1 2022. The March 2022 Ronin Network exploit and the 2021 Poly Network hack constitute nearly half of the overall figure.

While this sum is significant, the firm details that the rapidly expanding ecosystem makes it a small fraction of the overall market value.

The report indicates that the cryptocurrency market grew by 1,456% between 2019 to March 31, 2022. The market hit a peak of $3 trillion in November 2021 after several cryptocurrencies rallied high.

The firm also reported that most illicit activities have shifted into DeFi, NFTs, and next-generation mixing services.

It stated that the numbers used in the report do not reflect the actual value of illicit activities. It said, “To caveat, the fact remains that not all illicit activity is known whether that’s in traditional financial channels, in crypto, or in other informal value transfers. So, take any numbers you see from us or others with that perspective in mind.”

Regulators diving deep

Regulators have long expressed concerns about people using the crypto market as a haven for illicit activities. The significant growth experienced thus led to increased regulatory measures by governments to keep pace.

The report cited President Biden’s crypto executive order in March to study blockchain technology, Dubai establishing a virtual assets regulator, and the European Union’s proposed Anti-Money Laundering laws as examples of such regulatory attempts.

CipherTrace also added that most regulatory efforts would focus on curtailing the crypto ecosystem’s threats. This means that cryptocurrency organizations would come under increased regulatory watch.