- The sales volume of the Coinbase NFT marketplace has been underwhelming since it was launched.

- So far this year, there has been an increase in NFT trading activity.

Since its debut in May 2022, Coinbase‘s NFT marketplace has struggled. This was partly due to a lingering decline in interest in profile picture NFTs from the start of the 2022 bear market and difficulty in gaining traction.

Are your Coinbase holdings flashing green? Check the Profit Calculator

Coinbase, a leading centralized cryptocurrency exchange, announced its NFT marketplace with plans to introduce this new offering to its pre-existing user base. Prior to the launch, the marketplace garnered significant attention, with over two million people signing up for the waiting list.

Despite the initial excitement, the NFT marketplace has yet to live up to expectations, primarily due to the severe economic downturn in the last year and the consequential decline in the cryptocurrency market.

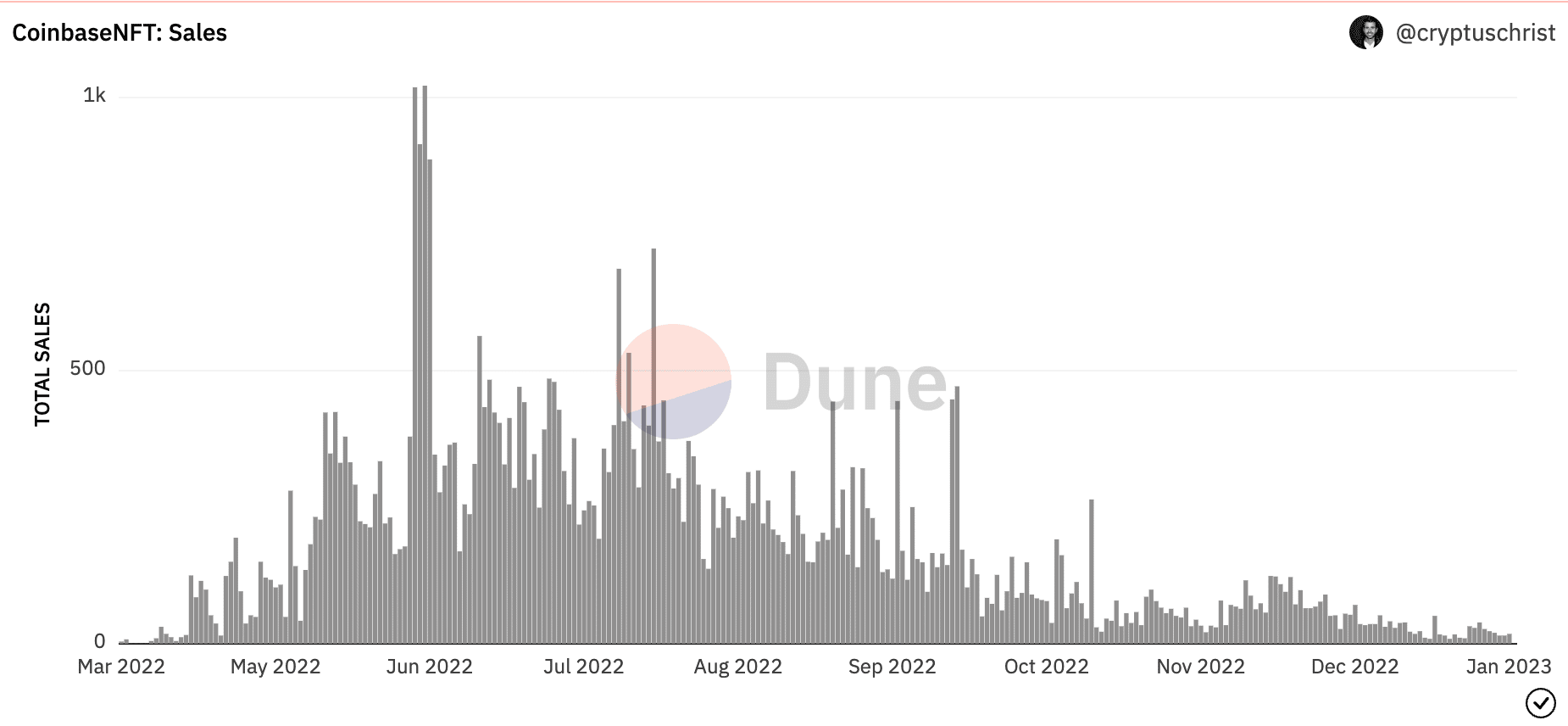

According to Dune Analytics, since its launch eight months ago, Coinbase NFT marketplace has recorded 50,421 NFT sales transactions. The platform saw its daily NFT sales peak at 1021 on 6 June 2022, but it has seen a drastic decrease since. As of 10 January, the marketplace recorded only 11 NFT sales transactions.

Source: Dune Analytics

With 50,421 NFT sales transactions processed since launch, Coinbase NFT marketplace has recorded a total sales volume of $7.27 million. This figure is considered underwhelming compared to Uniswap’s NFT marketplace aggregator, which was launched recently.

Yet, it recorded a sales volume of $4.49 million in just three months of operation. Additionally, in the last 24 hours, sales volume on Coinbase NFT marketplace totaled $319.

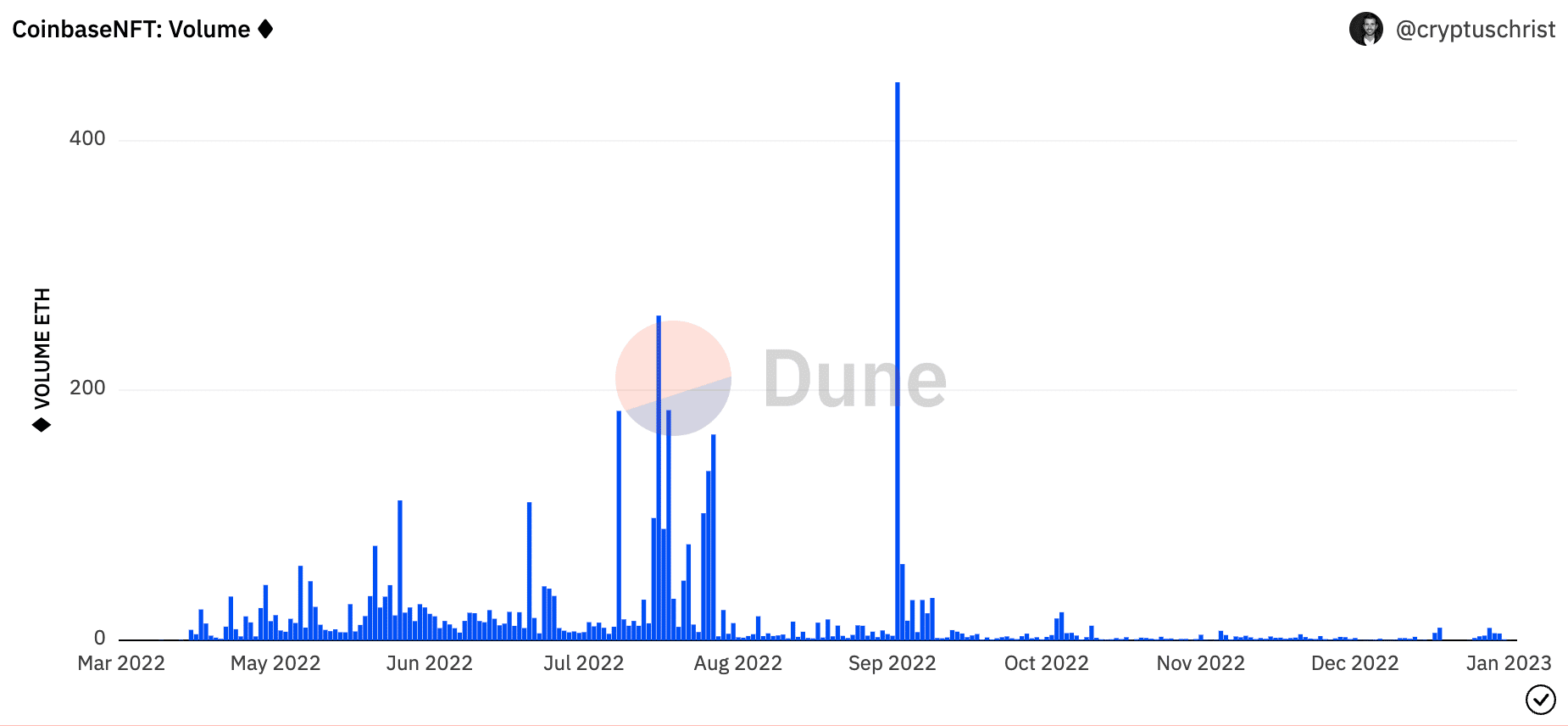

The Ethereum-based NFT marketplace saw its highest daily sales volume of 447 ETH on 8 September 2022. However, as of 10 January, this stood at zero, data from Dune Analytics revealed.

Source: Dune Analytics

Re-emerging interest?

So far in 2023, there has been a surge in trading activity in the NFT vertical of the crypto world, data from NFTGo revealed.

First, Blue Chip NFTs suffered a decline in value during the 2022 trading year as they closed the year at a Blue Chip index of 9,248 ETH.

Blue Chip NFTs are a subcategory of the NFT market that are perceived to be of high quality and value, such as Bored Ape Yacht Club [BAYC], Mutant Ape Yacht Club [MAYC], Crypto Punks, and Meebits.

The Blue Chip Index, calculated by NFTGo, tracks the performance of these collections by considering their market capitalization.

Sentiments towards this digital asset category have been significantly positive this year. Per data from NFTGo, Blue Chip Index has risen by 5% since the beginning of the year.

Source: NFTGo

As for the general NFT market, total market capitalization went up by 3%, and sales volume grew by 35% as well.

Source: NFTGo