Former BitMEX CEO Arthur Hayes says “pockets of forced selling” of Bitcoin (BTC) and Ethereum (ETH) could cause the crypto market to dip again in the near future.

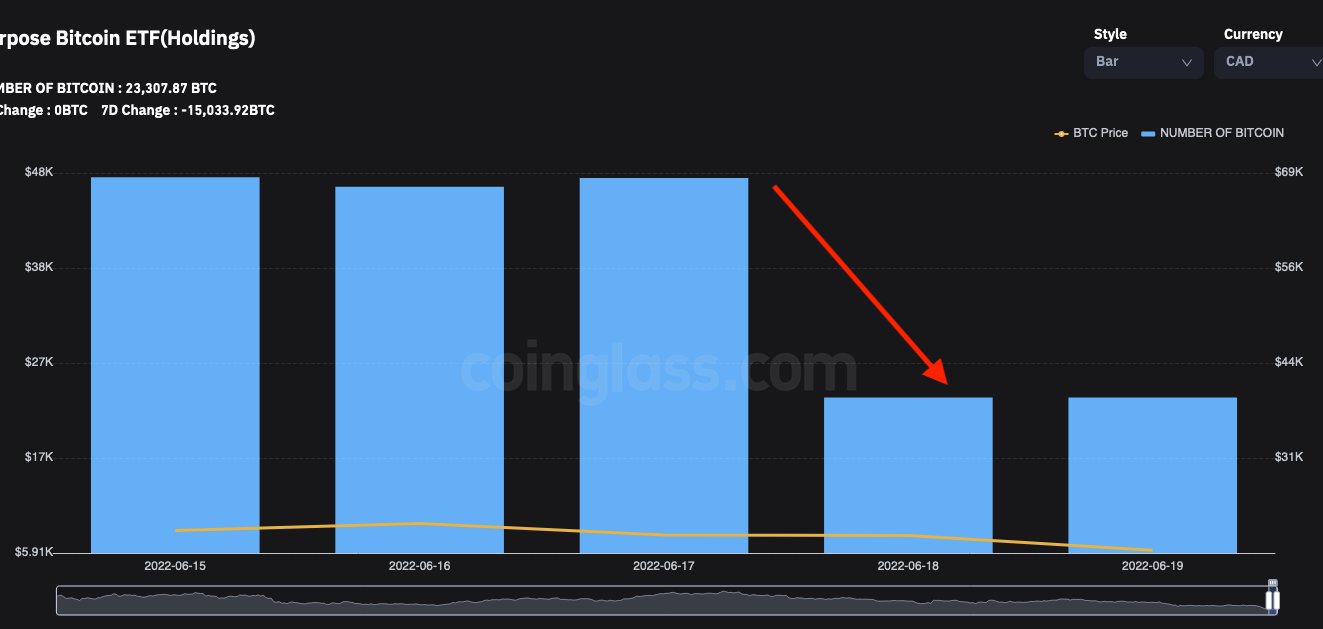

Hayes notes that Canada’s Purpose BTC exchange-traded fund (ETF) sold off a staggering 24,500 Bitcoin on Friday.

“I’m not sure how they execute redemptions but that’s a lot of physical BTC to sell in a small time frame. Over the weekend, while the fiat rails are closed, BTC dropped to a low of $17,600 down almost 20% from Friday on good volume. Smells like a forced seller triggered run-on stops.”

Bitcoin is trading for $20,474 at time of writing. Hayes says the market quickly rallied on low volume after sellers dumped their holdings.

“Given the poor state of risk management by cryptocurrency lenders and over-generous lending terms, expect more pockets of forced selling of BTC and ETH as the market figures out who is swimming naked.

Is it over yet… I don’t know. But for those skilled knife catchers, there may yet be additional opportunities to buy coin from those who must whack every bid no matter the price.”

Hayes said in a recent blog post that he’s looking at a particular weekend when crypto could capitulate as panic sellers flood a bidless market.

“By June 30th (second quarter end), the Fed will have enacted a 75 basis point rate hike and begun shrinking its balance sheet. July 4th falls on a Monday, and is a federal and banking holiday. This is the perfect setup for yet another mega crypto dump.”

In March, Hayes and fellow BitMEX co-founders Benjamin Delo and Samuel Reed pled guilty to breaking a law that requires financial institutions to help the government detect and counter money laundering schemes.

The U.S. Department of Justice (DOJ) alleged that the trio willfully failed to maintain anti-money laundering protocols and profited from the transactions of US-based customers despite claiming that BitMEX did not serve individuals in the US.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/sakkmesterke/Sensvector/eth VECTORY_NT