The chief executive of a prominent crypto exchange is revealing some of the platform’s reserve assets in a first step towards transparency.

Crypto.com CEO Kris Marszalek says that investors can expect the crypto exchange to remain safe and transparent while announcing a full audit that would prove Crypto.com has the 1:1 ratio of reserve assets it claims it has.

To start, Marszalek is sharing the exchange’s cold wallet addresses.

“While the proof of reserves audit preparation is underway, we are sharing our cold wallet addresses for some of the top assets on our platform. This represents only a portion of our reserves: about 53,024 BTC, 391,564 ETH, and combined with other assets for a total of $3 billion.

Please expect a full audited proof of reserves from us in the next couple of weeks, confirming the full 1:1 reserve of all customer assets. You can expect Crypto.com to continue working in [the] spirit of full transparency and remain the steady hand and a safe, secure platform.”

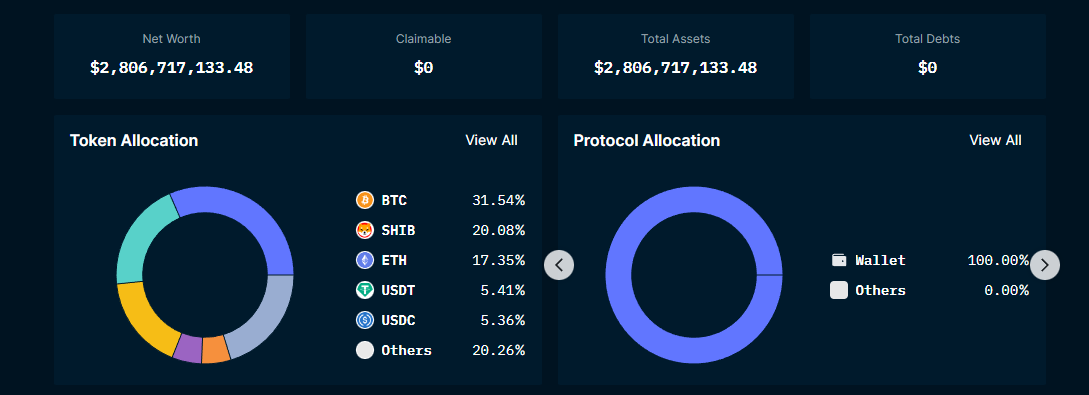

According to recent data from blockchain analytics platform Nansen, Crypto.com’s cold wallet portfolio has about $2.80 billion worth of assets, 31.54% of which is comprised of Bitcoin (BTC), the leading digital asset by market cap.

Other notable crypto assets include meme token Shiba Inu (SHIB), which makes up 20.08% of the total and leading smart contract platform Ethereum (ETH), which accounts for 17.35% of the portfolio.

Stablecoins Tether (USDT) and USD Coin (USDC) come in at 5.41% and 5.36%, respectively, while other altcoins make up 20.26% of the assets in the exchange’s cold wallets.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/X-Poser/Sensvector