A closely followed crypto strategist who continues to build a following with timely Bitcoin calls is unveiling his worst-case scenario for BTC.

Justin Bennett tells his 108,800 Twitter followers that Bitcoin is forming a large bearish pattern that could potentially push BTC close to its 2018 bear market lows.

“Since late May, BTC has formed a descending triangle. The objective of this pattern is $5,000. Yes, that.

This is probably a worst-case scenario for Bitcoin, and $12,000 comes before this. But don’t rule it out.”

Bennett also says that while $5,000 is the pattern’s objective, it doesn’t necessarily mean that BTC will actually drop down to those levels.

“If you apply a percentage objective to this instead of a price objective, you get a target of approximately $11,000 BTC, which is very close to the $12,000 support I mentioned above.

Either way, I think we get lower prices later this year.”

Although Bennett is long-term bearish on Bitcoin, he’s not discounting the possibility of a bounce this week as he says traders are heavily shorting the king crypto.

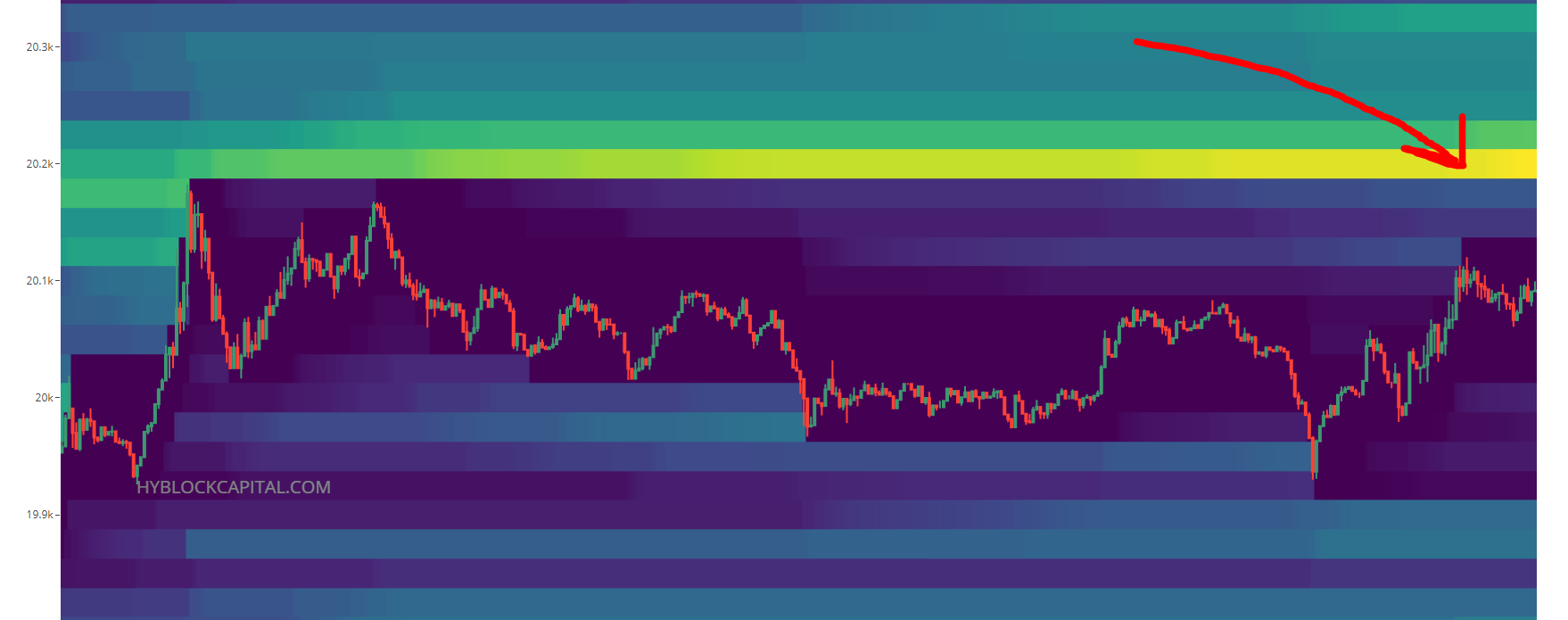

“BTC shorts have aped in again, which means more short liquidations above $20,200.

That’ll add more fuel on the way up if we see Bitcoin rally like I think we will… Scam pumps can last longer than most think. Those piling into BTC shorts at every sign of weakness will learn that the hard way.”

At time of writing, Bitcoin is trading for $18,788, down 6% on the day.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/nullplus