beginner

Cryptocurrency is still an incredibly new and young field. As a result, many people don’t really know how to approach it, which can lead to losses. There still aren’t that many established strategies that can tell you exactly how to make maximum profit with crypto. Investors and crypto traders have to be quick on their feet and come up with new approaches all the time.

However, that does not mean there are no “rules” when it comes to making money with cryptocurrencies. There are some common mistakes people often make that can cause them to lose their money. Let’s take a look at some of them – and how they can be avoided!

Please note that this article does not constitute investment advice.

Going All-In

One of the most critical mistakes people make when they first begin crypto investing is going all in. There are two sides to this: putting all your eggs in one basket and investing all your available resources right away.

The first mistake – investing all your money in a single coin or token – is written down in all Investment 101 rulebooks. Diversification is the foundation of any successful portfolio, and this is especially true for industries like crypto, where prices can crash within hours, if not minutes.

TIP: Learning more about the crypto market is a great way to diversify your investment portfolio. If you don’t want to trudge through millions of crypto coins, consider following influencers that highlight interesting projects or signing up for an email subscription service.

Another mistake people make is going all in with their funds. Remember that investment and trading are also a skill – and learning how to do them efficiently can take time. Money isn’t going anywhere, so don’t be afraid to take it easy at first and start your journey with small amounts and demo accounts.

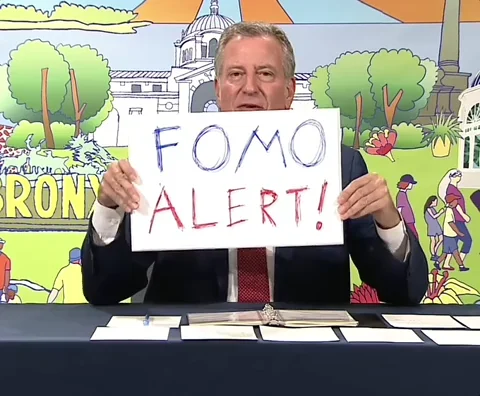

Losing To FOMO

FOMO is basically one of the four horsemen of the cryptocurrency market. Everyone knows about it, has heard a million times that they need to be aware of it, and yet… When the time comes, it can be so hard to resist it, especially if you like cryptocurrency only for the profit it can provide you with.

Now, there’s no shame in wanting to earn more. However, you should always remember that there’s no such thing as free money. When the hype for the coin is high, or when it’s dying down and the prices are declining, the rest of the market sees it, too – and can react accordingly.

One of the biggest threats FOMO poses is that it often forces us to make rash decisions… which in the crypto world can lead to falling prey to scammers. Imagine if all your online friends and communities are raving about the latest trending coin, and then you suddenly get a DM from a seemingly familiar face about a way to get that coin fast without having to pay high fees or dealing with volatile rates on exchanges.

Although laid out like this a message like that clearly screams “scam alert”, in the spur of the moment, FOMO can make you click on the link in it, leading to you losing access to your funds.

You can learn more about FOMO and the ways to fight it in this article.

Neglecting Your Emotions

This mistake ties into the previous one. Some people invest with their heart, not their brain. It’s fine if you’re only having fun with smaller amounts and are ready to lose your funds, but it can be detrimental to your bank account if you let your emotions rule over you when approaching crypto seriously, with an intention of making money.

Learning how to manage your mood and emotions well is a skill that will be useful even beyond your crypto investment journey. Controlling yourself will help you to make informed decisions and avoid unnecessary losses.

For example, let’s consider Eric, a beginner crypto trader and investor. He started off by buying Ethereum when it boomed in 2017. Then, he sold it in 2019 after losing his faith in the crypto market. Afterwards, he bought in again when crypto boomed at the beginning of the pandemic, and – you guessed it – sold his ETH when the market slowed down a month or so later. Eric was stuck in a typical crypto limbo as he kept letting his emotions make his trades for him.

TIP: While quick reactions can be really important in the crypto world, try to avoid making spur-of-the-moment decisions. Give yourself some time to think your trades over.

Not Learning From One’s Mistakes

An important part of learning any skill is looking back at what you have done previously and learning from your mistakes. However, many people neglect this rule when it comes to crypto.

We think it stems from some people not really taking cryptocurrency seriously. In fact, many new crypto investors probably see it as something akin to gambling. And while crypto’s volatility can sometimes be as unpredictable as a slot machine, there’s still a strategy to cryptocurrency investment and trading.

A good way to break out of this habit is keeping track of your results. First, write down all transactions you make. Although there are apps that show your trading history, it’s good to have all that information in one easily accessible place. Analyze those results, and try to see if there are any patterns you can find, especially ones that usually lead to losses.

Going In Without A Plan

A mistake people often make when it comes to working with crypto is not having any plan. First of all, you should establish what your goals are. Do you want to learn more about the market or make a profit? What return do you want to see? And “as much as possible” is not really a good answer – you should aim to keep your goals realistic. You should also decide how much money you can afford to lose – and never spend more than that.

Before you start investing or trading crypto, you should also get a reliable wallet. If you plan on holding large amounts of money, it’ll be worth it to get a hardware wallet. Remember to never share your private key with anyone.

Once that’s done, you can start researching the different ways you can use crypto to make money. And there’s a lot of them! Although the cryptocurrency industry is relatively young, there’s a lot of innovation surrounding it. Formulate your investment strategy, but also be ready that it may have to change if it doesn’t work as well as intended. If you’re trying something new, try to test the waters first and use stop-loss orders if possible.

Don’t be afraid to go for strategies you’ve never heard of before. For example, did you know that some people make money with crypto by playing games? There are some NFT platforms that give you tokens for completing tasks with your digital avatar, or PvP-ing to your heart’s content.

TIP: To learn more about new strategies of earning profit with digital currencies, join crypto communities on Discord and other social media platforms. Users there are often happy to give advice and share tips on innovative uses of blockchain technology!

Underestimating Margin Trading Risks

Margin trading is an advanced trading strategy, but this mistake is unfortunately all too common in the crypto world. While there are no studies that can conclusively tell us why it happens so often, we think it has something to do with the high risk, high reward nature of the cryptocurrency market. Margin trading raises the stakes even higher than usual crypto trading, which attracts risk-takers.

To add to that, many crypto exchanges are… very loosely regulated, to say the least. As a result, you may get access to margin trading long before you’re ready for it – and it may even be available as a basic feature, in-built in the standard trading terminal and not even locked behind two-factor authentication.

Avoid using leverage unless you really know what you’re doing, and don’t forget about features like stop losses. If you do decide to trade with leverage, prepare yourself mentally that you may receive a margin call and think about ways to offset your risk.

Final Thoughts

There are quite a lot of crypto mistakes that we haven’t even touched on in this article. However, most losses can be averted if you follow the basic investment rules: diversify, do your own research, and learn from your mistakes.

There are many reasons why you may lose your money in the crypto market: some of them can be avoided, while others happen due to bad luck. If you’re unhappy with your commission fees or rates, you can always contact the support team of the exchange you’re using. And don’t hesitate to step back if you ever feel like your crypto journey is becoming a negative experience – cryptocurrency isn’t going anywhere!