beginner

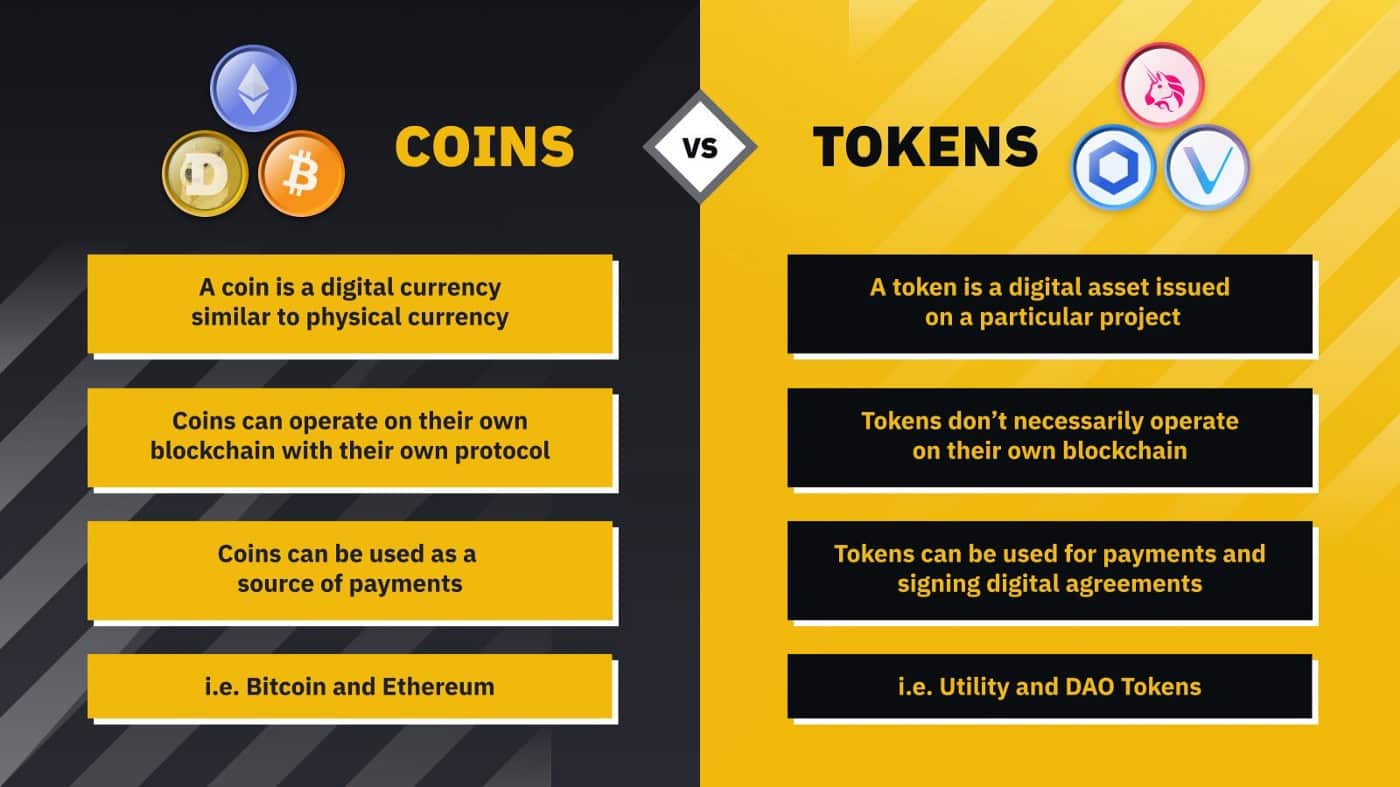

Although they are sometimes used interchangeably, these two words – coin and token – have different meanings. They may not seem that different at first glance, but in reality they often serve fundamentally different purposes.

Being able to tell crypto coins and tokens apart is an important skill for any crypto investor. So, let’s find out how they differ and whether one can be considered to be a better investment option than the other.

What Is a Crypto Coin?

Coins are crypto assets that have their own underlying blockchains and protocols. They operate in a way that is similar to how fiat currencies work and are mostly designed to be payment methods or storages of value.

Crypto coins are what people usually think of when they hear the word “cryptocurrency” – digital currency. The most popular ones are Bitcoin, Ethereum, and Ripple.

Wanna see more content like this? Subscribe to Changelly’s newsletter to get weekly crypto news round-ups, price predictions, and information on the latest trends directly in your inbox!

Stay on top of crypto trends

Subscribe to our newsletter to get the latest crypto news in your inbox

What Is a Crypto Token?

Unlike coins, tokens don’t have their own blockchains. Instead, they run on other cryptocurrencies’ networks. They are usually developed by various organizations and projects on top of other chains.

Seeing as they use the same blockchain, digital tokens and their “original” coin may sometimes share some similarities – and they are usually compatible. However, tokens are (typically) not designed to be purely a store of value or a payment method: they are a different asset type.

There are quite a few blockchains that support the creation of tokens. The most popular one is Ethereum – it houses the most commonly used token standard, ERC-20.

All tokens rely on a technology called smart contracts and have four defining characteristics. They have to be:

- Transparent

Everyone can see and verify both the transaction data and the rules that govern the token.

- Programmable

Tokens are developed and launched using smart contract technology. They are used to outline and program the token’s features, functions, purpose, and rules.

- Trustless

Tokens are decentralized – instead of relying on a central authority, they are run by the rules defined in its protocol using smart contracts.

- Permissionless

Finally, tokens have to be accessible to everyone. They cannot require any particular credentials from potential holders and users.

What Do Tokens Actually Do?

First and foremost, tokens can be used in the same way coins are – as a speculative asset to be invested in. However, unlike crypto coins, they have actual purposes, and can also represent physical assets or even certain utilities or services.

Tokens allow crypto projects to give some of their users special access to things like exclusive merch sales, dApps, blockchain games, and more. They can also be used to vote on various governance proposals and protocol upgrades.

Types of Crypto Tokens

Tokens can be divided into several different sub-groups depending on their design and purpose. Let’s take a look at the most common ones.

Non-Fungible Tokens (NFTs)

NFTs, or non-fungible tokens, are probably the most well-known type on this list. They serve no practical purpose and are mostly made and treated as luxury items. Each non-fungible token represents a separate asset.

Non-fungible tokens are essentially digital certificates of ownership. They usually represent unique digital assets such as pieces of art, videos, or even tweets. They are developed in the same way as other tokens – using smart contracts technology.

Utility Tokens

Utility tokens provide their holders access to goods and services. Sometimes they simply give you the right to interact with a platform or a digital product, other times they give a discount on fees, or make access to that platform completely free. They are the backbone of most dApps and other DeFi projects. As a result, owning a utility token may provide you with benefits far beyond monetary ones.

Utility tokens are typically not regulated and are not considered to be investment products.

Security Tokens

Security tokens are associated with external assets that can be traded as securities. They are a tokenized version of bonds, stocks, property, and so on. Because of this, their issuance and exchange are typically heavily controlled by various financial regulators.

Sometimes, a security token only represents a stake or a share in the asset it is tied to. Its holders can receive special benefits, such as part of the profit or the ability to partake in some decision-making processes. Unlike traditional securities, tokens can provide market participants with transparency, instant settlement, and other substantial benefits that come with being a crypto.

There are two types of security tokens: equity and asset-backed tokens.

Governance Tokens

Governance tokens do exactly what their name suggests – they give their holders access to governance decisions such as deciding which new upgrade will be pushed through. Typically, these decisions get applied automatically as the system operates on smart contracts. However, sometimes they are carried out manually by the team managing the project.

Governance tokens can empower their holders and thus make projects that use them significantly less centralized.

Examples of Crypto Tokens

There are many different tokens out there. NFTs include popular collections like the Bored Ape Yacht Club (check out our price prediction for their native token, ApeCoin, here) or even the world’s first tweet. The best example of a governance token is Maker (MKR).

The majority of tokens nowadays are still based on the Ethereum blockchain. However, some other networks are also starting to attract more and more developers, especially as ETH gas fees continue to rise. Tron and Solana are two other popular chains that have smart contract functionality and get chosen by many token creators.

Some cryptocurrencies have different token versions on different blockchains – for example, the stablecoin USDT.

The Difference Between a Coin and a Token

The primary difference between coins and tokens is the fact that the former have their own blockchain while the latter do not. Additionally, tokens are usually built with an actual purpose in mind, so their price is typically determined by more than just the law of supply and demand and market speculation – although this is also true for some coins, especially those that have extra features like Ethereum or ones that can be used as payment in some places like BTC.

There are thousands of various tokens in circulation – a lot more than coins. That is because the former are much easier to create, as one doesn’t need to code an entire new blockchain to make them.

Being able to differentiate tokens and coins is important as it helps you to better understand the cryptocurrency you’re trading or investing in. Ultimately, however, you can always look up whether a cryptocurrency is a coin or a token online.

You can buy the coins and tokens mentioned in this article (as well as many others!) at fair rates and with low fees on Changelly.

FAQ

Which is better – coins or tokens?

Coins and tokens serve different purposes and cannot be said to be better than the other.

Is Bitcoin a coin or a token?

Bitcoin has its own blockchain, so it is a coin.

Can a token become a coin?

Tokens can become coins if they manage to develop their own successful blockchain and migrate to it. Some examples are the Binance Coin (BNB) and Tron (TRX).

Does every blockchain need a token?

No, tokens aren’t a necessity for blockchains.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.