The total cryptocurrency market capitalization stood at $938.47 billion as of 07:00 UTC on Sept. 7 — down 5.2% over the past 24 hours.

Bitcoin’s market cap fell by around $20 billion or 6.2% to $358.94 billion over the day. Meanwhile, Ethereum’s market cap stood at $185 billion, down 7.9% from around $201 billion on Sept 6.

The top ten market cap cryptocurrencies were all red over the past 24 hours, with Cardano posting the highest losses after falling 9.26%, according to CryptoSlate data.

Tether (USDT) and USD Coin (USDC) market caps stood at $67.55 billion and 51.61 billion, respectively, while BinanceUSD (BUSD) market cap stood at $19.74 billion, rising slightly compared to Sept 5. USDT’s market cap remained flat, while USDC’s market cap fell slightly over the past day.

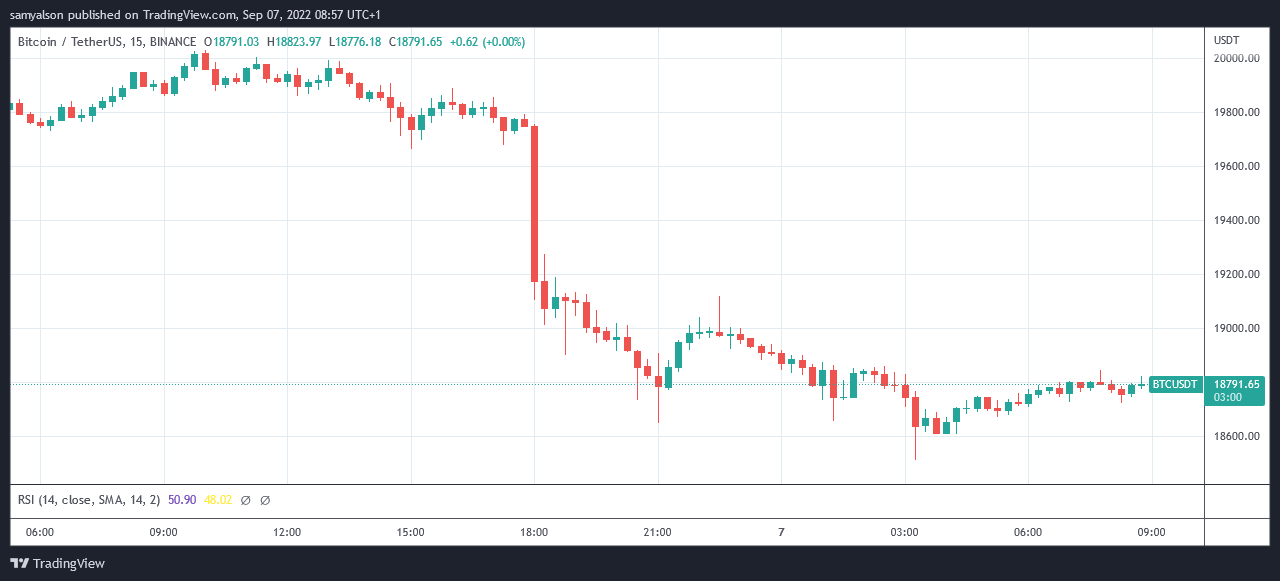

Bitcoin

Bitcoin (BTC) saw significant losses over the past 24 hours and was trading down 5.21% at 18,700 as of 07:00 UTC — below the previous all-time high set in November 2017. BTC’s market dominance dipped to 38.3% since 8 am, the lowest since February 2018.

The price of the largest cryptocurrency continues to struggle and lose market share. Market sentiment remains mostly bearish, with the Bitcoin greed and fear index pointing towards extreme fear.

BTC was trading flat on Sept 6 until around 17:00 UTC, when it started crashing significantly. The price of BTC dropped as low as $18,715 around 20:00 UTC, post which it recovered slightly, only to crash again, slumping below $18,600 at around 02:15 UTC on Sept 7.

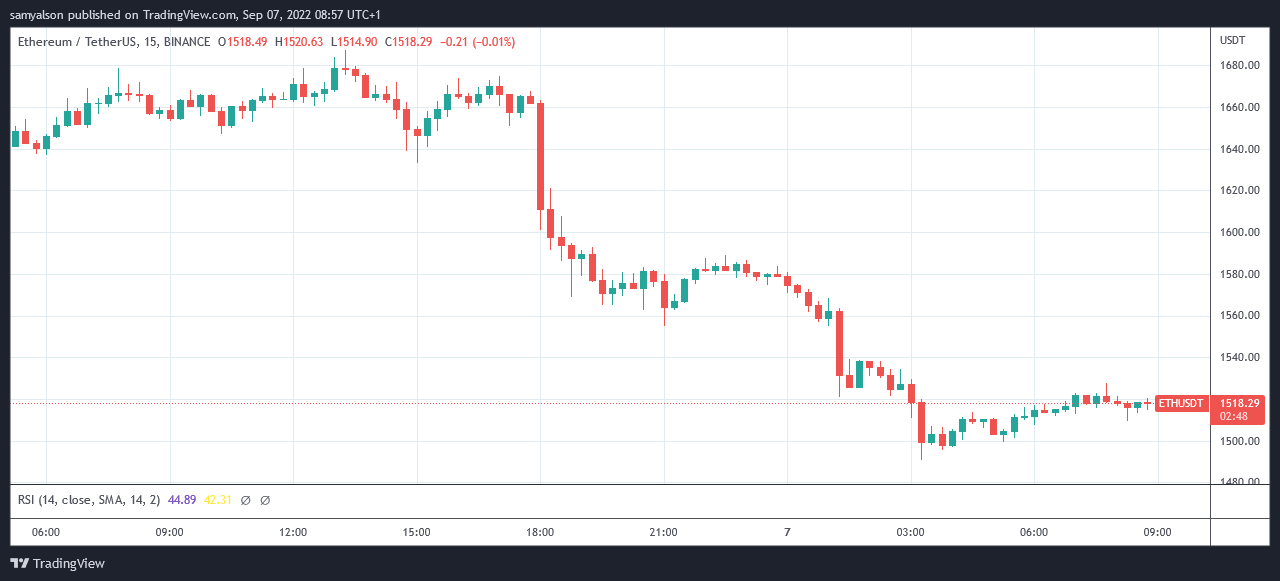

Ethereum

Ethereum (ETH) fell 8.65% and was trading at $1,51 as of 07:00 UTC after losing most of the gains made over the past week. Anticipation of the Bellatrix upgrade — the last significant upgrade before the Merge — boosted the price of ETH in the early hours of Sept 6. However, the technical issues after the upgrade went live caused bearish pressure on ETH’s price.

Despite the price falling 4.11% over the past week, ETH has been consistently performing better than Bitcoin over the last 30 days as the Merge comes closer. The Merge has also ballooned staked ETH to an all-time high of 14.26 million, valued at around $21.6 billion at current prices.

ETH price started falling sharply at around 17:00 UTC, dipping to around $1,560 by 20:00 UTC. The price then recovered slightly, but continued to fall soon after until it dipped below $1,500 at around 02:30 UTC on Sept 7.

Top 5 gainers

Voyager Token

VGX bagged the biggest gains for the day, up 20.94% over the past 24 hours. The token was trading at around $0.92 as of press time — up 67.99% over the past 7 days.

Although Voyager was the first lender to file for bankruptcy after Three Arrows Capital went bust, the firm is now evaluating bids for a buyout, the deadline for which was Sept 6. Voyager had previously rejected FTX’s proposal for buying out its loans and assets at market price, except its exposure to 3AC. Supporters of the token believe VGX could soon test $1, despite the company’s liquidity crisis.

Binary X

BNX bagged the biggest gains for the day and was trading at $1.36, up 5.85% over the past 24 hours. The token’s price increased sharply at around 12:30 UTC on Sept 6, although the token has been trading downwards since. It is not currently known why the token’s price shot up.

Voxels

VOXEL is up 5.2% over the past 24 hours, trading at $0.28 as of press time. The token is up 24.12% over the past week, but its current trading price is significantly lower than in mid-August when it was trading at around $0.42.

Radio Caca

While the token has been trading nearly flat over the past week, it posted 2.09% gains over the past 24 hours and was trading at $0.00038. This is despite the token price falling sharply around 17:00 UTC, mirroring the fall of BTC and ETH prices. The token is down 15.39% over the past week.

Helium

HNT gained 2.05% over the past 24 hours and was trading at $3.88 as of publishing time. However, the token is down 30.36% over the past week. The community has been plagued with doubts since the developers proposed moving the project to Solana from its native blockchain late last month.

Top 5 losers

DeFiChain

DFI saw the largest losses of the day, slumping by 23.22% over the past 24 hours to trade at $1.03 at the time of publishing. The token had experienced a sharp uptick on Sept 3, but the day’s losses eliminated all gains.

SSV Network

SSV dipped 16.98% over the past 24 hours, trading at around $14 at press time. The token, however, posted gains of 5.53% over the past week, and the current slump could to attributed to volatility.

Synapse

SYN posted losses of 16.62% over the past 24 hours. The token was trading at $1.29 as of press time, after eliminating all its gains since Sept 5. The reason behind the volatility of the token is not known at present.

Lido DAO Token

Following the slump in ETH price, LDO also suffered losses. It slipped by 16.55% over the past 24 hours, trading at $1.82 around press time. Over the past month, the token price has dropped by 21.66%.

Ethereum Classic

As of press time, Ethereum Classic (ETC) had lost the gains made over the week and was trading at $34.32, down 16.16% on a daily basis,

Earlier this week, the price of ETC was pumping as ETH miners moved to the network ahead of the Merge, which will turn Ethereum into a proof-of-stake network.