- ENS witnessed consistent growth in terms of monthly active users

- Though its prices surged over the past week, network growth and volume depreciated

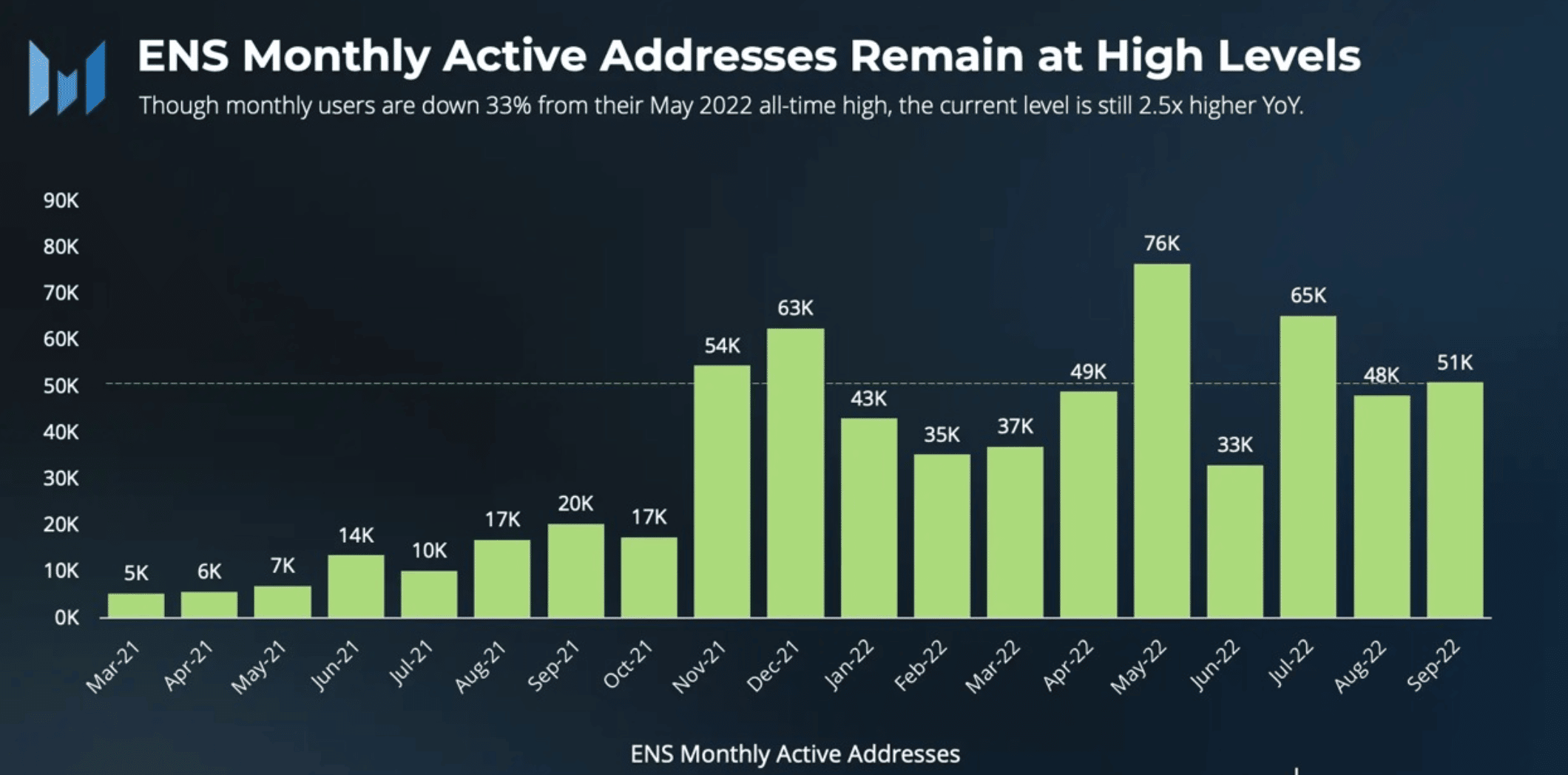

The monthly active addresses on ENS continued to grow as per analytical platform Messari. This took place despite declining user activity across the board due to the volatility that occurred in the Web3 space. The growth could eventually play a key role in impacting the network’s future.

Data shows that @ensdomains monthly active addresses remain robust even as the broader Web3 market suffered large user drawdowns over the past quarters.

The current level of active addresses is still 10x higher than at the beginning of 2021 and 2.5x higher than a year ago. pic.twitter.com/Mx4Mt4ltlO

— Messari (@MessariCrypto) December 3, 2022

Read ENS’s Price Prediction 2022-2023

ENS, against all odds

The surge could be one reason why ENS’ prices surged by 6.54% over the last week. The number of active addresses on the platform was 10x higher than the activity registered last year, as can be seen from the image below.

Source: Messari

Coupled with growth in activity, the decentralized web content on the network grew as well. Moreover, DWEB‘s growth was consistent over the past few months. Furthermore, the protocol made $1.7 million in protocol revenue and added 22k new accounts in November. However, despite this, avatar records declined.

ENS stats for November 2022

– 70k new .eth registrations (total 2.79m names)

– $1.7m in protocol revenue (all goes to the @ENS_DAO)

– 22k new eth accounts w/ at least 1 ENS name (total 612k)

– 5,445 avatar records set (total 62k)

– 1,660 DWeb content records set (total 16,715) pic.twitter.com/LRK2iqPQjr— ens.eth (@ensdomains) December 1, 2022

Not all roses and sunshine for ENS

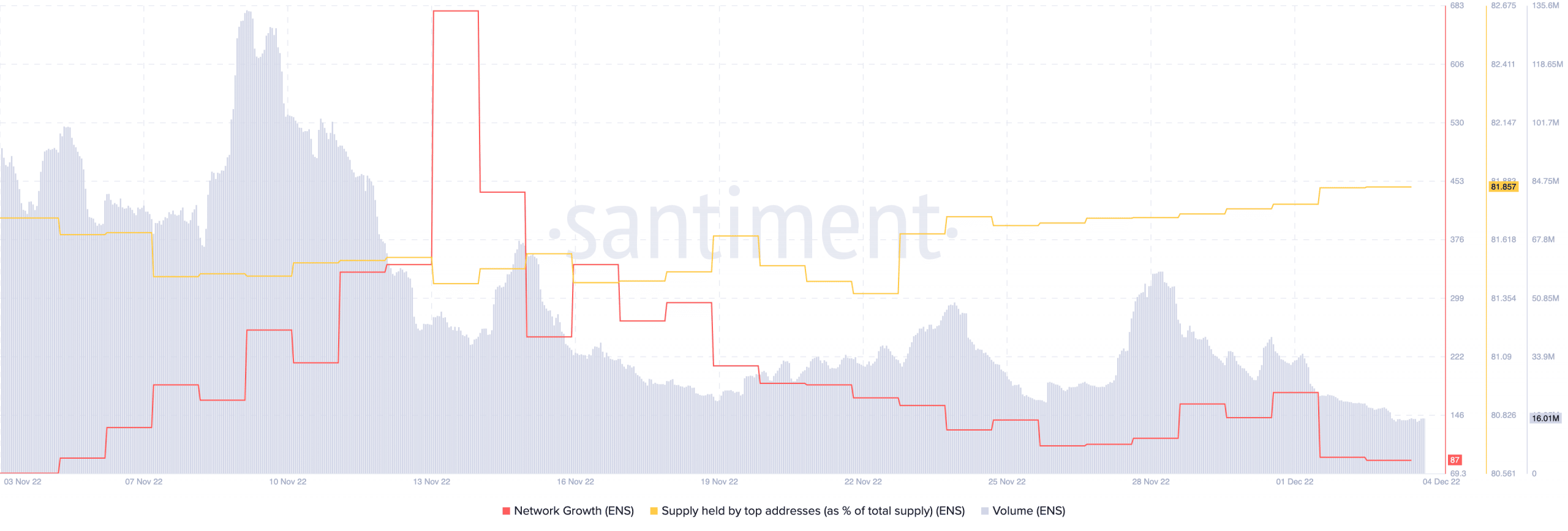

ENS had a rough time this crypto winter with on-chain metrics. Its network growth declined significantly over the past month, as the number of addresses that transferred ENS for the first time reduced.

ENS witnessed a drop in terms of volume as well, as it plummeted from 94.3 million to 15.2 million in the last month. This suggested a declining interest from traders. However, despite these indicators, large addresses showed faith in ENS, as there was an uptick in the supply held by top addresses. Thus, increasing interest from whales could propel ENS’ prices even further.

Source: Santiment

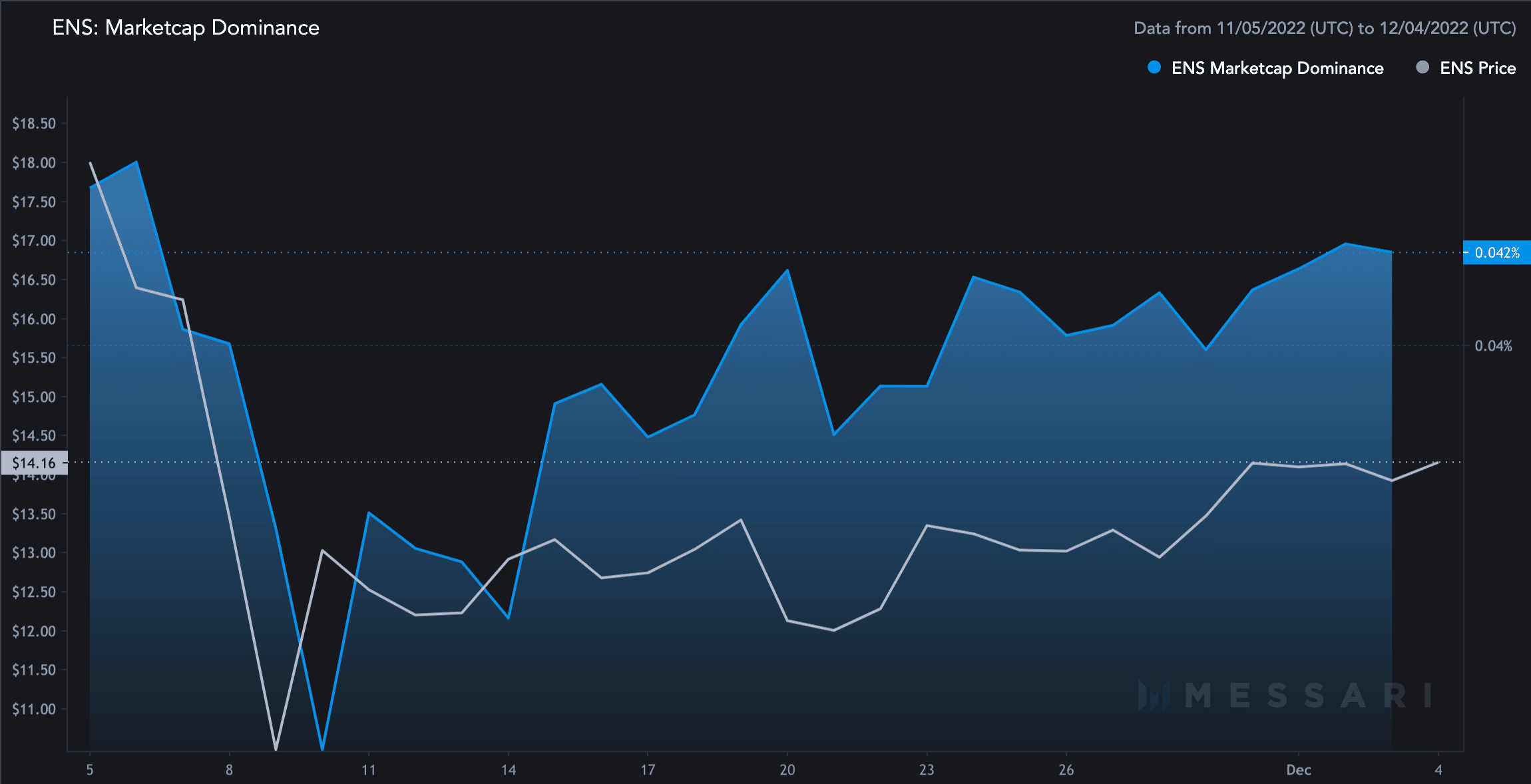

It appeared that, along with helping with price action, whales helped ENS soar in terms of market cap dominance as well, as it grew by 3.02%. At the time of writing, ENS captured 0.04% of the overall crypto market.

Source: Messari

However, investors looking to buy ENS should be cautious as the token’s volatility increased by 74% over the last 30 days. This implied that ENS had been more susceptible to massive price fluctuations in the past month.