- ETH receives a 30% discount as the market crashes

- Whales holding 32 ETH reach new ATH

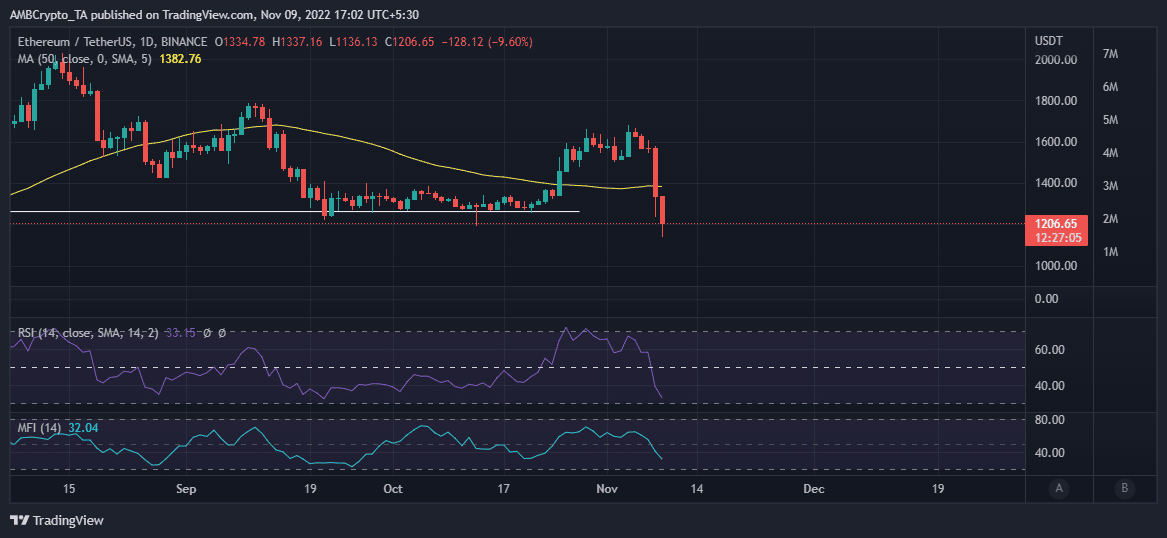

Ethereum [ETH] experienced a sizable discount this week as the latest FTX-related events wreak havoc on the market. ETH reverted to price levels below $1,200 and the last time it was within this range was in July.

Read Ethereum’s [ETH] price prediction 2023-2024

ETH, so far, dropped by as much as 30% this week courtesy of the ongoing market crash. Many traders were wondering whether this was a good time to buy back or to wait until the sell pressure witnessed a slowdown. But before traders make a decision, here are some recent observation that may help provide more clarity.

ETH Whales are buying at discounted prices

Glassnode researchers observed a continued increase in the number of addresses holding 32 ETH or more. Why is this important? Well, 32 ETH is the minimum requirement to run a validator node. Operating an Ethereum validator node can be quite lucrative. It thus, made sense why many aspiring validators were taking advantage by accumulating at lower prices.

#Ethereum $ETH Number of Addresses Holding 32+ Coins just reached a 1-month high of 120,554

View metric:https://t.co/rkRWanL3OS pic.twitter.com/6jSAHZ4g4c

— glassnode alerts (@glassnodealerts) November 9, 2022

Glassnode also reported a continued increase in the total value of ETH locked in ETH 2.0 deposit contracts. Furthermore, the same report revealed that ETH 2.0 deposit contracts reached a new all-time high at 14.8 million ETH.

Source: Glassnode

The total value staked in ETH 2.0 also increased despite the bearish market conditions. This was a sign that ETH holders were not just buying the dip but staking to take advantage of growth opportunities in the next bull run.

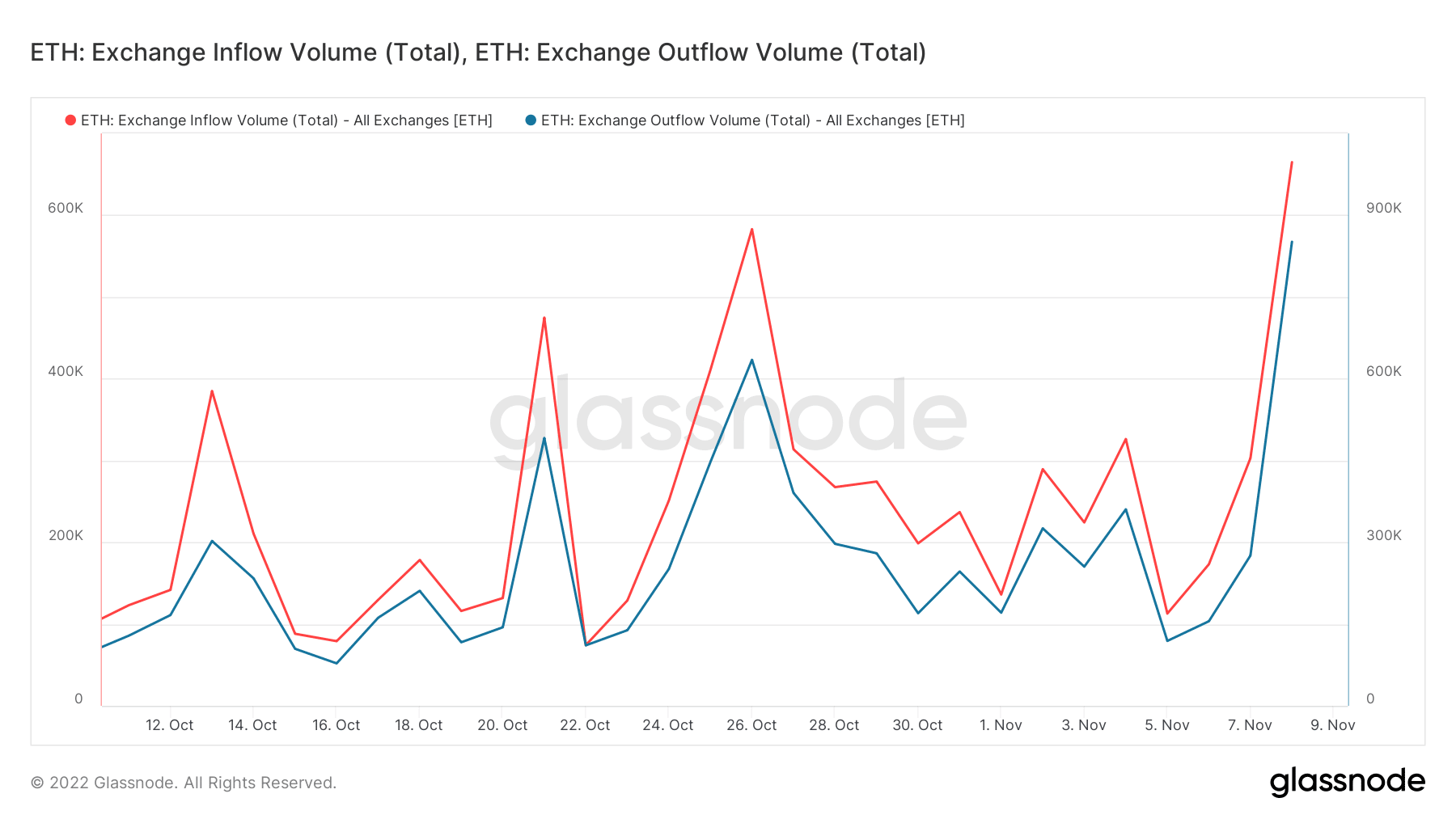

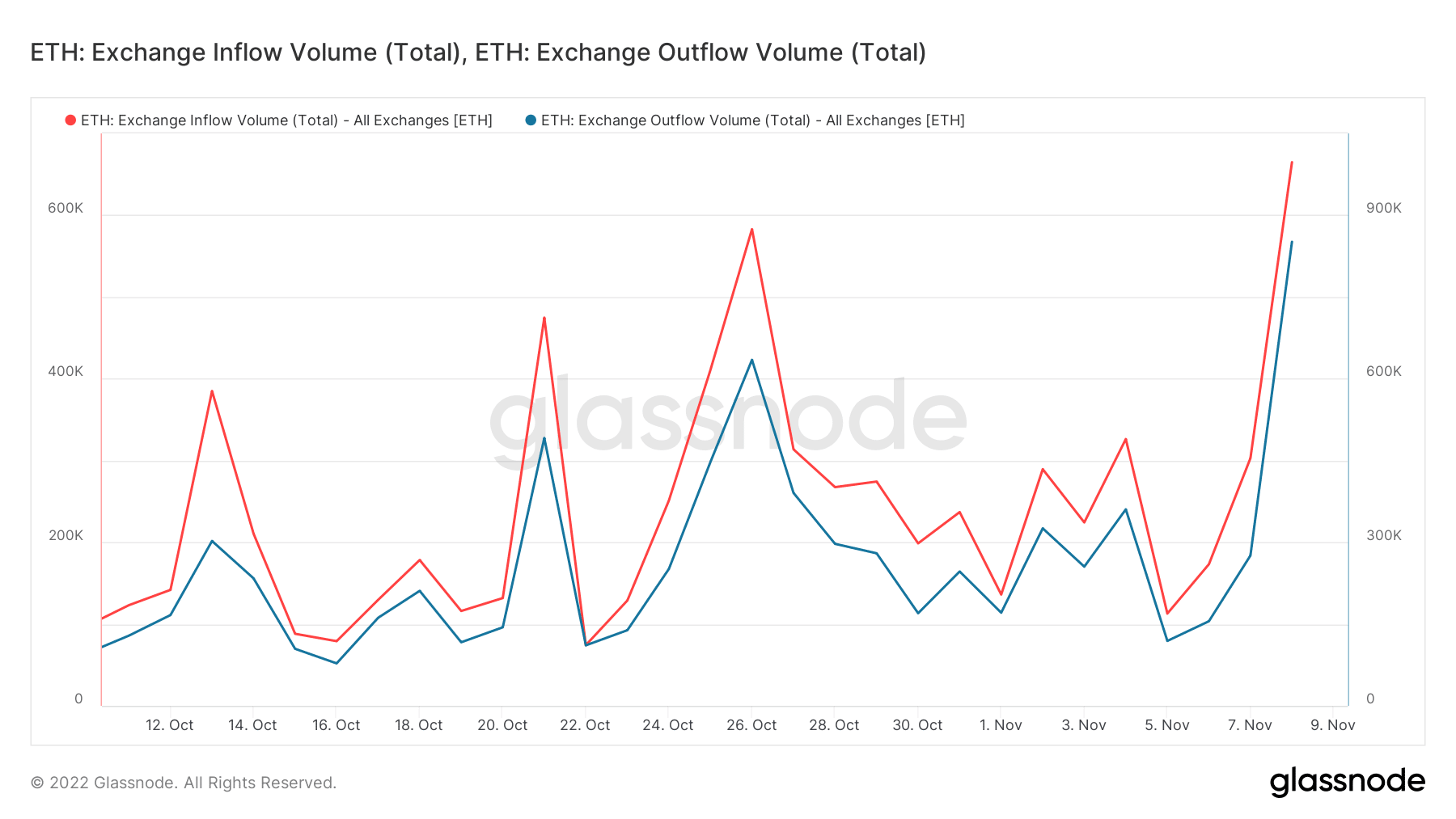

A look at ETH exchange flows also confirmed that there was healthy accumulation despite the downside. ETH exchange outflows outweighed exchange inflows at the time of writing.

Source: Glassnode

The exchange outflow metric registered 851,225 ETH while the exchange inflow metric registered 664,811 ETH at press time. Higher exchange outflows than inflows can be considered as a bullish sign. This accumulation can also be considered as a bit of a bullish recovery back above $1,200, after briefly dropping as low as 1,136.

Source: TradingView

More upside in the future?

ETH’s downside came shy of the oversold zone, but there was still a chance that it might drop into oversold territory if the selloff continued. That would happen if the current FUD maintains its level but so far the sell pressure seemed to be tapering out.

The observed return of bullish demand was also one of the key signs confirming accumulation. Traders should expect more bullish short-term recovery if the sell pressure dies down giving way to more upside.