Key Takeaways

- The amount of Ethereum needed to process transactions has dropped 94% since January.

- The low gas fees on Ethereum result from less demand for block space.

- Historical patterns indicate that when the median cost of using the Ethereum network reaches record lows, the price of Ethereum often increases.

Share this article

Gas fees on Ethereum have reached lows not seen in over nine months. While decreasing network activity is the main reason for the decline, the number of unique active users on Ethereum remains stable.

Ethereum Activity Decreases

The cost of using Ethereum is reaching record lows.

According to the data analytics site Nansen, gas fees hit a low of 10 gwei today. Average transaction costs have come in at 12 gwei over the last few days, which equates to roughly $0.67 for peer-to-peer ETH transfers. To put that figure into perspective, in January, average gas costs on Ethereum were as high as 218 gwei, revealing a 94% drop in the amount of Ethereum needed to process transactions.

The decline in gas fees on the network is due to decreasing demand for Ethereum block space. Because blocks only contain a finite amount of space for transactions, during periods of high congestion, users bid up the price they are willing to pay to have their transactions processed in the next block. However, when activity decreases, the network lowers the amount of gas needed to reflect demand.

The NFT marketplace OpenSea, which has consistently been one of the biggest gas users on the Ethereum network over recent months, has seen activity decline in recent weeks. According to data from token terminal, OpenSea handled $67.5 million worth of transactions on Mar. 13, a 70% decline from peak February levels.

OpenSea is not the only Ethereum application to see a decrease in activity. Uniswap, the most popular decentralized exchange on Ethereum, has seen a steady decline in transactions since last November. On Mar. 12, the exchange hit a new multi-month low in trading volume of $799 million. In comparison, the exchange handled a colossal $8.8 billion worth of transactions over a 24-hour period at its peak on Nov. 10.

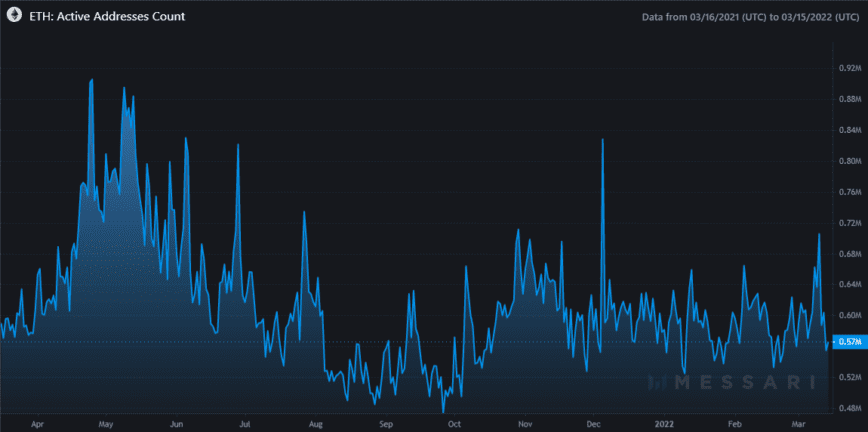

Despite the shrinking demand for Ethereum block space, the number of wallets actively using the network does not appear to be decreasing. According to data from Messari, the amount of unique active Ethereum addresses has stayed consistently above 500,000 and has not capitulated to the lows observed during the summer of 2021.

As the number of unique active users on Ethereum remains constant, it implies that users are still transacting on the network, only less frequently than before.

For many Ethereum power users, the low gas fees likely come as a blessing. As network transactions are now cheaper, traders are able to take advantage of smaller arbitrage opportunities, thus improving capital efficiency. The low gas fees will also be seen as a welcome relief for more casual users. The cost of buying and listing NFTs on platforms like OpenSea has also become significantly cheaper. Users who had pending airdrops or staking rewards to collect will be able to do so without eating into their profits as much as they would have done when fees were at record highs.

While gas fees are low, they won’t necessarily stay that way for long. Looking at historical patterns, whenever the median cost of using Ethereum reaches record lows, it often jumps back up due to the price of Ethereum increasing. Whether a similar event will play out soon remains to be seen.

Disclosure: At the time of writing this piece, the author owned ETH and several other cryptocurrencies.