- Ethereum’s validators continue to grow on the network as they adopt MEV boost at a massive scale.

- Trader addresses holding long positions on Ethereum decline.

According to data provided by Delphi Digital, most validators on the Ethereum network adopted the MEV (Miner Extractable Value) boost, after the merge. This MEV boost allows validators to earn more profits while reducing the risk of centralization on the Ethereum network.

Read Ethereum’s Price Prediction 2023-2024

A MEVy Christmas

From Delphi Digital’s data, it was gathered that 90% of the validators on the Ethereum network had adopted MEV boost. The MEV boost could be one of the reasons why validators continue to move toward the Ethereum network despite declining revenues.

90% of Ethereum validators are now running MEV-boost following the merge. pic.twitter.com/XDVBFLXDXH

— Delphi Research (@Delphi_Digital) December 23, 2022

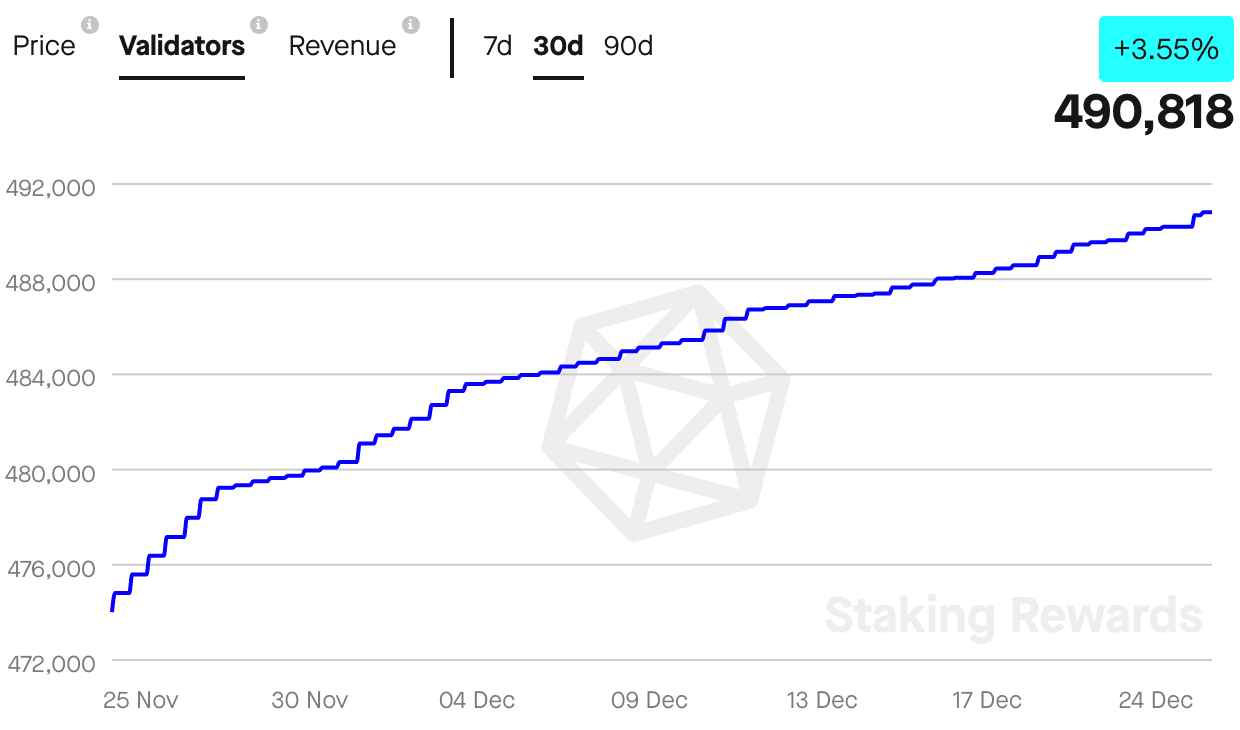

According to data provided by Staking Rewards, the number of validators on the Ethereum network increased by 3.55% over the last 30 days. At the time of writing, the number of validators on the Ethereum network was 490.818.

However, despite the growing number of validators, the revenue collected by them had declined significantly. Over the last month, the revenue collected by the validators had fallen by 20.39%.

Source: Staking Rewards

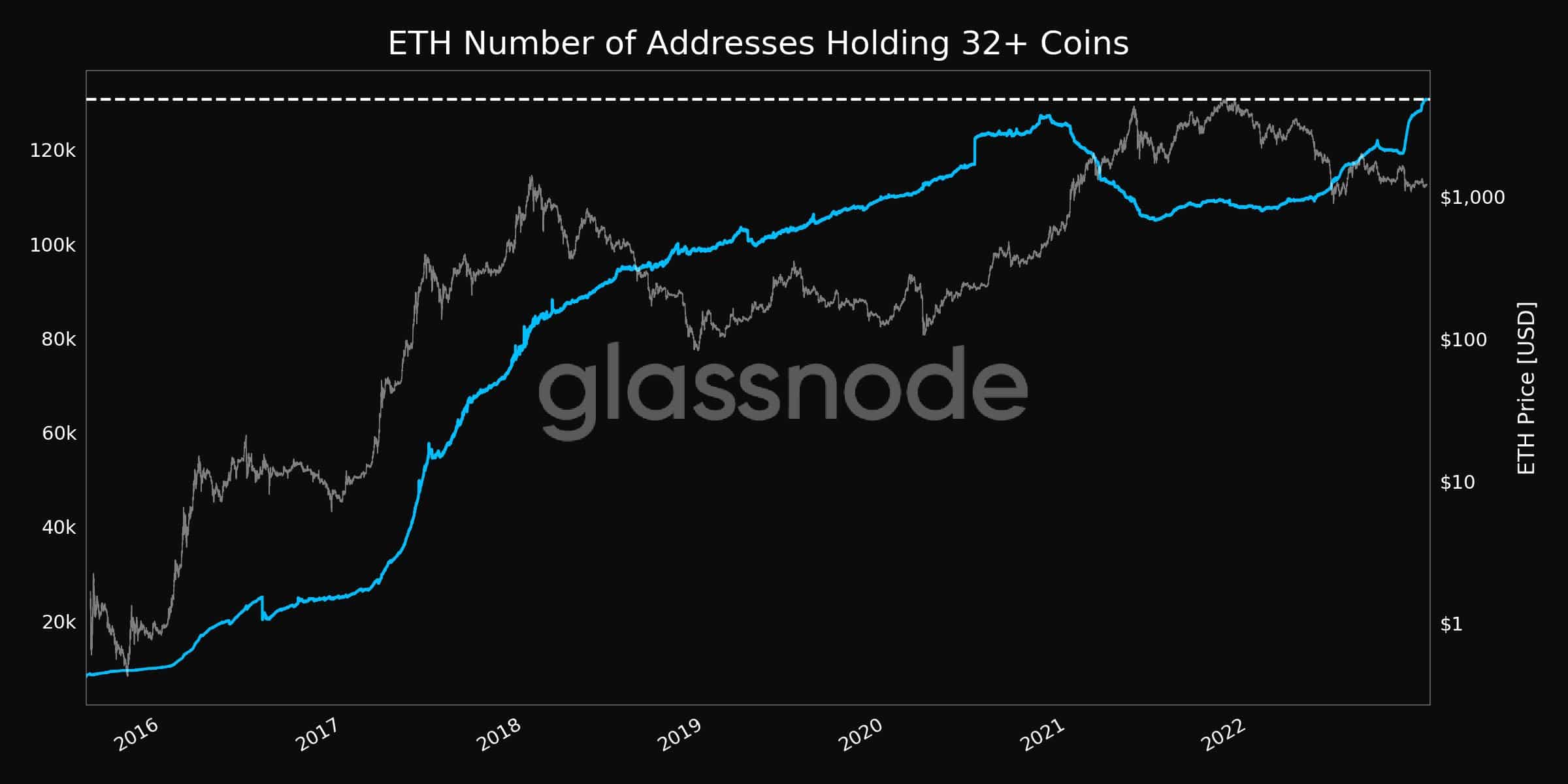

It wasn’t just validators that showed faith in Ethereum in spite of turbulent circumstances. According to data provided by glassnode, large addresses that were holding more than 32 coins of Ethereum, had kept growing.

At press time, the number of addresses holding more than 32 coins had reached an all-time high of 130,679 addresses.

Source: glassnode

Traders turn skeptical

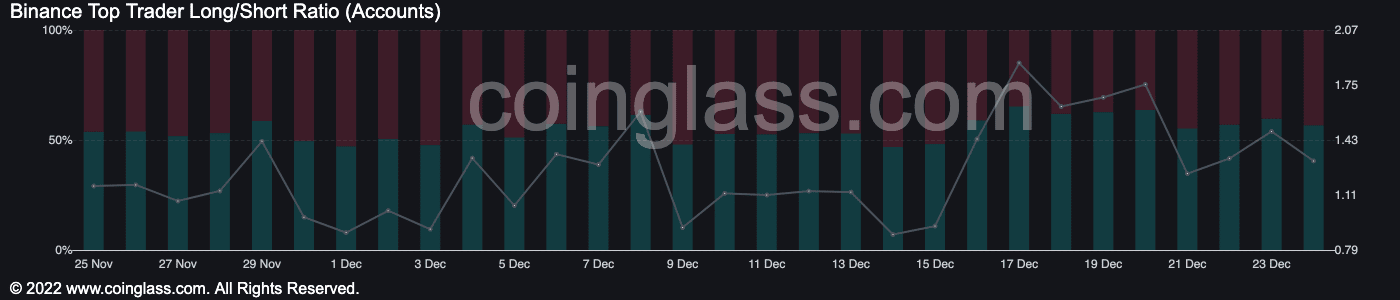

Even though large addresses were showing interest in Ethereum, retail traders’ interest had started to dwindle. Moreover, over the last few days, the percentage of long positions held by top traders had reduced from 65.25% to 56.67% according to coinglass’ data.

Source: coinglass

One of the reasons for the same could be the declining activity on Ethereum’s network.

Are your ETH holdings flashing green? Check the profit calculator

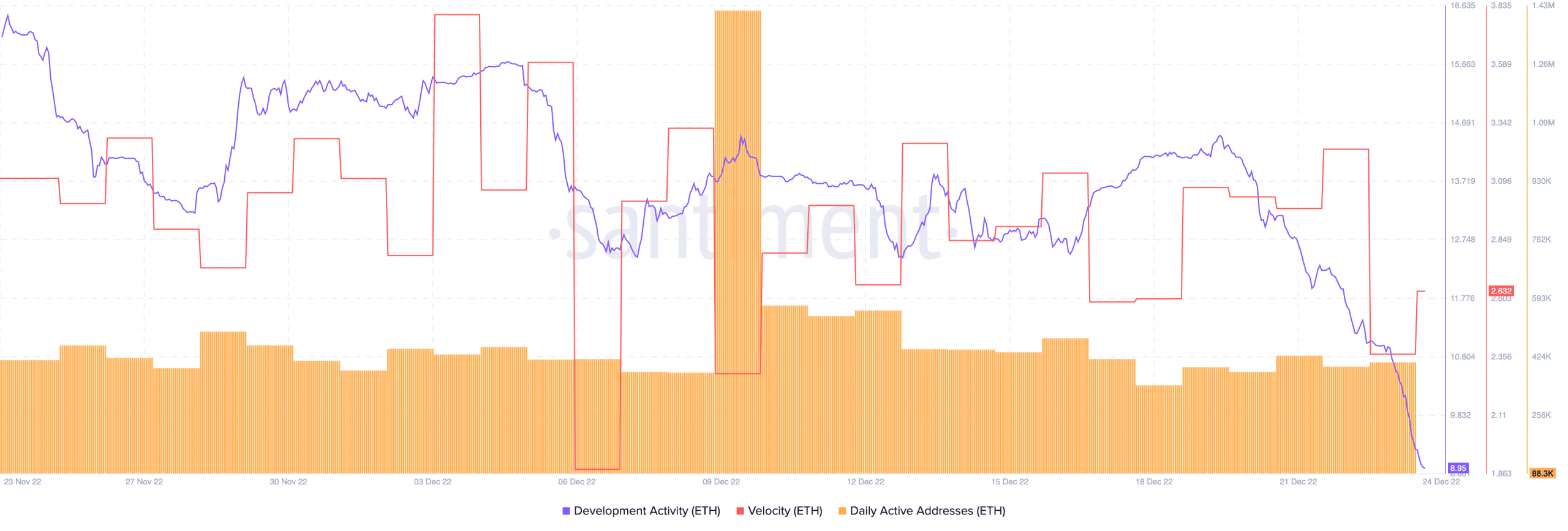

According to data provided by Santiment, the daily active addresses on Ethereum’s network had fallen from 1.42 million to 408.8k in the past two weeks.

Besides, Ethereum’s velocity decreased materially over the past month. This indicated that the frequency with which Ethereum was being exchanged amongst addresses had reduced.

Another reason for the skepticism from traders could be Ethereum’s declining development activity. A decreasing development activity indicated that the number of contributions being made to Ethereum’s GitHub by the Ethereum developers had reduced.

Source: Santiment

At press time, Ethereum was being traded at $1,215.61 and its price had depreciated by 0.4% in the last 24 hours.