A closely followed crypto strategist and trader says Bitcoin’s recent correction below $40,000 has set the stage for BTC to rally to $50,000 in the coming weeks.

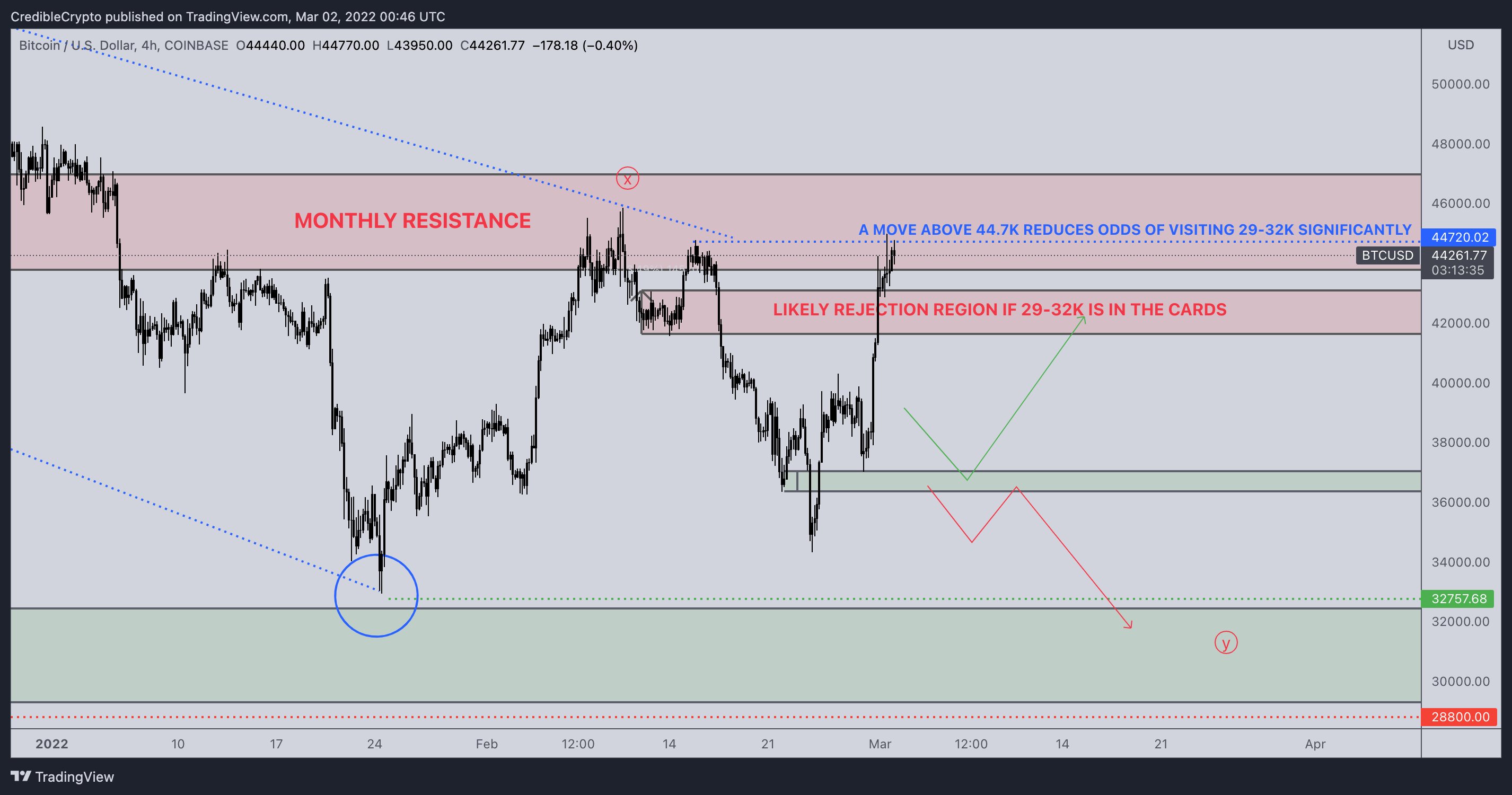

Pseudonymous analyst Credible tells his 312,900 Twitter followers that Bitcoin’s rejection at $45,069 on March 2nd indicates that BTC is now trading inside a triangle pattern while carving a bottom.

“The depth of this retracement means our B wave is likely complete already if this is a triangle structure – now a standard triangle (like we had at $10,000) rather than running. Daily demand in BLUE at $38,000 is still the key to hold for this idea to remain valid.”

According to Credible, his bullish thesis is based on BTC’s market structure when it traded below $10,000 from September to October 2020. The crypto strategist says that the triangle pattern that formed during that time preceded Bitcoin’s massive rally from $10,000 to $60,000.

“The last segment of our corrective structure that preceded the third impulse wave from $10,000 to $60,000+ was a triangle. [It] would be nice to see something similar here if our bottom is in. Remember a longer base typically leads to a stronger impulse. Pullbacks on BTC to $38,000 – $42,000 are healthy.”

While Credible expects Bitcoin to continue consolidating in the coming days, he highlights that BTC’s recent move above $44,700 has significantly reduced the odds that the king crypto will breach support at $30,000.

“A very strong close here on BTC. This indicates chances we see $29,000 – $32,000 are a lot less likely. Now we just need to seal the deal with a monthly close above $46,800 to put the nail in the coffin for beras.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Dotted Yeti/Chuenmanuse