A popular crypto strategist is looking at one key metric to determine whether or not Bitcoin (BTC) has finally reached the bottom during the current extended bear market.

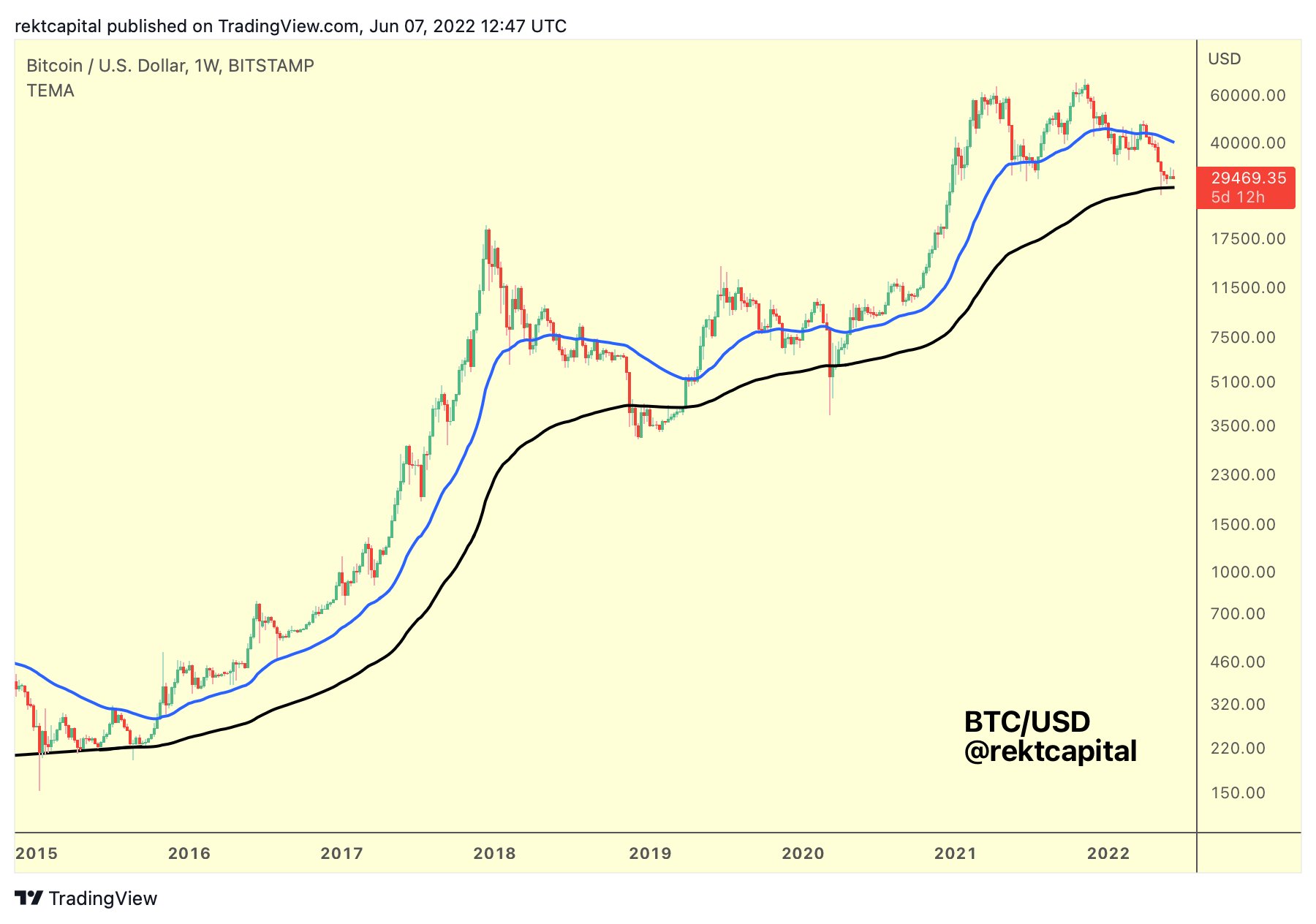

The pseudonymous trader Rekt Capital offers his 312,800 Twitter followers a lengthy thread about how Bitcoin’s price is affected by its exponential moving average (EMA), a calculation where the most recent data points have greater weight and significance.

“BTC tends to confirm uptrends when it breaks above the blue 50-week EMA.

BTC tends to confirm maximum financial opportunity when it reaches and breaks down from the black 200-week EMA.

Is the BTC bottom in already or is there more downside to come?”

The chart guru references several past price moves of significance in 2015, 2018 and 2020 before explaining that BTC likely has not reached a cycle bottom because its price remains 66% off from the 50-week EMA (WEMA).

“Key takeaway is that the first BTC bottom tends to form at least ~100% away from the blue 50-week EMA.

And the second BTC bottom tends to form ~50-70% away from the 50 WEMA.

If this continues to be true then BTC hasn’t yet bottomed in this cycle… because the current local BTC bottom is 66% away from the blue 50-week EMA.

Typically the first BTC bottom is ~100% away and the second bottom 50-70% away from the 50 WEMA. This current situation resembles ‘second bottom behavior more than ‘first bottom’ price action.”

Rekt Capital concludes his analysis by targeting approximately $20,000 as the level investors should expect Bitcoin to fall to before having touched a cycle bottom.

“Should BTC once again repeat a 100% separation from the blue 50-week EMA…

Then that could suggest a BTC bottom close to the ~$20,000 area.

This would satisfy the general tendency of previous BTC all-time highs not being revisited during corrective periods.”

At time of writing, Bitcoin continues to witness choppy price action around the $30,000 level.

BTC is currently down 3.07% over the past 24 hours and trading for $30,252.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/designcreativex/Chuenmanuse