We’re excited to announce Topper as the latest addition to our fiat-to-crypto on-ramp partners! Developed by the trusted Web3 financial platform Uphold, Topper revolutionizes the payment process by accepting various currencies and offering superior approval rates, which, in turn, boosts revenue potential.

This comprehensive guide will walk you through each step of buying cryptocurrency using Topper. We’ll cover the essentials of successful verification and provide tips for navigating common issues. Ready to get started? Follow along!

Step 1 – Set Up Your Transaction

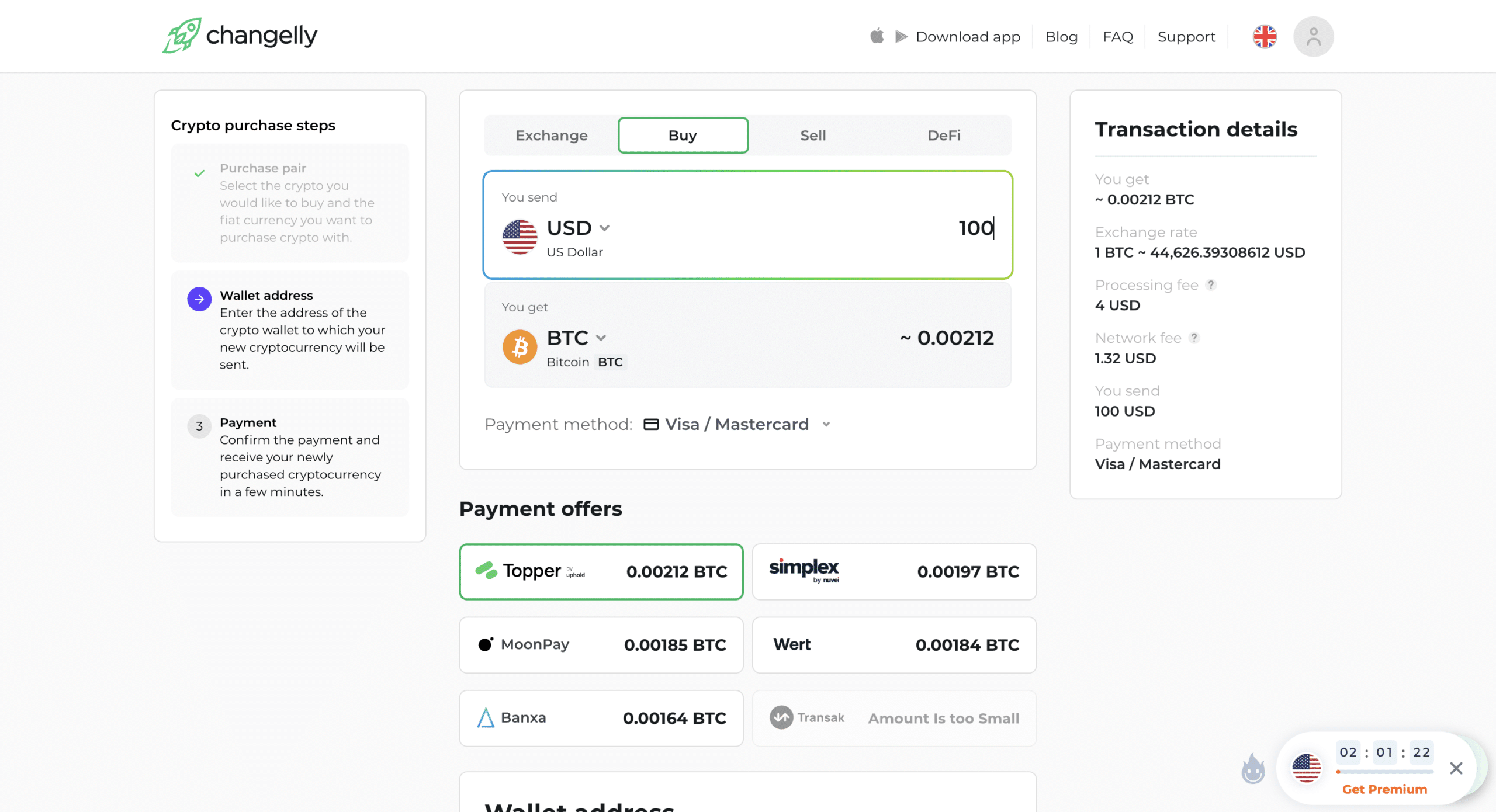

Start your crypto purchase journey by heading to the Changelly Buy page (https://changelly.com/buy-crypto). Here, you can select the cryptocurrency you wish to buy and the fiat currency you plan to use for payment.

Afterward, enter the fiat amount you want to spend on the cryptocurrency and click the green ‘Buy now’ button.

The next step involves choosing your payment method. Depending on the fiat currency you’ve selected, you’ll see a variety of available payment options.

Topper exclusively supports Visa, MasterCard, Apple Pay, and Google Pay as payment methods. Please note that PayPal and other payment methods are not supported by Topper.

Below this section, you’ll find information about our partners who can facilitate the purchase. For each partner, including Topper, we indicate how much cryptocurrency you’ll receive for a specified fiat amount.

To proceed with Topper, simply select it from the list of partners. Rate and commission calculations will be displayed on the right side of your screen.

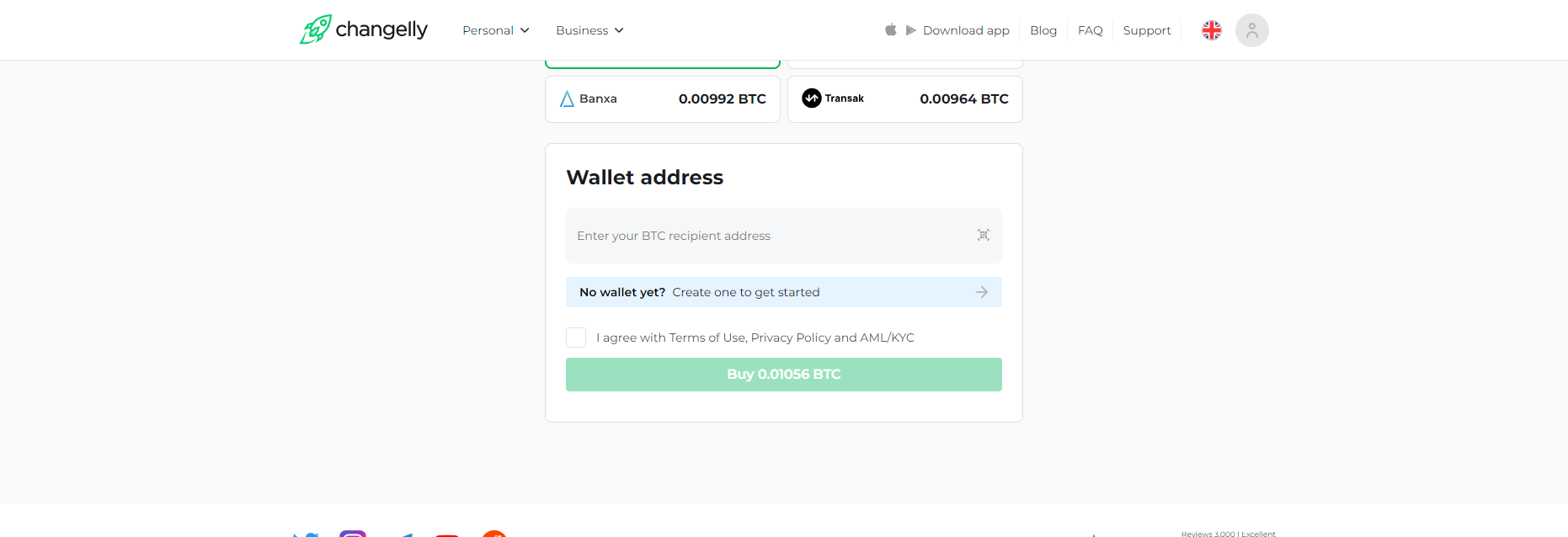

After selecting Topper, scroll down to enter the address of your crypto wallet in the designated field. This is the wallet you intend to fund with your purchase. Please remember that you should only use your personal wallet address. Be aware that if funds are sent to an incorrect or unauthorized address, a refund will not be issued.

Verify that all details are correct, check the box to agree to the Terms of Use, and then confidently click the green Buy button to finalize your purchase.

Step 2 – Be Redirected to Topper

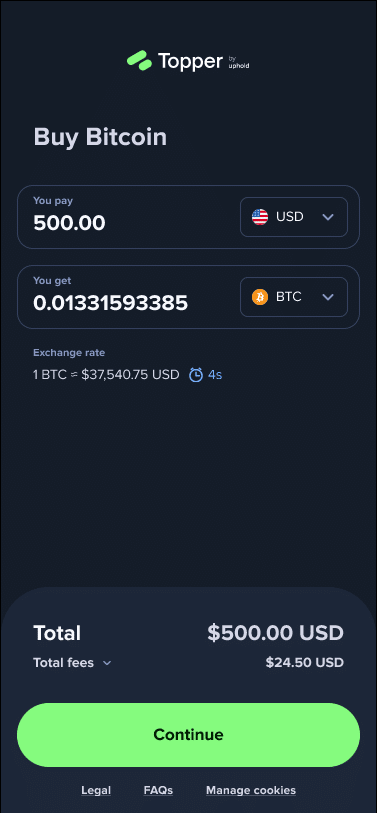

Once you proceed, you’ll be redirected to the Topper purchase window displaying how much cryptocurrency you’re to receive. Take a moment to review the exchange rate just below these calculations.

Review commission details at the bottom of the page. Here, you’ll find information on the total fees, which consist of network fees (calculated based on network utilization) and transaction fees, including a 3.9% charge for payment processing.

If you agree to the conditions, simply click Continue to proceed.

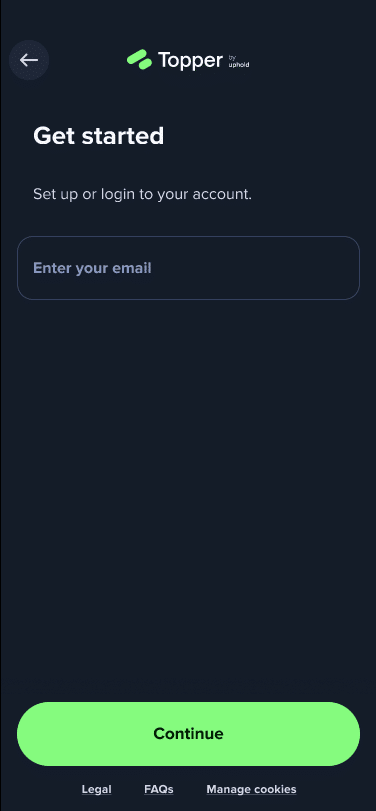

Step 3 – Sign Up for a Topper Account

At this stage, you’ll either need to log in to your existing Topper account or create a new one.

If you’re a new user, start by entering your email address.

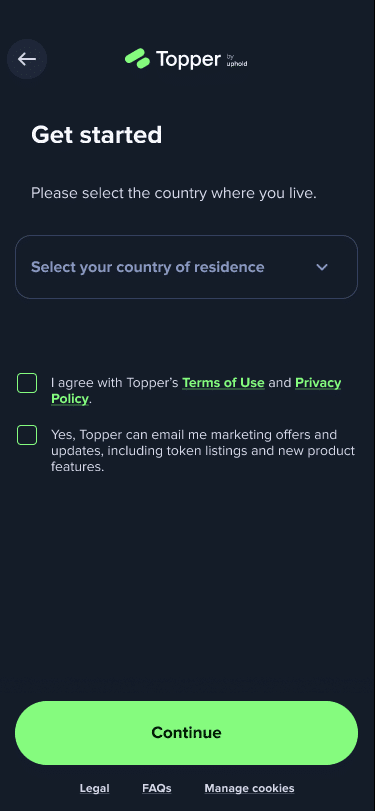

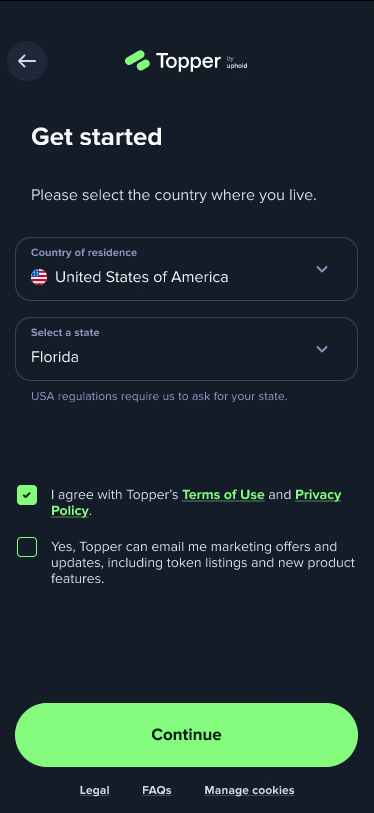

Then, select your country of residence. Please note that users who reside in the US must also specify their state.

Carefully read Topper’s Terms of Use and Privacy Policy. Check the box to confirm your understanding and agreement, and then you can safely click Continue.

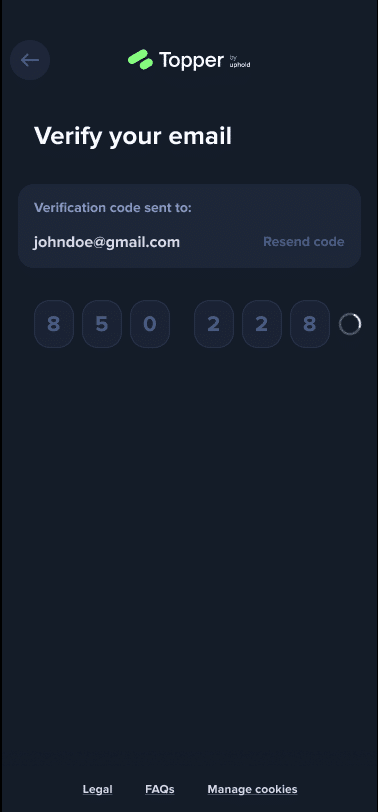

The final step in the registration process involves email verification.

Check your email for a code sent by Topper, and enter this code to verify your email address. This step is crucial for the security of your account and proceeding with your crypto purchase.

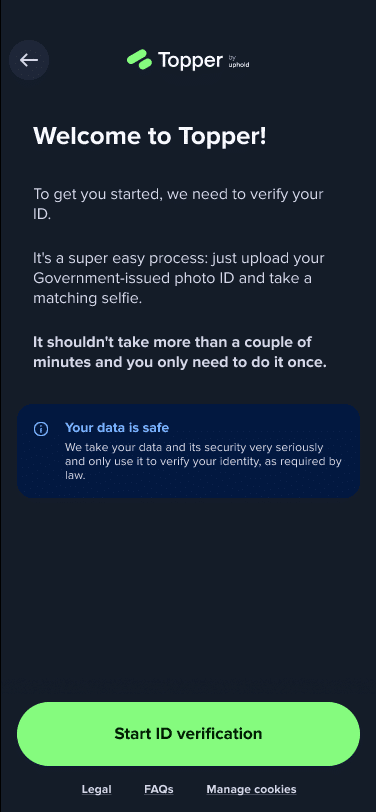

Step 4 – ID Verification

Next up is the ID Verification step. This is more than just a procedural task; it’s a legal obligation for crypto exchanges to deter money laundering and other illegal activities. By confirming the identities of our users, we’re able to bolster security and minimize the risk of fraudulent transactions.

Don’t worry, this quick and easy process takes just a little of your time and is essential for keeping our platform secure and trustworthy.

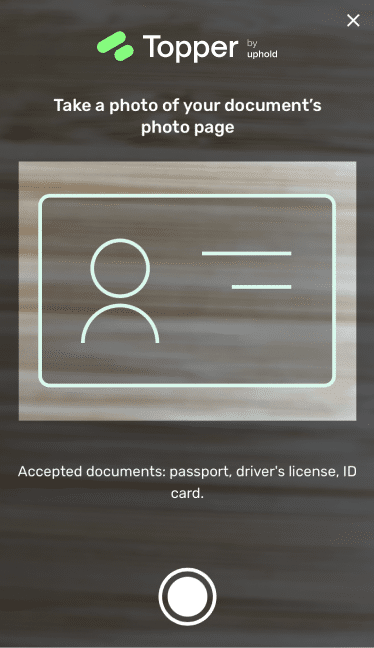

You’ll need to have a government-issued ID at hand for this step. This could be your passport, driver’s license, or ID card. The key here is to ensure the document you choose is valid and clearly identifies you.

Please keep in mind that you need to be of legal age to buy cryptocurrency from Topper and access our exchange platform.

When you take a picture, make sure that all corners of the document are within the frame. The information in the document must be clearly readable—good lighting is really important for this step. Please follow these guidelines to avoid delays in the verification process.

Tips for Smooth Verification

- Take a clear picture of your photo ID, ensuring all details are legible.

- Your photo ID should be valid for at least another three months.

- Position the document so that all its corners are within the frame.

- If you encounter camera issues on the desktop, switch to the mobile app.

- Refresh the page to restart if you make a mistake; do not proceed with known errors.

- Live photos only; no scans or saved image files are allowed.

- Ensure the light source is in front of you for a clear selfie.

Remember, avoiding common mistakes can significantly speed up the verification process.

Submit a photo of your ID for verification. Please wait a few seconds and don’t close the window, as the verification is in progress.

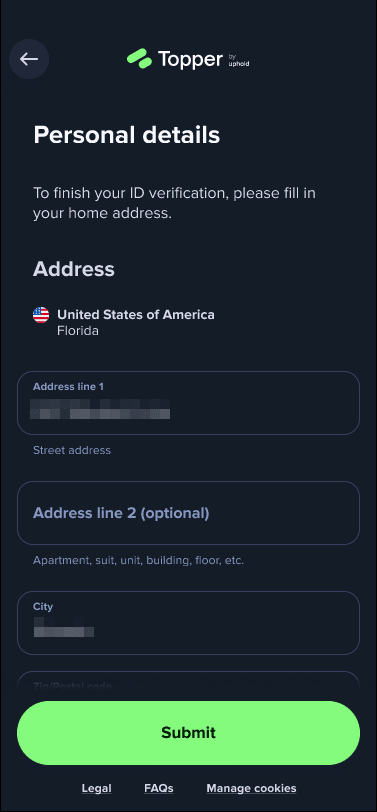

Next, you’ll need to enter your residential address. Carefully fill in the required fields and double-check the accuracy of the information. Once you’ve confirmed that all details are correct, click Submit to proceed.

Step 5 – Provide Your Crypto Wallet Address and Payment Method Details

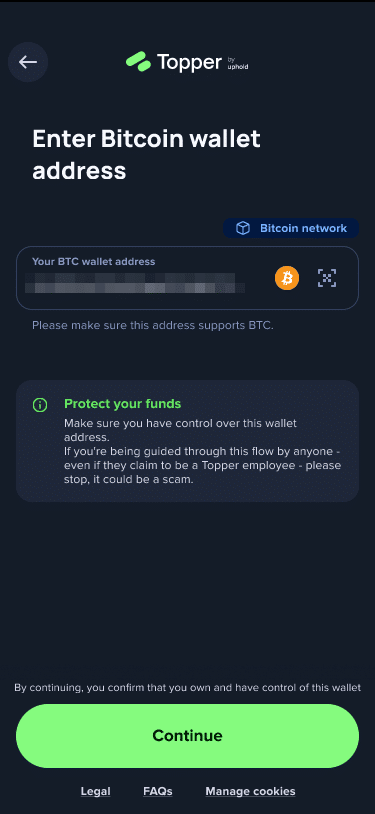

Next, enter your crypto wallet address carefully.

Cryptocurrency transactions are final and irreversible due to the decentralized nature of blockchain technology. Once a transaction is recorded on the blockchain, it becomes a permanent part of the ledger, immune to alteration or cancellation. That’s why ensuring the accuracy of your wallet address is a must: any mistake could result in the permanent loss of funds to an incorrect or non-existent address.

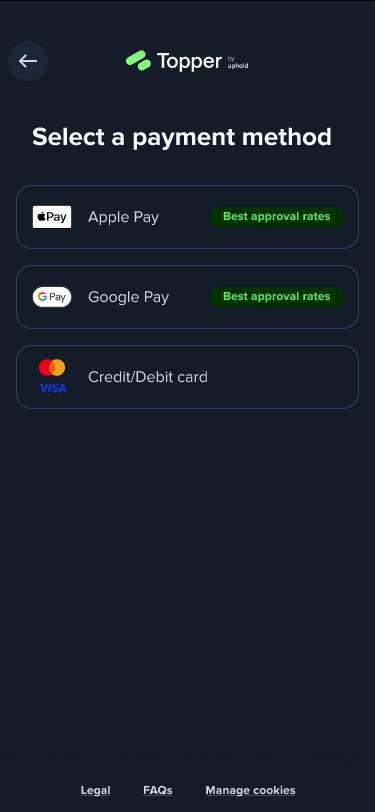

For your next step, choose your payment method from the options Topper supports: Apple Pay, Google Pay, Visa, and MasterCard debit/credit cards. In this guide, we’ll demonstrate the process using a bank card as an example.

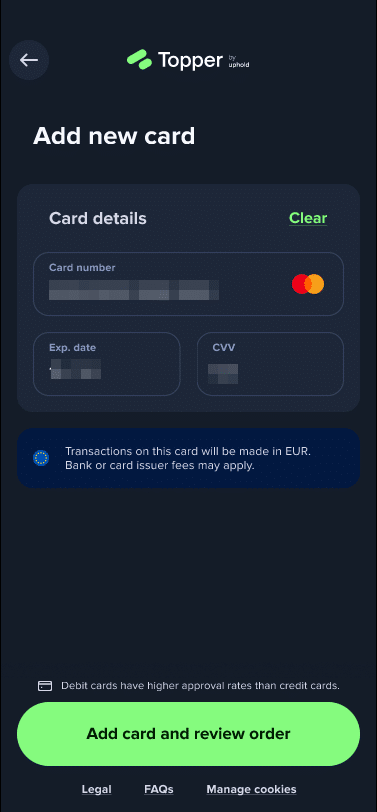

If you’re also using this method, input your card number, expiry date, and CVV. Topper accepts many major fiat currencies, such as USD, EUR, and GBP. Click ‘Add card and review order.’

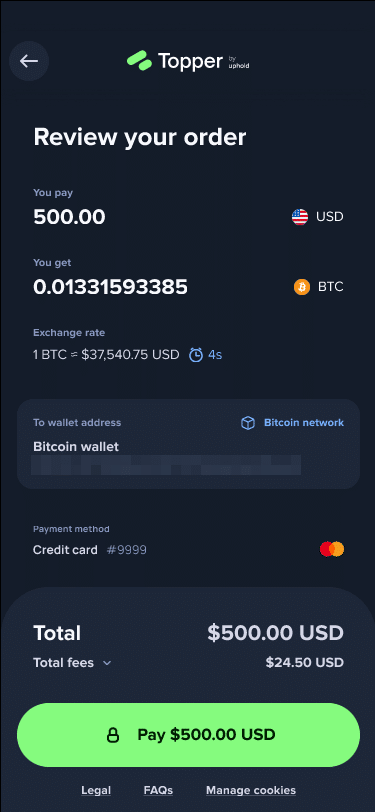

At this stage, a summary of your transaction will be displayed. Check the amount, wallet address, and payment method carefully. If all looks good, click the Pay button at the bottom of the screen.

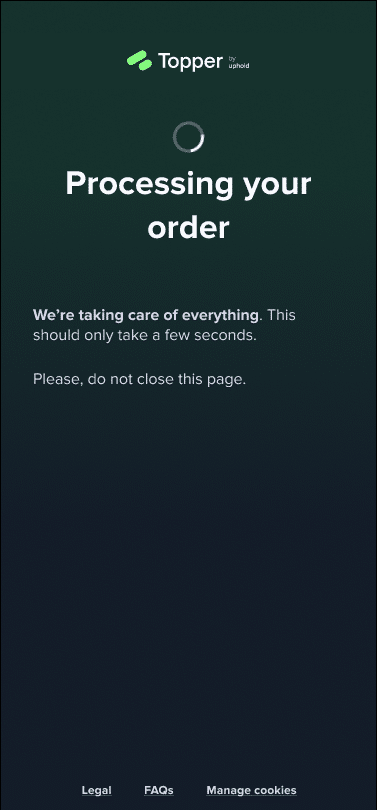

Next, processing will begin. Do not close this window while your order is being processed.

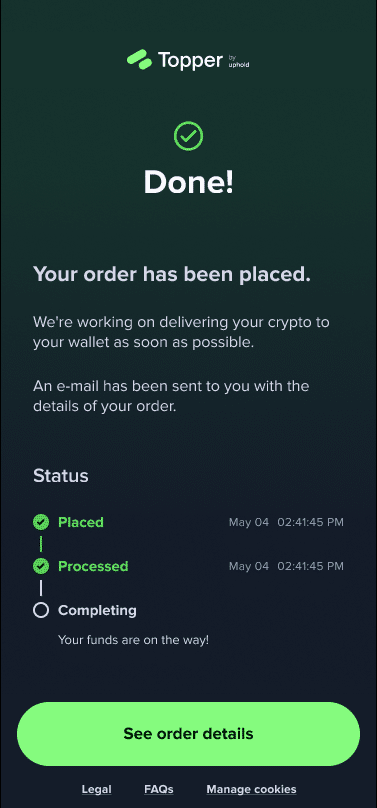

After processing, the funds will be sent to your address. The order status will be updated to reflect this, as shown in the screenshot below.

You can click ‘See order details’ for further information. Additionally, an email with the transaction details will be sent to you.

And that’s it! Now, simply wait for the cryptocurrency to be credited to your wallet.

Processing of fiat-to-crypto transactions typically takes longer than crypto-to-crypto transactions. While it is mostly completed within one hour, the timeframe may vary depending on network traffic. Please allow up to an hour for processing, and don’t worry about checking transaction status during that time.

FAQ on Using Topper

This section aims to address common queries about using Topper. If your question remains unanswered or you encounter an issue, please feel free to reach out to Topper’s support team here.

What are Topper’s purchase limits?

The minimum purchase amount on Topper is 10 USD/EUR/GBP. For transactions in other fiat currencies, the minimum limit is equivalent to these amounts at the current exchange rate.

Topper’s daily purchase limit is $2,500, resetting at midnight (00:00). Be mindful of this limit when making purchases. For additional information regarding limits, please contact Topper’s support team.

Should your transaction exceed this set limit, you will be prompted to increase your limit, which necessitates further verification. To do this, please contact Topper’s help center by submitting a ticket here.

Why did my transaction fail?

Transactions may fail due to various reasons, such as insufficient funds, incorrect card details, or network issues. Here are some common error messages and their meanings:

- Insufficient Funds: If you see ‘Unfortunately, we couldn’t complete the transaction due to insufficient funds,’ this means your account lacks the necessary funds to cover the transaction. Please check and ensure adequate balance before retrying.

- Unsupported Card or Bank Decline: The message ‘The transaction was declined by your bank’ indicates a bank rejection. This could be due to insufficient balance, suspicious activity, or account restrictions. If you see ‘Sorry, your card isn’t supported,’ it means our payment processor does not accept your card. Try using an alternative payment method.

- Expired Card: An expired card will trigger the message, ‘This card has expired.’ Ensure your card is valid for transactions.

- Transaction Declined: The general decline message, ‘Your transaction was declined. For help, contact our Support Team,’ suggests an issue requiring support intervention. You can submit a ticket on Topper’s website for assistance—click the link at the beginning of this section.

It’s important to note that if a transaction is declined, the funds are not withdrawn from your account. Instead, they will remain ‘frozen’ and will be released according to the internal regulations of your bank.

- Request Timed Out or Service Unavailability: If you encounter ‘Sorry, we couldn’t complete the transaction,’ it might be due to a network delay or server overload. Sometimes, Topper’s service may undergo maintenance or face technical issues, causing transaction failures. In such cases, please try to make the transaction again later, or for additional help, reach out to Topper’s support team.

Where is Topper available?

Topper offers services in over 180 countries. If you do not find Topper listed during the provider selection step, it means that their services are not yet available in your country. For the latest updates and information, please visit Topper’s website.

Uphold is regulated in the U.S. by FinCen and state regulators, in the U.K. by the FCA, and in Europe by The Bank of Lithuania.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.