A new study finds that many Wall Street investors believe Bitcoin (BTC) hasn’t bottomed out and will fall to nearly half its current value.

A new Bloomberg MLIV Pulse survey says it asked 950 Wall Street investors whether they expected Bitcoin to first recapture the $30,000 level or fall to $10,000, with 60% saying they agreed with the bearish scenario.

The poll ran from July 5th to 8th, during which time Bitcoin ranged from a low of $19,420 up to as high as $22,109. At Bitcoin’s current price of $19,883, the leading crypto asset by market cap would have to drop by 49.7% to be priced at $10,000.

Conversely, Bitcoin would need to rally by 50.88% to reach $30,000.

Regarding the overall bearish sentiment, Bloomberg says,

“The crypto industry has been rocked by troubled lenders, collapsed currencies, and an end to the easy money policies of the pandemic that fueled a speculative frenzy in financial markets.”

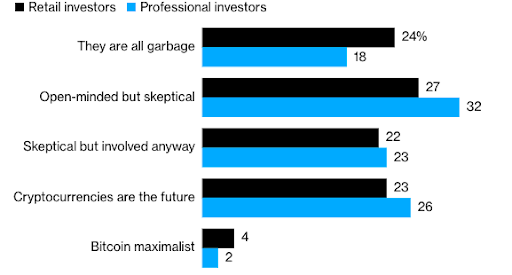

The survey group was also questioned about other aspects of the crypto space, with retail investors taking a more skeptical view compared to their industry counterparts.

Among professionals, 26% believe cryptocurrencies are the future compared to 23% on the retail side, and 24% of retail respondents think digital assets are “all garbage” versus just 18% of the pros having such a bleak opinion.

Despite the staggering tumble the crypto markets have endured since achieving all-time highs last November, Bloomberg notes that those surveyed still believe Bitcoin or Ethereum (ETH) could survive in the long term.

“A majority of respondents anticipate that one of those two will remain a driving force in five years even while a significant share sees central bank digital currencies taking on a key role.”

While non-fungible tokens (NFTs) surged into the mainstream in 2021, only 9% of the investors believe this niche area of crypto is a viable investment opportunity.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/3Dsculptor/David Sandron