- Top Ethereum whales held more MANA than any other token

- MANA’s price action showed that it was demanding a bearish exit

According to a tweet posted by WhaleStats in the wee hours of 4 December, the top 500 Ethereum [ETH] whales preferred to hold Decentraland [MANA]. The database noted that these whales held about $1.05 million worth of MANA. This made the virtual reality platform token a favored one over Enjin Coin [ENJ].

The top 500 #ETH whales are hodling

$1,057,661 $MANA

$370,000 $ANT

$137,135 $ENJ

$103,813 $UTK

$51,747 $CVC

$35,084 $TKN

$34,245 $DAWN

$30,843 $SNTWhale leaderboard

https://t.co/tgYTpOm5ws pic.twitter.com/hEtF0QqqLp

— WhaleStats (tracking crypto whales) (@WhaleStats) December 4, 2022

Read Decentraland’s [MANA] Price Prediction 2023-2024

Although the holdings looked impressive, MANA eroded against the US Dollar (USD). At press time, the token was trading at $0.408, according to CoinMarketCap; a modest 1.50% decline in the last 24 hours. A scrutiny of its volume showed that MANA’s transactions fell 31.72%, leaving the 24-hour volume less than $50 million.

Ask for “MANA” and get what in return?

On the daily chart, MANA was struggling to exit its weakened position. As of this writing, altcoin’s Relative Strength Index (RSI) was 40.63. This zone signaled that MANA had not solidified its buying momentum.

However, since it had overcome dangling around the oversold region of the last week of November, the current position could mean solace was close. Nevertheless, there was still no justification indicating towards bullish momentum.

Furthermore, the Money Flow Index (MFI) showed that the Decentraland’s ecosystem was filled with active investors. At press time, the MFI surged to 61.30. At this rate, it signified that a good amount of liquidity had flowed into the MANA ecosystem. This had been the case since 23 November.

![Decentraland [MANA] price action](https://ambcrypto.com/wp-content/uploads/2022/12/MANAUSD_2022-12-04_12-02-40.png)

Source: TradingView

However, the potential upliftment from the RSI and MFI did not spread across every MANA section. As for the Directional Movement Index (DMI), it was time to lay powers to sellers. This was because the sellers’ strength (red), at 25.75, indicated strong control over buyers (green) at 16.28.

In addition, the Average Directional Index (ADX) supported a bearish movement in the short term. This was due to the ADX breaking above the solid value of 25, and remaining at 37.20. In a case where the ADX value was less than 25, then MANA could have a chance of changing the price channel.

Network and addresses fall in the camp

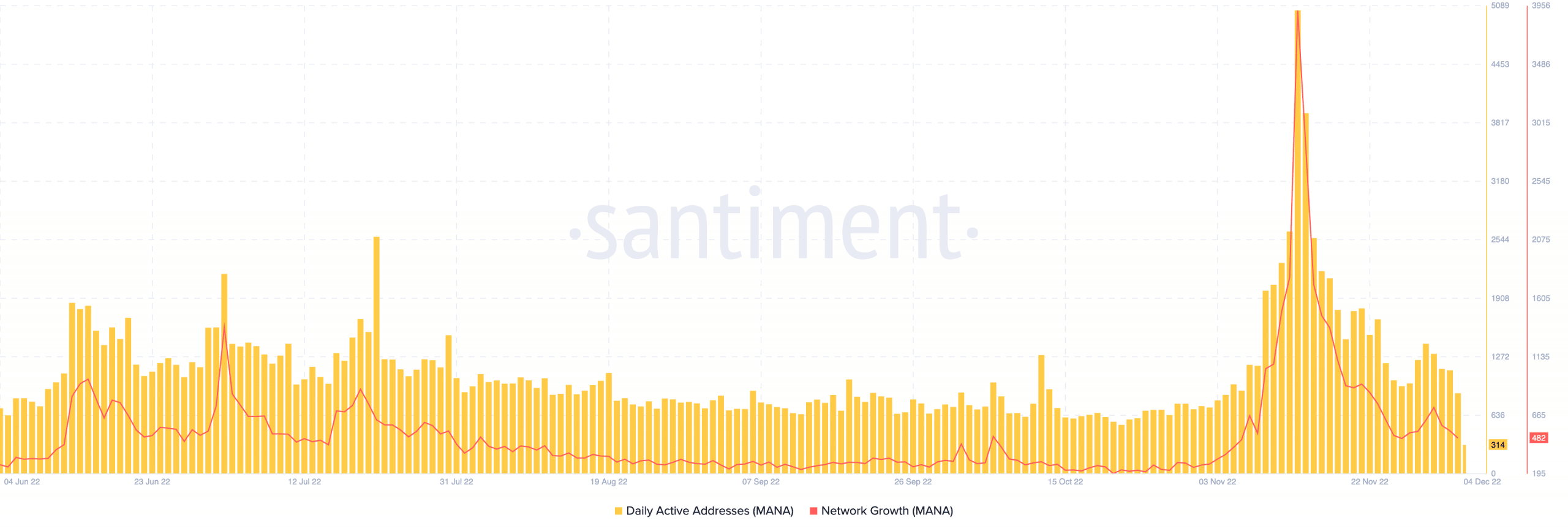

Per its on-chain condition, Decentraland could not revive in some areas. According to Santiment, the network growth which increased tremendously in mid-November had plunged. Its value at 482 meant that new addresses were not cheery in taking part in MANA transactions.

Furthermore, active addresses, which spiked around the same period, followed a downtrend. As with its network growth, deposits have not been impressive.

Source: Santiment