New data from a crypto insights firm reveals that non-fungible token (NFT) collectors have already poured a staggering $37 billion into NFT marketplaces in the first four months of 2022.

According to a new blog post by Chainalysis, collectors are on pace to comfortably eclipse the $40 billion that went into NFT marketplaces last year.

However, the market analytics firm notes that the growth of NFT transaction volume over the last 12 months has been sporadic.

“NFT transaction growth has come in fits and starts, with activity largely remaining flat except for two big spikes: One in late August, which was likely driven by the release of the Mutant Ape Yacht Club collection, and one stretching from late January to early February of 2022, which was likely driven by the launch of the LooksRare NFT marketplace.

After that spike though, NFT transaction activity declined significantly beginning in mid-February, dropping from $3.9 billion the week of February 13 to $964 million the week of March 13 — the lowest weekly level since the week of August 1, 2021.”

Chainalysis highlights that NFT transaction transaction volume started to pick up steam last month likely due to the release of Bored Ape Yacht Club’s metaverse project.

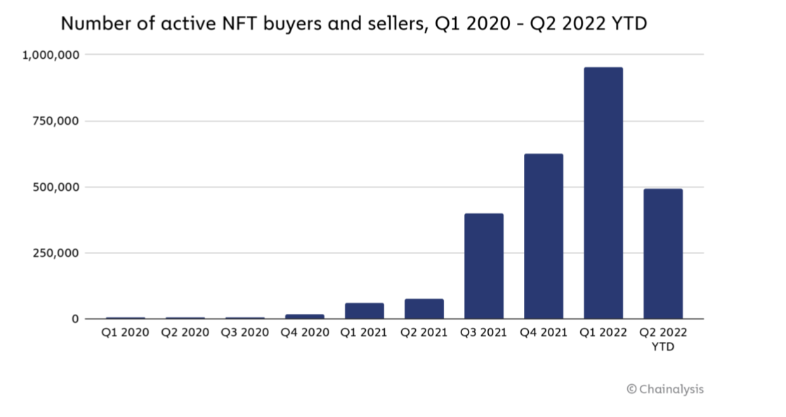

Despite the fluctuations in transaction volume, the market analytics firm says the number of NFT market participants is on the rise.

“In Q1 2022, 950,000 unique addresses bought or sold an NFT, up from 627,000 in Q4 2021. Overall, the number of active NFT buyers and sellers has increased every quarter since Q2 2020.

In Q2 2022 as of May 1st, 491,000 addresses have transacted with NFTs, putting the NFT market on pace to continue its quarterly growth trend in number of participants.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Maquette.pro/Natalia Siiatovskaia