A widely followed crypto analyst says that one key on-chain indicator is pointing toward a cyclical bottom for Bitcoin (BTC).

In a new video update, crypto analyst Benjamin Cowen tells his 774,000 YouTube subscribers that Bitcoin’s percentage of supply in profit and loss metric is flashing signs of a historical bottom for the top crypto asset by market cap.

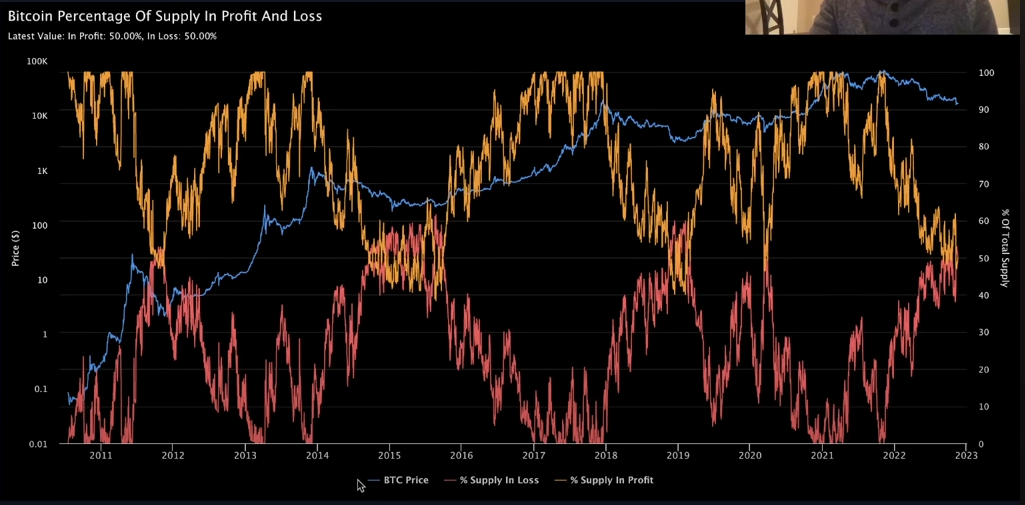

The on-chain indicator shows what percentage of BTC coins are giving their holders a profit or a loss.

Says Cowen,

“One of my favorite on-chain indicators is the Bitcoin percentage of supply in profit and loss. The reason I like this one is because of how cyclical it looks – the ebb and flow of this indicator…

What you’ll notice is that there is a clear ebb and flow to the bear markets and the bull markets…

What you may notice is that they tend to cross at a certain point throughout the bear market, and in fact, in every bear single market, the Bitcoin [percentage of] supply in profit and loss, they cross. Here in 2011, and in 2014, 2015, and in 2018 and 2019, and they’re starting crossing here again in late 2022.”

Cowen goes on to say that when applying the 30-day moving average to Bitcoin’s percentage of supply in profit and loss, it shows a historical pattern that often foreshadows a price bottom.

“If you apply the [30-day] moving average to [the Bitcoin percentage of supply in profit and loss]… what you’ll notice is that historically, they have always crossed before the bottom was in.”

Bitcoin is changing hands for $16,114 at time of writing, a dip of over 3.50% during the last 24 hours.

I

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Garan Julia/Aleksandr Kovalev