Want to work with us? CryptoSlate is hiring for a handful of positions!

Want to work with us? CryptoSlate is hiring for a handful of positions!

The proposed Responsible Financial Innovation Act (RFIA) bill has been uploaded to GitHub for the crypto community to give their recommendations about the bill.

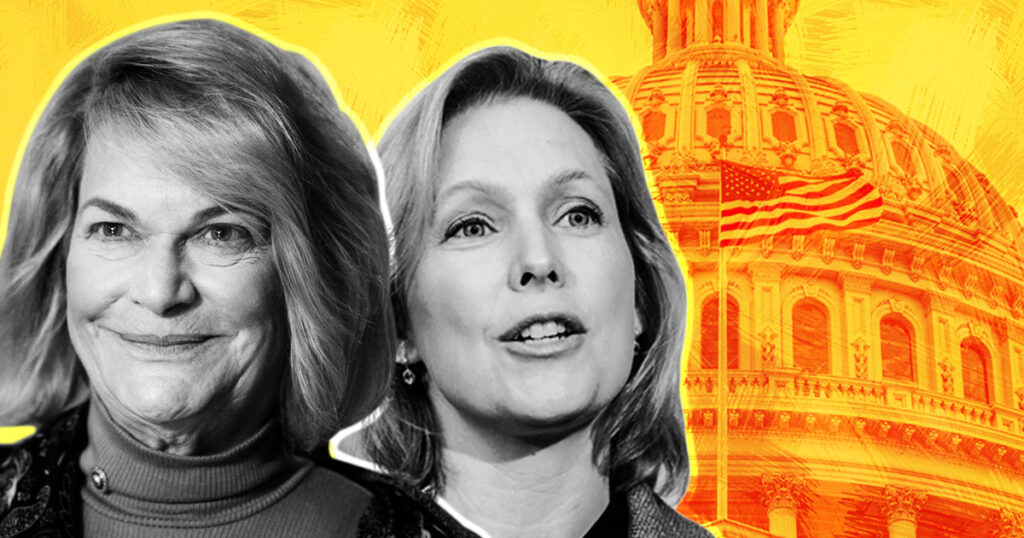

In a Twitter post by Senator Cynthia Lummis, one of the two bipartisan senators responsible for the bill, the decision to update it on GitHub is to get the grassroots opinion about the bill.

Plebs! As promised, you can now contribute comments on my bill establishing a framework for digital assets with @SenGillibrand via GitHub. Civil comments and criticisms welcome. Please share widely. We want to get this right. Help us iterate publicly on policy. https://t.co/1eOb6jfKaA

— Cynthia Lummis

(@CynthiaMLummis) June 22, 2022

According to a press statement from the Senator’s office, the bill seeks comments from industry stakeholders to reflect the space’s innovations properly.

The bipartisan had suggested that Bitcoin and Ethereum be classified as commodities while other altcoins should be labeled as securities. The bill also proposed that the Commodity Futures Trading Commission should be tasked with regulating the industry.

However, the bill has faced criticism from the community over its blanket classification of other crypto assets as securities. Some argue that Bitcoin should be considered separately from other digital assets.

Crypto community makes recommendations

As of press time, there have been only nine comments on the bill, with most of them being constructive recommendations.

One of the comments called for a separate Bitcoin Bill that is different from the crypto Bill. Stduey explained that Bitcoin is different from other risky assets even though the current market downturn might make it feel like both are the same.

In his words,

If you buy 5,000 satoshis for $1, you will have 5,000/2.1 quadrillion satoshis forever, and no one can change that. People cannot understand the magnitude of this yet, but this subtle difference is what separates bitcoin from every other crypto, fiat, precious metal, and commodity. Absolute scarcity. Nothing else has this feature.

Another recommendation for the bill was made by Asherhopp, who said that the legislation should include language that will limit the Federal Reserve from creating unlimited CBDC, the same way fiat currencies are minted.

He added that the bill should compel the Fed to add crypto to its balance sheet, apply tariffs to the digital yuan, and ban any CBDC.

One of the recommendations touched on the subject of airdrops and unrealized gains.

According to the recommendation,

Airdrop receivers should only have to pay short or long-term taxes on the coins they cash out assuming the initial value is $0 because they do not realize the gains until they trade or sell.