The total crypto market cap fell $53 billion as news of the U.S. Securities and Exchange Commission (SEC) filing against Binance came through.

On June 5, the SEC charged Binance, its CEO Changpeng Zhao, and related entities with 13 violations, including wash trading, evasion of regulations, and offering unregistered securities.

Binance said it was disappointed with the complaint and had always worked cooperatively with regulator’s inquiries. However, it disputed the enforcement action and intended to “vigorously” defend the charges.

A key component of Binance’s defense centers on the SEC’s purported unwillingness to provide regulatory clarity. It further claimed that the company was a victim of the ongoing “regulatory tug-of-war,” in which government agencies seek to “claim jurisdictional ground from other regulators.”

“Unfortunately, the SEC’s refusal to productively engage with us is just another example of the Commission’s misguided and conscious refusal to provide much-needed clarity and guidance to the digital asset industry.“

Crypto markets crash

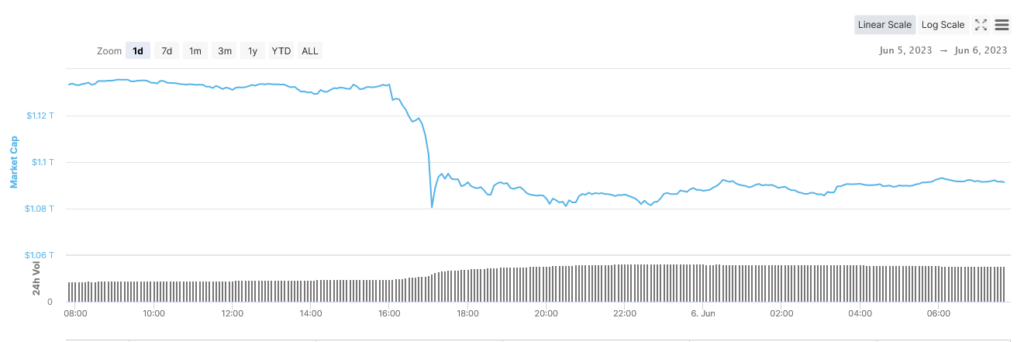

Markets tanked on the news of the SEC filing against Binance.

On June 5, at 16:00 BST, just before the news broke, the total crypto market cap was valued at $1.13 trillion. As word spread, the ensuing dump bottomed at $1.08 trillion approximately an hour later – equating to a $52.7 billion, or 4.7%, drawdown.

A bounce followed to top out at $1.1 trillion. The market has since traded flat as participants consider the gravity of the situation, particularly the allegations that several third-party tokens were named as securities in the SEC filing, including ADA, SOL, and MATIC.

Biggest winners and losers

Of the top 100, the biggest losers over the last 24 hours were Pepe, The Sandbox, and Sui, which lost 15.2%, 14.8%, and 12.7%, respectively. The Sandbox was named as an unregistered security in the SEC filing.

Kava was the only top 100 token (excluding stablecoins) to stay green over the period, which grew 9.6%.

Market leader Bitcoin suffered a peak-to-trough loss of 5% to find support at $25,400. It has since peaked at $25,890 but is shaping to retest $25,600 support.