According to WhaleStats, Curve Finance [CRV] joined nine others as part of the top ten traded by Ethereum [ETH] whales on 4 November. The whale tracking platform showed that the top 100 whales had engaged about 5,000 CRV in trading activity within the period.

JUST IN: $CRV @curvefinance now on top 10 by trading volume among 100 biggest #ETH whales in the last 24hrs

Check the top 100 whales here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see data for the top 5000!)#CRV #whalestats #babywhale #BBW pic.twitter.com/3tqToPPBes

— WhaleStats (tracking crypto whales) (@WhaleStats) November 4, 2022

Here’s AMBCrypto’s Price Prediction for Curve Finance [CRV] for 2023-2024

“One dollar” and others won’t follow

Following the update, details from CoinMarketCap indicated a price uptick for the on-chain liquidity token. As of 4 November, CRV was exchanging hands at $1— a milestone it had failed to reach since 18 September.

However, the landmark would have been impossible without the rising volume. The price tracking platform revealed that CRV’s volume had increased 56% between 3 and 4 November to reach $108.23 million. This indicated that an improved number of CRV transactions rallied round the network within the aforementioned period.

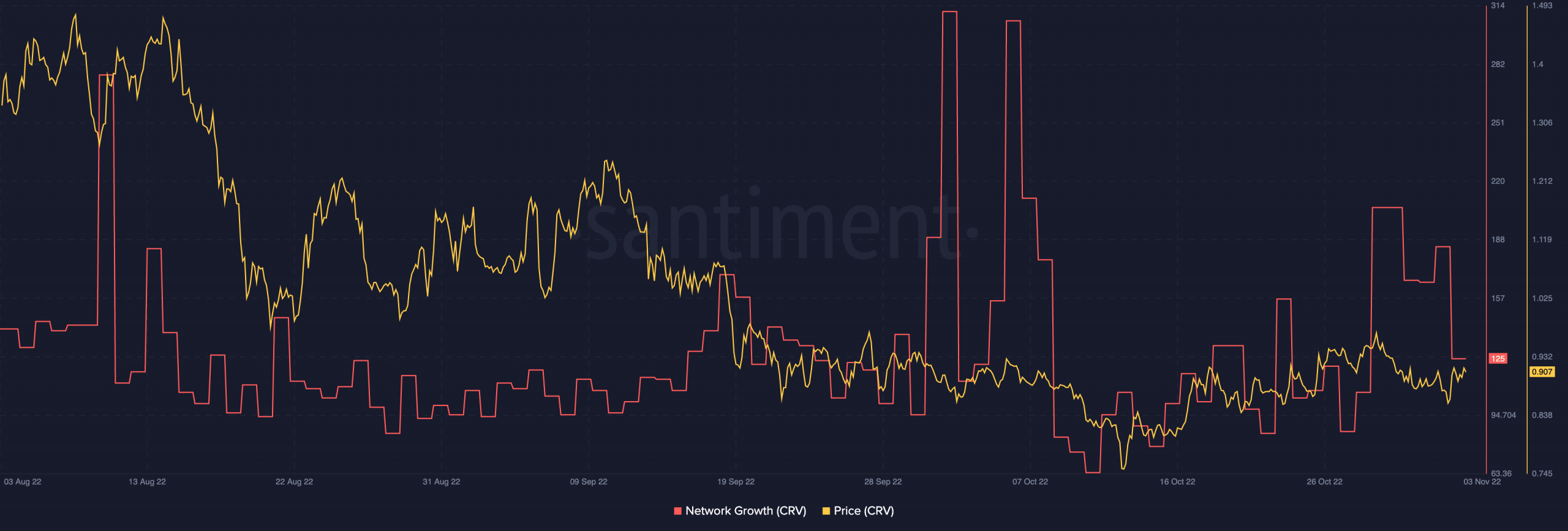

Despite the increases, not all aspects of Curve followed. According to Santiment, the network growth which was 184 on 2 November had decreased to 125 at press time. Due to the reduction, CRV might need to lower their expectations of a continued price increase.

Source: Santiment

Furthermore, the above data suggested that the number of addresses created on the Curve network decreased between 3 and 4 November. Hence, user adoption was not close to its peak. So, those involved with accumulating to help CRV re-reach the crest were existing investors. To sustain this level, CRV might require the token to gain more traction among crypto investors outside its jurisdiction.

For its Total Value Locked (TVL), Curve managed to hold on to its worth of 3 November. According to DeFi Llama, CRV’s TVL was $5.95 billion as of 4 November. This was a 2.88% increase in the last seven days. Thus, this implied that the chains under the Curve protocol had relatively attracted more liquidity deposited despite its shortcomings in adding more investors.

Source: DeFi Llama

Investors, it may be time to rethink!

Considering the CRV status, it was not uncommon for investors not to try grabbing a share of the profits. However, on-chain indication might require caution rather than excitement.

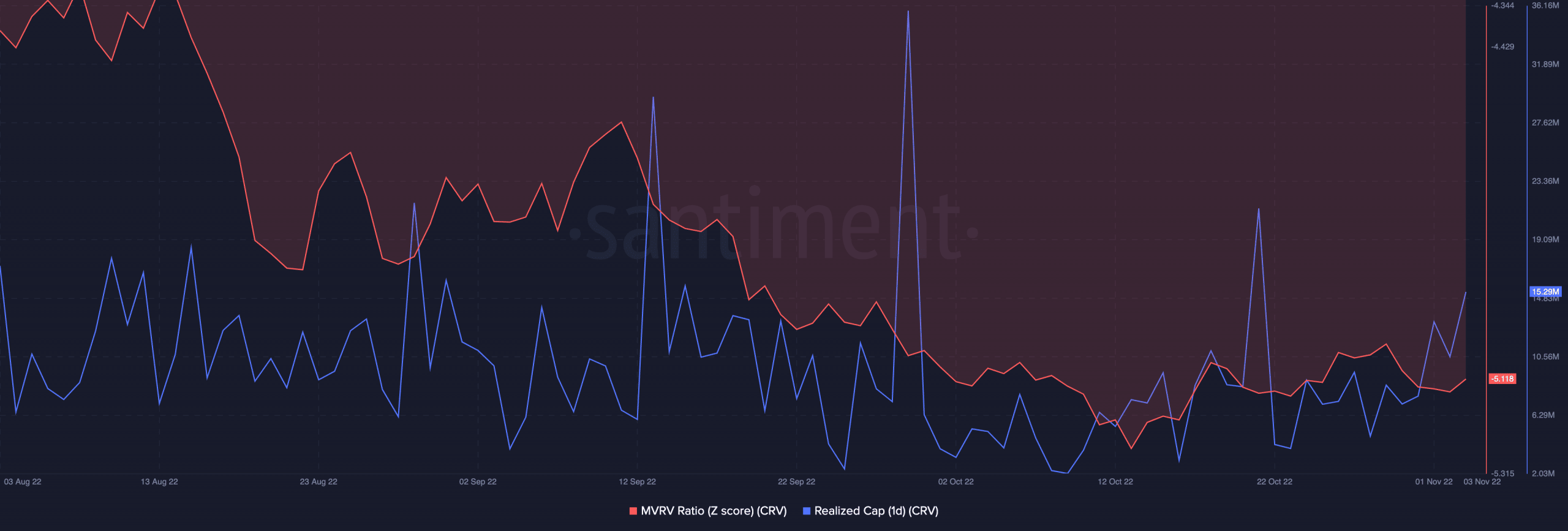

According to Santiment, the Market Value to Realized Value (MVRV) z-score showed that CRV might be exiting its undervalued state. Although a z-score of -5.118 would have translated to Curve being a depreciated asset, the overall current market condition might not subscribe to the point of view.

In addition, the current z-score was higher than the value it was on 2 November. Besides, the CRV realized cap aiming higher than 15.29 million meant that the price assigned to CRV was at risk of a decrease. Still, remaining in a more neutral position might be the next for CRV after this uptick ends.

Source: Santiment

![Should Curve Finance [CRV] investors be thrilled by this whale attention](https://www.cryptonewsmetaverse.com/wp-content/uploads/2022/11/po-2022-11-04T144630.707-1000x600.png)